Question: Additional Question 1: Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $94.34, while a 2-year zero sells at $84.99. You

Additional Question 1:

Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $94.34, while a 2-year zero sells at $84.99. You are considering the purchase of a 2-year-maturity bond making annual coupon payments. The face value of the bond is $100, and the coupon rate is 12% per year.

a) What is the yield to maturity of the 2-year zero?

b) What is the yield to maturity of the 2-year coupon bond?

c) What is the forward rate for the second year?

d) According to the expectations hypothesis, what are (i) the expected price of the coupon bond at the end of the first year and (ii) the expected holding-period return on the coupon bond over the first year?

Additional Question 2:

An insurance company must make payments to a customer of $10 million in one year and $4 million in five years. The yield curve is flat at 10%. Use annual compounding.

a) If it wants to fully fund and immunize its obligation to this customer with a single issue of a zero-coupon bond, what maturity bond must it purchase?

b) What must be the face value and market value of that zero-coupon bond

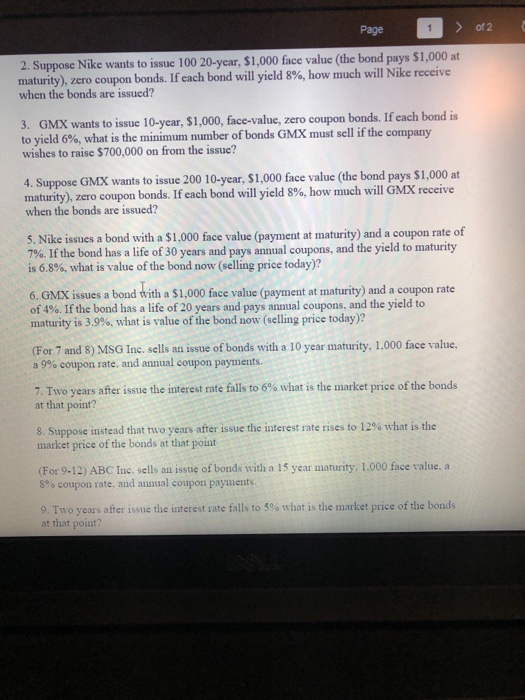

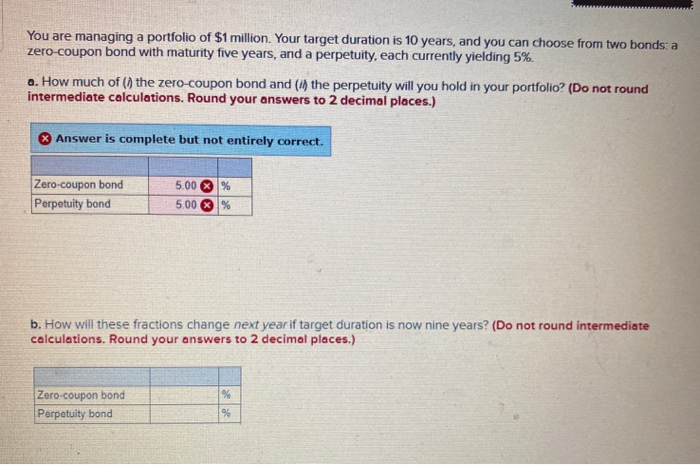

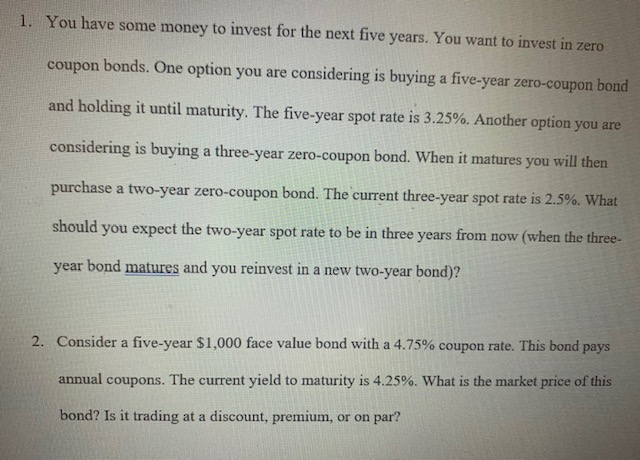

Page 1 of 2 2. Suppose Nike wants to issue 100 20-year, $1,000 face value (the bond pays $1,000 at maturity), zero coupon bonds. If each bond will yield 8%, how much will Nike receive when the bonds are issued? 3. GMX wants to issue 10-year, $1,000, face-value, zero coupon bonds. If each bond is to yield 6%, what is the minimum number of bonds GMX must sell if the company wishes to raise $700,000 on from the issue? 4. Suppose GMX wants to issue 200 10-year, $1,000 face value (the bond pays $1,000 at maturity), zero coupon bonds. If each bond will yield 8%, how much will GMX receive when the bonds are issued? 5. Nike issues a bond with a $1,000 face value (payment at maturity) and a coupon rate of 7%. If the bond has a life of 30 years and pays annual coupons, and the yield to maturity is 6.8%, what is value of the bond now (selling price today)? 6. GMX issues a bond with a $1,000 face value (payment at maturity) and a coupon rate of 4%. If the bond has a life of 20 years and pays annual coupons, and the yield to maturity is 3.9%, what is value of the bond now (selling price today)? (For 7 and 8) MSG Inc. sells an issue of bonds with a 10 year maturity, 1.000 face value. a 9% coupon rate, and annual coupon payments. 7. Two years after issue the interest rate falls to 6% what is the market price of the bonds at that point? 8. Suppose instead that two years after issue the interest rate rises to 12% what is the market price of the bonds at that point (For 9-12) ABC Inc. sells an issue of bonds with a 15 year maturity, 1.000 face value. a 8% coupon rate. and annual coupon payments. 9. Two years after issue the interest rate falls to 5% what is the market price of the bonds at that point?You are managing a portfolio of $1 million. Your target duration is 10 years, and you can choose from two bonds: a zero-coupon bond with maturity five years, and a perpetuity, each currently yielding 5% a. How much of () the zero-coupon bond and ( the perpetuity will you hold in your portfolio? (Do not round intermediate calculations. Round your answers to 2 decimal places.) X Answer is complete but not entirely correct. Zero coupon bond 5.00 x % Perpetuity bond 5.00 x % b. How will these fractions change next year if target duration is now nine years? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Zero-coupon bond Perpetuity bond1. You have some money to invest for the next five years. You want to invest in zero coupon bonds. One option you are considering is buying a five-year zero-coupon bond and holding it until maturity. The five-year spot rate is 3.25%. Another option you are considering is buying a three-year zero-coupon bond. When it matures you will then purchase a two-year zero-coupon bond. The current three-year spot rate is 2.5%. What should you expect the two-year spot rate to be in three years from now (when the three- year bond matures and you reinvest in a new two-year bond)? 2. Consider a five-year $1,000 face value bond with a 4.75% coupon rate. This bond pays annual coupons. The current yield to maturity is 4.25%. What is the market price of this bond? Is it trading at a discount, premium, or on par