Question: ADDITIONAL INFORMATION: X = 8 Y = 1 Timmy Turner, Inc Income Statement 2019 Sales $ 215,000.00 Cost $ 125,000.00 EBIT $ 90,500.00 Interest $

ADDITIONAL INFORMATION:

X = 8

Y = 1

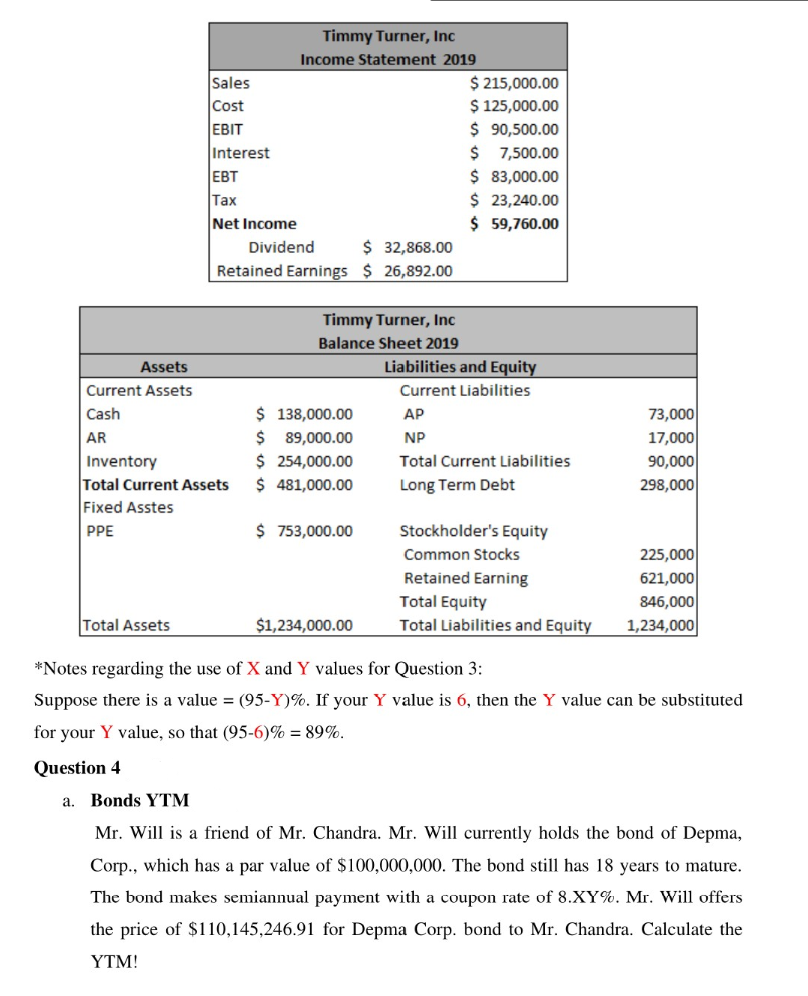

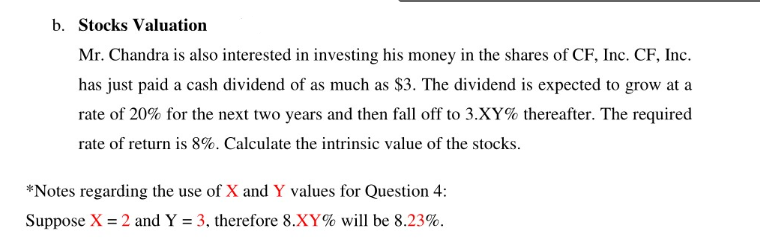

Timmy Turner, Inc Income Statement 2019 Sales $ 215,000.00 Cost $ 125,000.00 EBIT $ 90,500.00 Interest $ 7,500.00 EBT $ 83,000.00 Tax $ 23,240.00 Net Income $ 59,760.00 Dividend $ 32,868.00 Retained Earnings $ 26,892.00 Assets Current Assets Cash AR Inventory Total Current Assets Fixed Asstes PPE Timmy Turner, Inc Balance Sheet 2019 Liabilities and Equity Current Liabilities $ 138,000.00 AP $ 89,000.00 NP $ 254,000.00 Total Current Liabilities $ 481,000.00 Long Term Debt 73,000 17,000 90,000 298,000 $ 753,000.00 Stockholder's Equity Common Stocks Retained Earning Total Equity Total Liabilities and Equity 225,000 621,000 846,000 1,234,000 Total Assets $1,234,000.00 *Notes regarding the use of X and Y values for Question 3: Suppose there is a value = (95-Y)%. If your Y value is 6, then the Y value can be substituted for your Y value, so that (95-6)% = 89%. Question 4 a. Bonds YTM Mr. Will is a friend of Mr. Chandra. Mr. Will currently holds the bond of Depma, Corp., which has a par value of $100,000,000. The bond still has 18 years to mature. The bond makes semiannual payment with a coupon rate of 8.XY%. Mr. Will offers the price of $110,145,246.91 for Depma Corp. bond to Mr. Chandra. Calculate the YTM! b. Stocks Valuation Mr. Chandra is also interested in investing his money in the shares of CF, Inc. CF, Inc. has just paid a cash dividend of as much as $3. The dividend is expected to grow at a rate of 20% for the next two years and then fall off to 3.XY% thereafter. The required rate of return is 8%. Calculate the intrinsic value of the stocks. *Notes regarding the use of X and Y values for Question 4: Suppose X = 2 and Y = 3, therefore 8.XY% will be 8.23%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts