Question: ADDITIONAL INFORMATION - The profit before the changes in working capital amounted to R 1 9 2 0 0 0 0 . - All purchases

ADDITIONAL INFORMATION

The profit before the changes in working capital amounted to R

All purchases and sales of inventories were on credit.

Equipment was purchased for cash.

Vehicles with a cost price of R and accumulated depreciation of R were sold at carrying value.

Interim dividends paid during the year amounted to R No final dividends were declared.

The issued share capital for the year ended December consisted of ordinary shares. The market price of a share in Grenville Limited was cents on December

The creditors granted Grenville Limited credit terms of days.

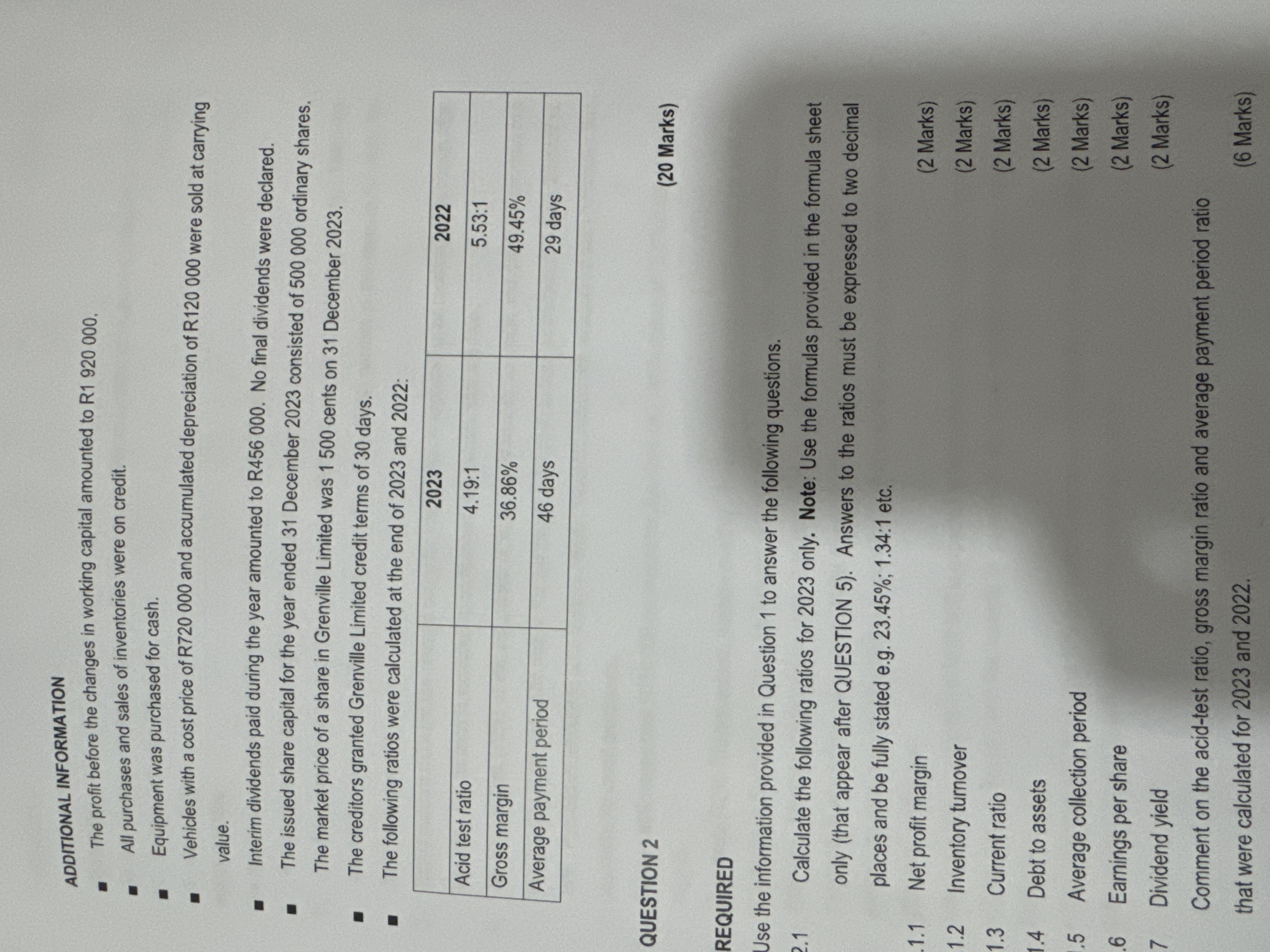

The following ratios were calculated at the end of and :

QUESTION

REQUIRED

Use the information provided in Question to answer the following questions.

Calculate the following ratios for only. Note: Use the formulas provided in the formula sheet only that appear after QUESTION Answers to the ratios must be expressed to two decimal places and be fully stated eg; : etc.

Net profit margin

Inventory turnover

Current ratio

Debt to assets

Average collection period

Earnings per share

Dividend yield

Comment on the acidtest ratio, gross margin ratio and average payment period ratio that were calculated for and ADDITIONAL INFORMATION

The profit before the changes in working capital amounted to R

All purchases and sales of inventories were on credit.

Equipment was purchased for cash.

Vehicles with a cost price of R and accumulated depreciation of R were sold at carrying value.

Interim dividends paid during the year amounted to R No final dividends were declared.

The issued share capital for the year ended December consisted of ordinary shares.

The market price of a share in Grenville Limited was cents on December

The creditors granted Grenville Limited credit terms of days,

The following ratios were calculated at the end of and :

QUESTION

Marks

REQUIRED

Use the information provided in Question to answer the following questions.

Calculate the following ratios for only. Note: Use the formulas provided in the formula sheet oniy that appear after QUESTION Answers to the ratios must be expressed to two decimal places and be fully stated eg; : etc.

Net profit margin

Marks

Inventory turnover

Marks

Current ratio

Marks

Debt to assets

Marks

Average collection period

Marks

Earnings per share

Marks

Dividend yield

Marks

Comment on the acidtest ratio, gross margin ratio and average payment period ratio that were calculated for and

Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock