Question: Additional information you will need for Production Budget: Additional information you will need for Selling and Admin Expense ( or Operating Expense ) Budget: Selling

Additional information you will need for Production Budget: Additional information you will need for Selling and Admin Expense or Operating Expense Budget:

Selling expenses include sales commissions of of sales revenue and sales salaries of $ per quarter.

Administrative expenses include office building depreciation of $ per quarter and office salaries of $ per quarter.

tabletableEnter your company name hereSelling and Admin Expense Budgetst Qtrnd Qtrrd Qtrth QtrYEARSelling expenses:Sales commissionsSales salariesTotal selling expenseAdministrative expenses:Depreciation expense office bldgOffice salariesTotal Administrative expensesTotal Selling and Admin ExpensesLess: Noncash ExpensesTotal Cash Payments for Selling & Admin

tableEnter your company name hereBudgeted Income Statementst Qtrnd Qtrrd Qtrth QtrYEARSales RevenueLess: Cost of goods soldGross Profit or Gross MarginSelling and Admin ExpensesNet Income,,,,, Additional information you will need for Schedule of Cash Payments for Purchases:

All direct material purchases are made on credit and budgeted purchases are provided below. Cash payments for purchases are

made in the same quarter as the purchase and will be paid in the quarter after the purchase. Outstanding accounts

payable as of Jan is $ and will be paid in the first quarter. SHOW ALL CALCULATIONS CLEARLY.

Enter your company name here

Schedule of Cash Payments for Purchases Additional information you will need for the Cash Budget:

The beginning cash balance on January is expected to be $ Remember to use the information calculated in the Selling and Admin Expense budget, Schedule of Cash Receipts, and Schedule of Cash Payments for Purchases.

Enter your company name here

tableCash Budgetst Qtrnd Qtrrd Qtrth QtrYEARBeginning Cash Balance,,,,,Add: Cash Collections from Customers,,,,,Total Cash Available,,,,,Less Cash Payments:,,,,,Cash payments for direct material purch.,,,,,Cash payments for selling and admin.,,,,,Total Cash Payments,,,,,Ending Cash Balance,,,,,$

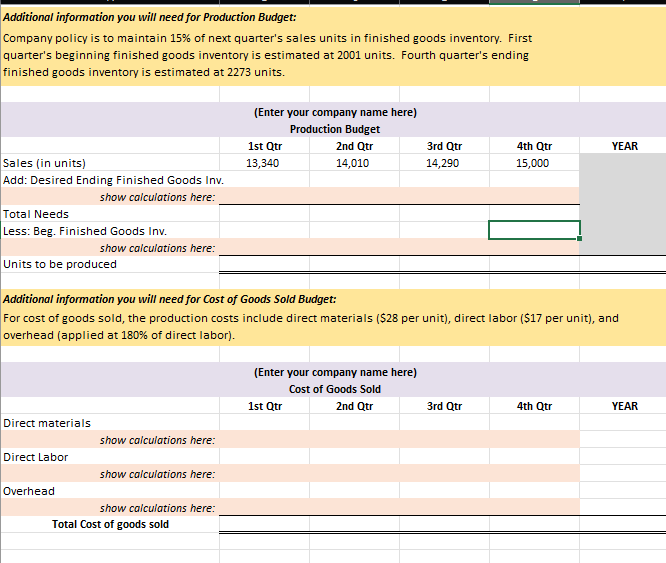

Company policy is to maintain of next quarter's sales units in finished goods inventory. First

quarter's beginning finished goods inventory is estimated at units. Fourth quarter's ending

finished goods inventory is estimated at units.

Units to be produced

Additional information you will need for Cost of Goods Sold Budget:

For cost of goods sold, the production costs include direct materials $ per unit direct labor $ per unit and

overhead applied at of direct labor

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock