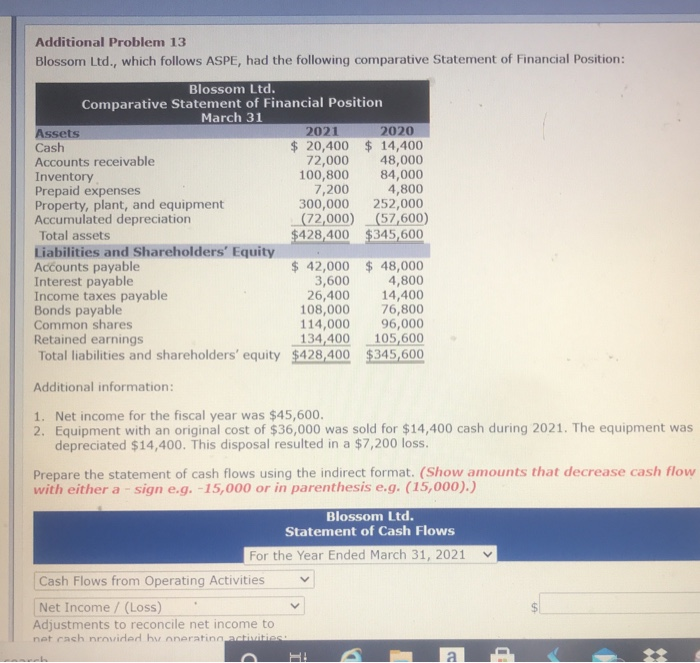

Question: Additional Problem 13 Blossom Ltd., which follows ASPE, had the following comparative Statement of Financial Position: Blossom Ltd. Comparative Statement of Financial Position March 31

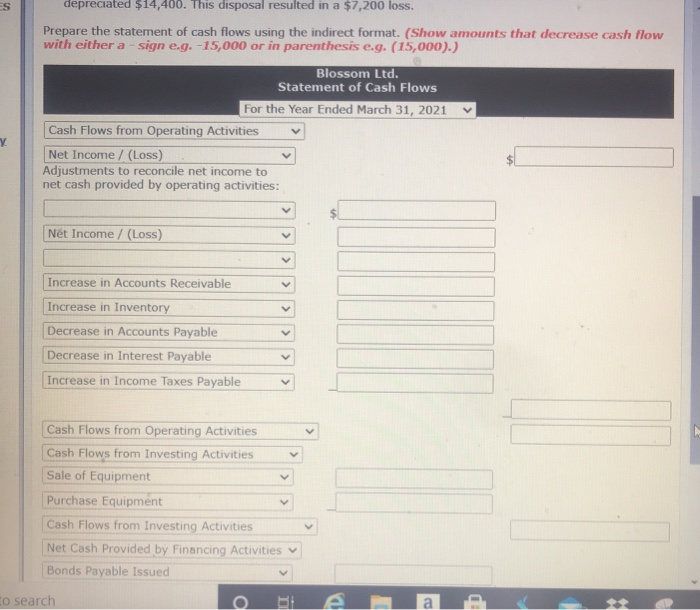

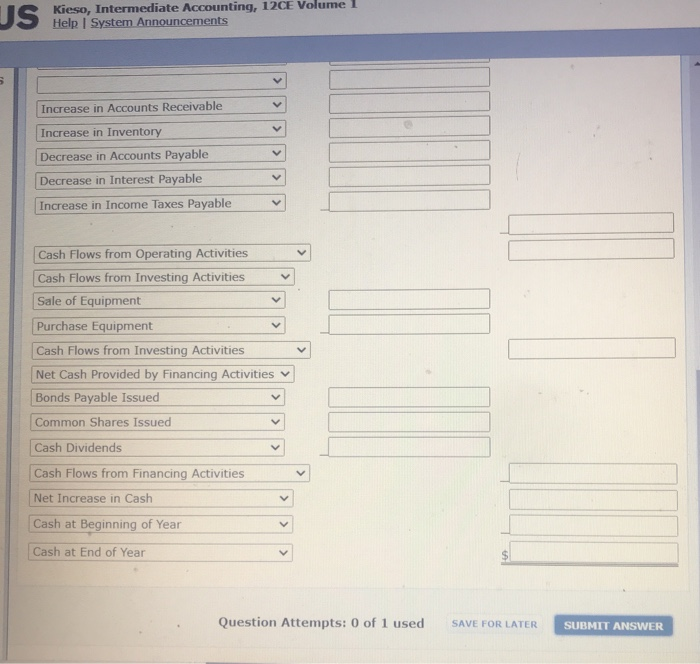

Additional Problem 13 Blossom Ltd., which follows ASPE, had the following comparative Statement of Financial Position: Blossom Ltd. Comparative Statement of Financial Position March 31 Assets 2021 2020 Cash $ 20,400 $ 14,400 Accounts receivable 72,000 48,000 Inventory 100,800 84,000 Prepaid expenses 7,200 4,800 Property, plant, and equipment 300,000 252,000 Accumulated depreciation (72,000) (57,600) Total assets $428,400 $345,600 Liabilities and Shareholders' Equity Accounts payable $ 42,000 $ 48,000 Interest payable 3,600 4,800 Income taxes payable 26,400 14,400 Bonds payable 108,000 76,800 Common shares 114,000 96,000 Retained earnings 134,400 105,600 Total liabilities and shareholders' equity $428,400 $345,600 Additional information: 1. Net income for the fiscal year was $45,600. 2. Equipment with an original cost of $36,000 was sold for $14,400 cash during 2021. The equipment was depreciated $14,400. This disposal resulted in a $7,200 loss. Prepare the statement of cash flows using the indirect format. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Blossom Ltd. Statement of Cash Flows For the Year Ended March 31, 2021 Cash Flows from Operating Activities Net Income / (Loss) Adjustments to reconcile net income to net cash nrovided by onerating activities D a ES depreciated $14,400. This disposal resulted in a $7,200 loss. Prepare the statement of cash flows using the indirect format. (Show amounts that decrease cash flow with either a - sign e.g.-15,000 or in parenthesis e.g. (15,000).) Blossom Ltd. Statement of Cash Flows For the Year Ended March 31, 2021 Cash Flows from Operating Activities Net Income /(Loss) Adjustments to reconcile net income to net cash provided by operating activities: $ Net Income /(Loss) > > Increase in Accounts Receivable Increase in Inventory Decrease in Accounts Payable Decrease in Interest Payable Increase in Income Taxes Payable >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts