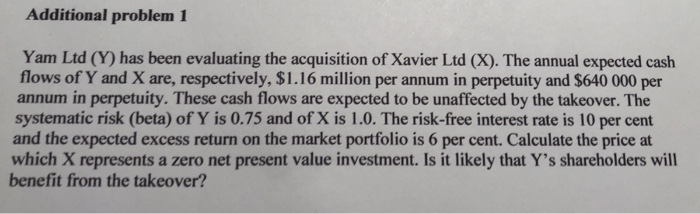

Question: Additional problem 1 Yam Ltd (Y) has been evaluating the acquisition of Xavier Ltd (X). The annual expected cash flows of Y and X are,

Additional problem 1 Yam Ltd (Y) has been evaluating the acquisition of Xavier Ltd (X). The annual expected cash flows of Y and X are, respectively, $1.16 million per annum in perpetuity and $640 000 per annum in perpetuity. These cash flows are expected to be unaffected by the takeover. The systematic risk (beta) of Y is 0.75 and of X is 1.0. The risk-free interest rate is 10 per cent and the expected excess return on the market portfolio is 6 per cent. Calculate the price at which X represents a zero net present value investment. Is it likely that Y's shareholders will benefit from the takeover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts