Question: Additional information with regards to adjustments that you still need to take into account. (a) CK Traders sublets part of its building to B Silver.

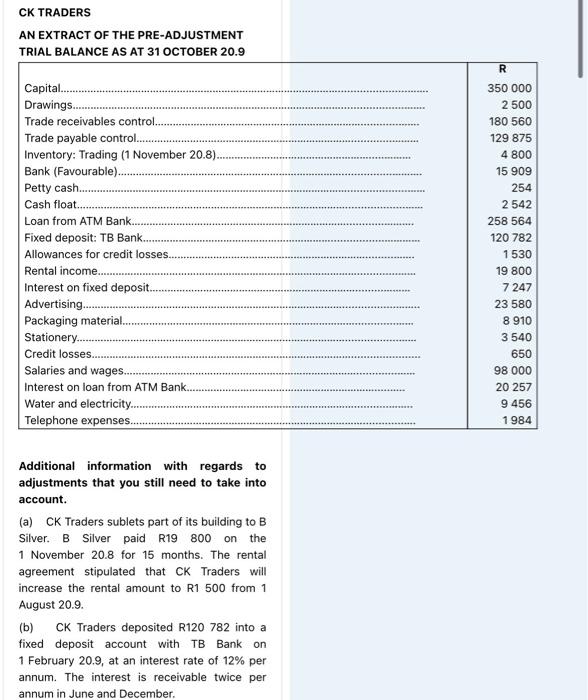

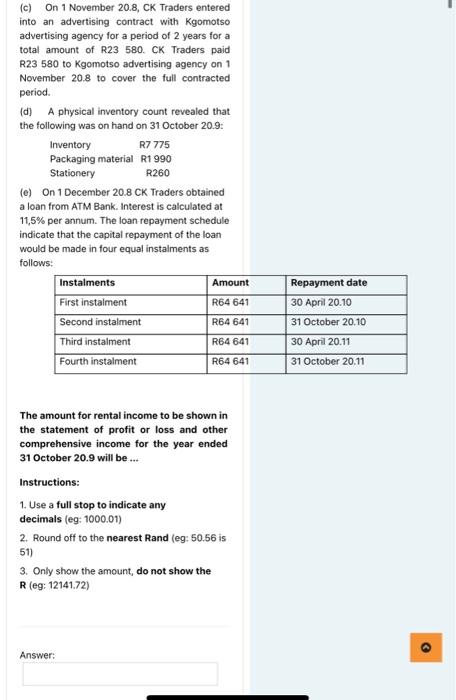

Additional information with regards to adjustments that you still need to take into account. (a) CK Traders sublets part of its building to B Silver. B Silver paid R19 800 on the 1 November 20.8 for 15 months. The rental agreement stipulated that CK Traders will increase the rental amount to R1 500 from 1 August 20.9. (b) CK Traders deposited R120 782 into a fixed deposit account with TB Bank on 1 February 20.9 , at an interest rate of 12% per annum. The interest is receivable twice per annum in June and December. (c) On 1 November 20.8 , CK Traders entered into an advertising contract with Kgomotso advertising agency for a period of 2 years for a total amount of R23 580. CK. Traders paid R23 580 to Kgomotso advertising agency on 1 November 20.8 to cover the full contracted period. (d) A physical inventory count revealed that the following was on hand on 31 October 20.9: (e) On 1 December 20.8 CK Traders obtained a loan from ATM Bank. Interest is calculated at 11,5% per annum. The loan repayment schedule indicate that the capital repayment of the loan would be made in four equal instalments as follows: The amount for rental income to be shown in the statement of profit or loss and other comprehensive income for the year ended 31 October 20.9 will be ... Instructions: 1. Use a full stop to indicate any decimals (eg: 1000.01) 2. Round off to the nearest Rand (eg: 50.56 is 51) 3. Only show the amount, do not show the R (eg: 12141.72)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts