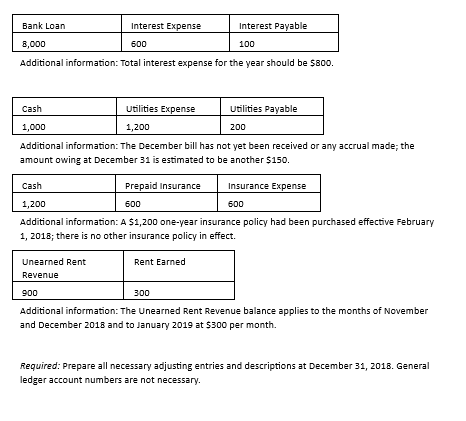

Question: Additional information: Total interest expense for the year should be $800. Additional information: The December bill has not yet been received or any accrual made;

Additional information: Total interest expense for the year should be $800. Additional information: The December bill has not yet been received or any accrual made; the amount owing at December 31 is estimated to be another $150. Additional information: A $1,200 one-year insurance policy had been purchased effective February 1,2018 ; there is no other insurance policy in effect. Additional information: The Unearned Rent Revenue balance applies to the months of November and December 2018 and to January 2019 at $300 per month. Required: Prepare all necessary adjusting entries and descriptions at December 31, 2018. General ledger account numbers are not necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts