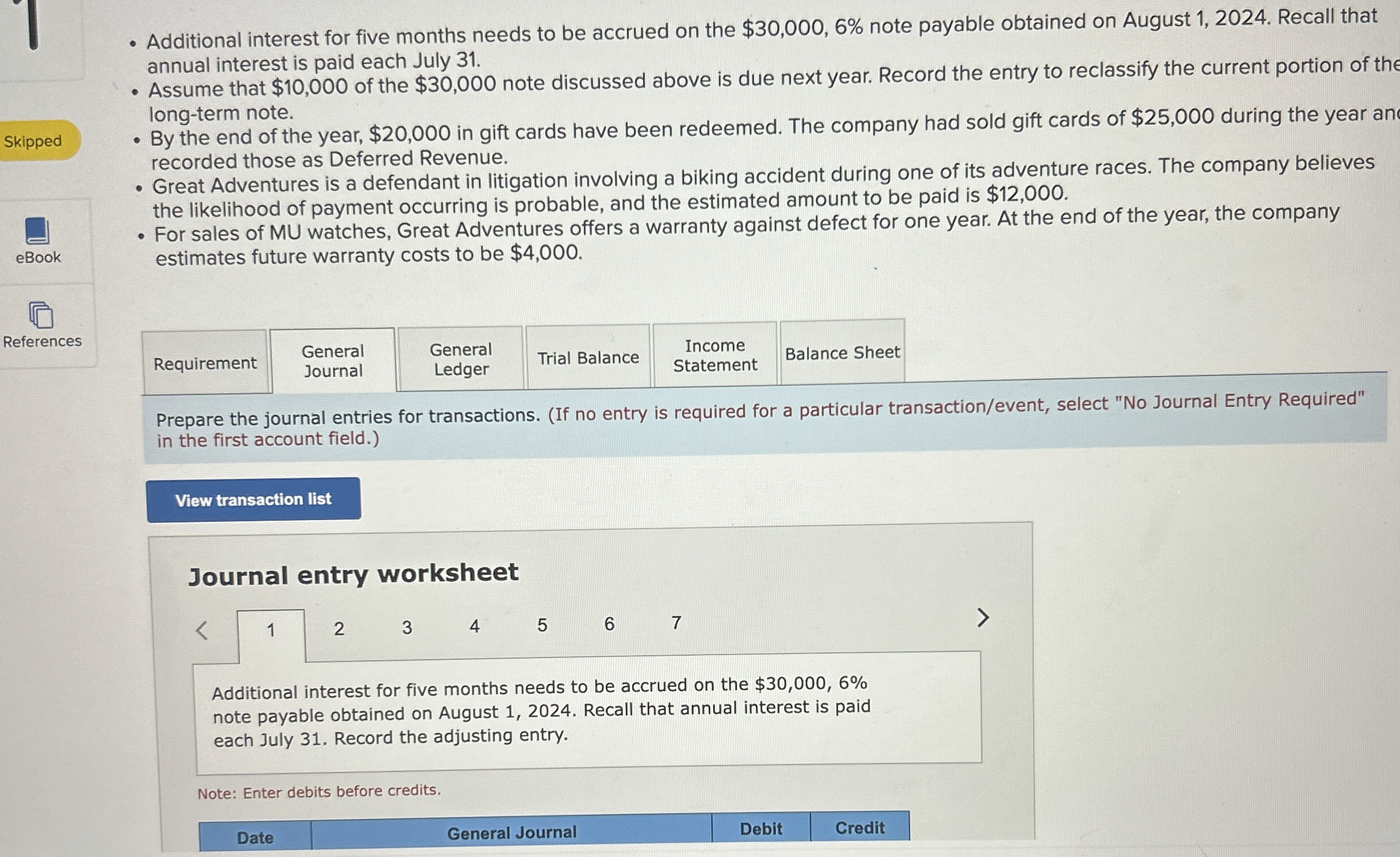

Question: Additional interest for five months needs to be accrued on the $ 3 0 , 0 0 0 , 6 % note payable obtained on

Additional interest for five months needs to be accrued on the $ note payable obtained on August Recall that

annual interest is paid each July

Assume that $ of the $ note discussed above is due next year. Record the entry to reclassify the current portion of the

longterm note.

By the end of the year, $ in gift cards have been redeemed. The company had sold gift cards of $ during the year an

recorded those as Deferred Revenue.

Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes

the likelihood of payment occurring is probable, and the estimated amount to be paid is $

For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company

estimates future warranty costs to be $

Prepare the journal entries for transactions. If no entry is required for a particular transactionevent select No Journal Entry Required"

in the first account field.

Journal entry worksheet

Additional interest for five months needs to be accrued on the $

note payable obtained on August Recall that annual interest is paid

each July Record the adjusting entry.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock