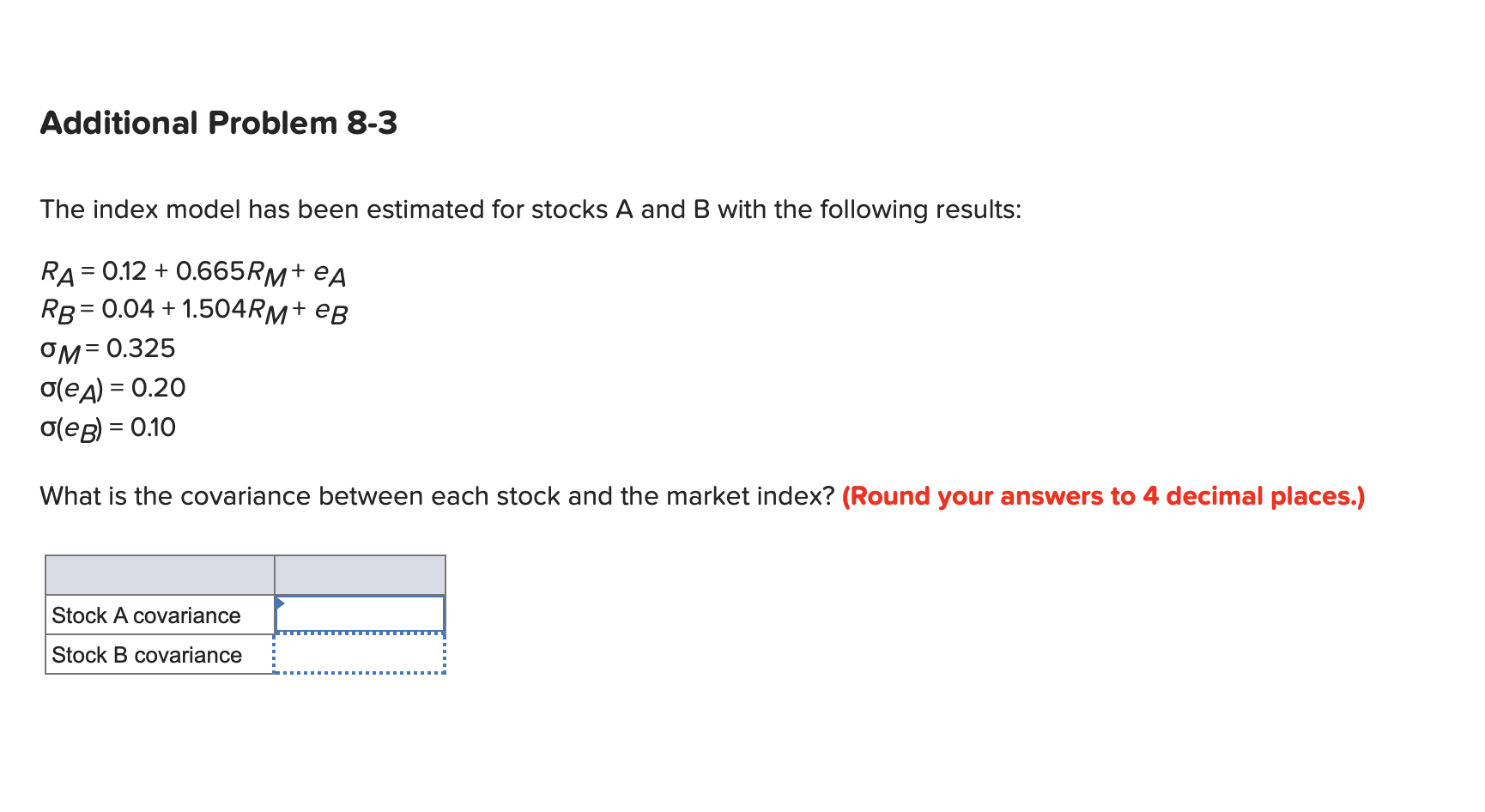

Question: Additional Problem 8-3 The index model has been estimated for stocks A and B with the following results: RA= 0.12 + 0.665RM+ ea RB=0.04 +1.504RM+

Additional Problem 8-3 The index model has been estimated for stocks A and B with the following results: RA= 0.12 + 0.665RM+ ea RB=0.04 +1.504RM+ eB Om=0.325 OleA) = 0.20 Oles) = 0.10 What is the covariance between each stock and the market index? (Round your answers to 4 decimal places.) Stock A covariance Stock B covariance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts