Question: Additional information: The weighted-average common shares outstanding during the year was 50,000 . (a) Compute the following values and ratios for 2025 . (We provide

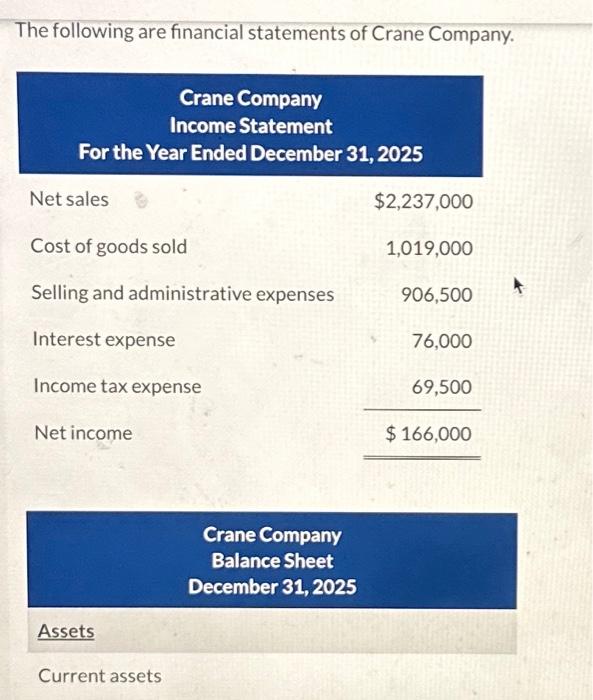

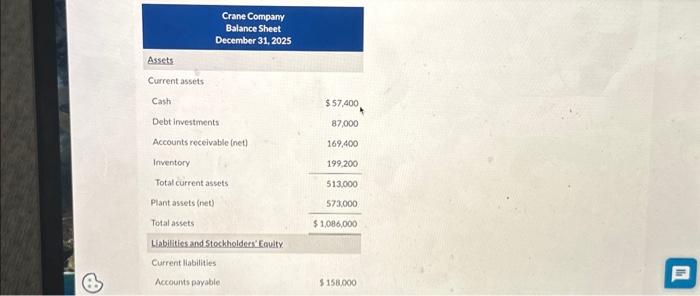

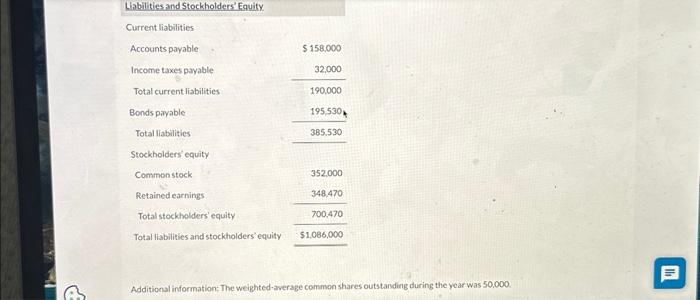

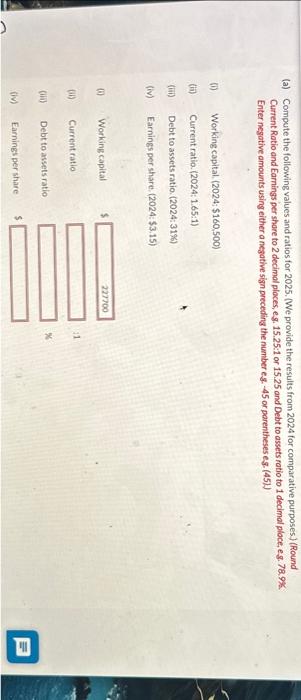

Additional information: The weighted-average common shares outstanding during the year was 50,000 . (a) Compute the following values and ratios for 2025 . (We provide the results from 2024 for comparative purposes) (Round Current Ratio and Earnings per share to 2 decimal places, eg. 15.25:1 or 15.25 and Debt to assets ratio to 1 decimal ploce, eg. 78.9\%. Enter negative amounts using either a negative sign preceding the number es. -45 ar parentheses es. (45).) (i) Working capital. (2024; $160,500) (ii) Current ratio. (2024: 1.65:1) (iii) Debt to assets ratio. (2024:31\%) (iv) Earnings per share. (2024:\$3,15) (1) Working capital (ii) Currentratio (iii) Debt to assets ratio 11 (iv) Earningspershare Crane Company Balance Sheet December 31, 2025 Assets Current assets Cash $57,400 Debt investments 87,000 Accounts receivable (net) 169,400 Inventory 199,200 Total current assets 513,000 Plant assets (net) 573000 Total assets $1,006,000 Lisbilities and Stockholders' Equity. Current liabilities Accounts payable $158,000 The following are financial statements of Crane Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts