Question: Additional Question 1: Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $94.34, while a 2-year zero sells at $84.99. You

Additional Question 1:

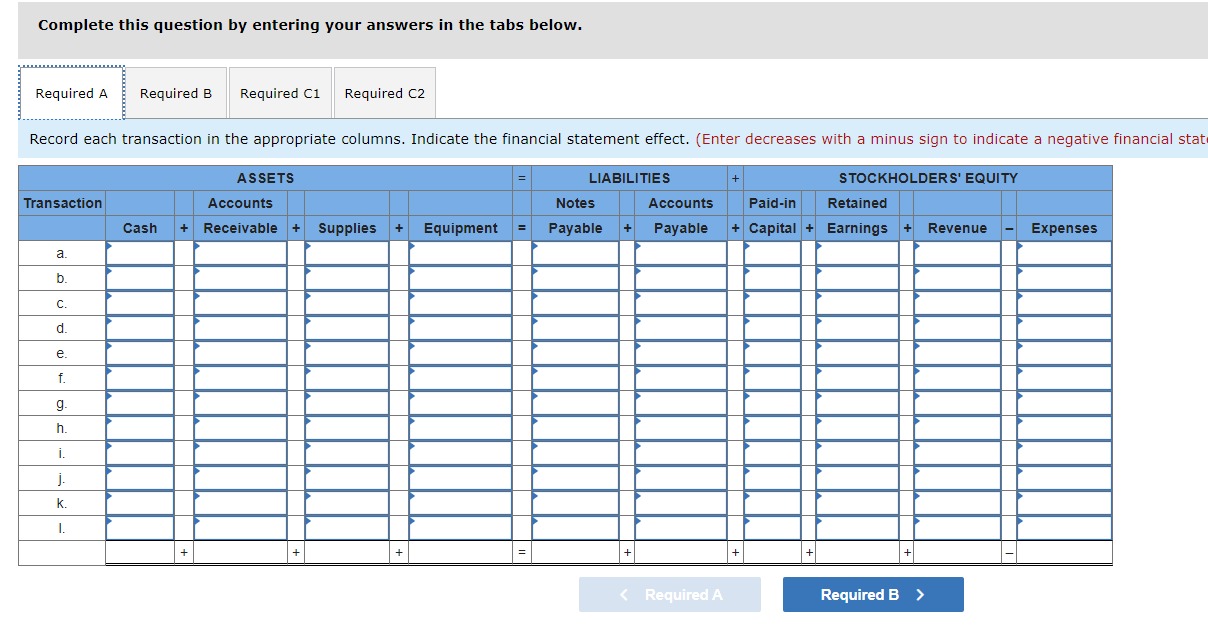

Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $94.34, while a 2-year zero sells at $84.99. You are considering the purchase of a 2-year-maturity bond making annual coupon payments. The face value of the bond is $100, and the coupon rate is 12% per year.

a) What is the yield to maturity of the 2-year zero?

b) What is the yield to maturity of the 2-year coupon bond?

c) What is the forward rate for the second year?

d) According to the expectations hypothesis, what are (i) the expected price of the coupon bond at the end of the first year and (ii) the expected holding-period return on the coupon bond over the first year?

Additional Question 2:

An insurance company must make payments to a customer of $10 million in one year and $4 million in five years. The yield curve is flat at 10%. Use annual compounding.

a) If it wants to fully fund and immunize its obligation to this customer with a single issue of a zero-coupon bond, what maturity bond must it purchase?

b) What must be the face value and market value of that zero-coupon bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts