Question: Additional part to this problem: If it was determined that the lease was an operating lease Crane should record the following at the end of

Additional part to this problem:

Additional part to this problem:

If it was determined that the lease was an operating lease Crane should record the following at the end of 2020, the first year of the lease.

a. interest expense $63,397 and ammortization expense of $166,795

b. lease expense 166,795

c. lease expesnse 119,149

d. interest expense 83,397 and amortization expense 119,139

e. lease expense 200,000

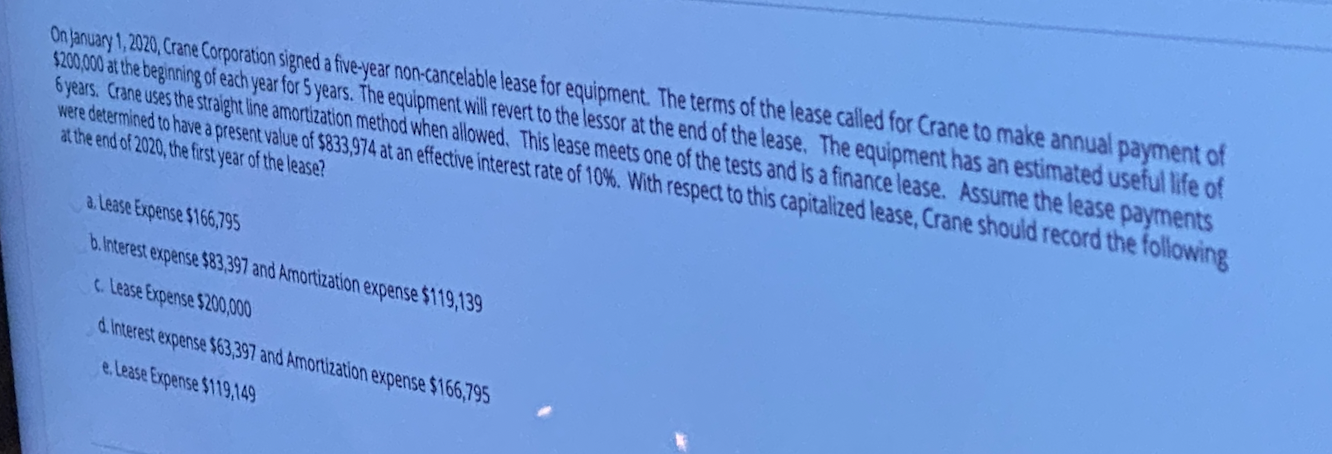

On January 1, 2020, Crane Corporation signed a five-year non-cancelable lease for equipment. The terms of the lease called for Crane to make annual payment of $200,000 at the beginning of each year for 5 years. The equipment will revert to the lessor at the end of the lease. The equipment has an estimated useful life of 6 years . Crane uses the straight line amortization method when allowed. This lease meets one of the tests and is a finance lease. Assume the lease payments were determined to have a present value of $833,974 at an effective interest rate of 10%. With respect to this capitalized lease, Crane should record the following at the end of 2020, the first year of the lease? a Lease Expense $166,795 b. Interest expense $83,397 and Amortization expense $119,139 c. Lease Expense $200,000 d. Interest expense $63,397 and Amortization expense $166,795 elease Expense $119,149

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts