Question: Additional Notes Stock at year end was valued at $85,000 Wages is owing by $8,600 Insurance is prepaid by $2,300 During the year the owner

Additional Notes

-

Stock at year end was valued at $85,000

-

Wages is owing by $8,600

-

Insurance is prepaid by $2,300

-

During the year the owner took goods values at $10,000. This was not yet recorded

-

The rent received is prepaid by $5,000

-

Commission income is owing by $6,250

-

The provision for bad debts is to be adjusted to 10% of debtors

-

Depreciation charges are to be applied as follows

| ASSET | RATE | METHOD |

| Land and Building | 5% | Reducing Balance |

| Motor Vehicle | 5% | Straight Line |

| Machinery and Equipment | 5% | Reducing Balance |

Required : Prepare the following

-

The Statement of Profit and Loss for the year ending December 31, 2020 .

-

The Statement of Financial Position at at December 31, 2020.

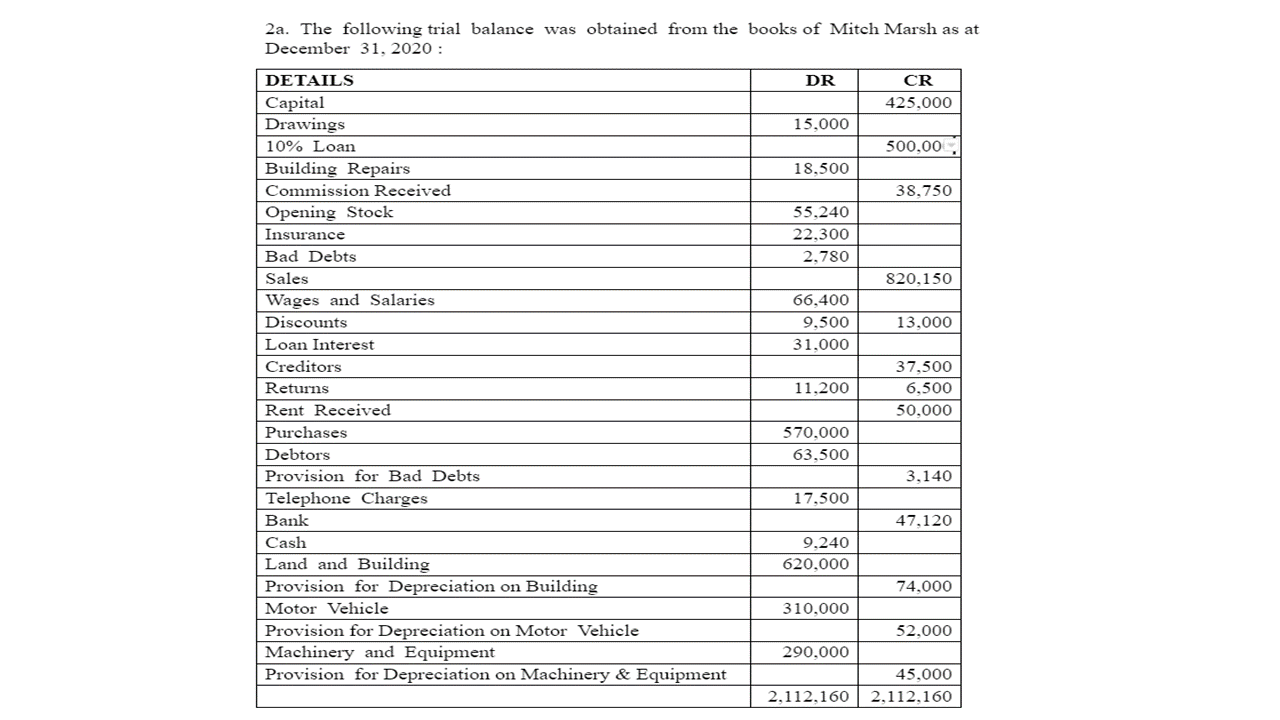

2a. The following trial balance was obtained from the books of Mitch Marsh as at December 31. 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts