Question: Additional Problem 22 Consider the following terms relating to a lease involving machinery entered into by Sinko Ltd on 1 January 2014: One initial payment

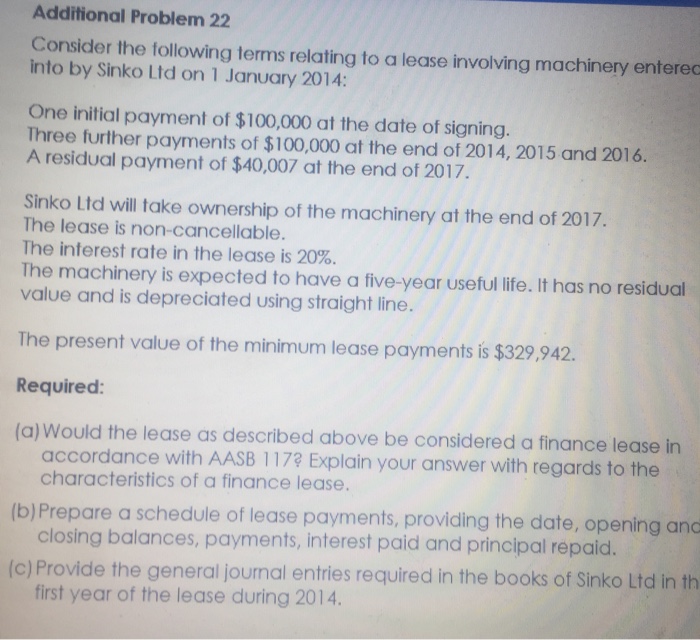

Additional Problem 22 Consider the following terms relating to a lease involving machinery entered into by Sinko Ltd on 1 January 2014: One initial payment of $100,000 at the date of signing. Three further payments of $100,000 at the end of 2014, 2015 and 2016. A residual payment of $40,007 at the end of 2017. Sinko Ltd will take ownership of the machinery at the end of 2017. The lease is non-cancellable. The interest rate in the lease is 20%. The machinery is expected to have a five-year useful life. It has no residual value and is depreciated using straight line. The present value of the minimum lease payments is $329,942. Required: (a) Would the lease as described above be considered a finance lease in accordance with AASB 1173 Explain your answer with regards to the characteristics of a finance lease. closing balances, payments, interest paid and principal repaid. first year of the lease during 2014. b)Prepare a schedule of lease payments, providing the date, opening and (c) Provide the general journal entries required in the books of Sinko Ltd in th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts