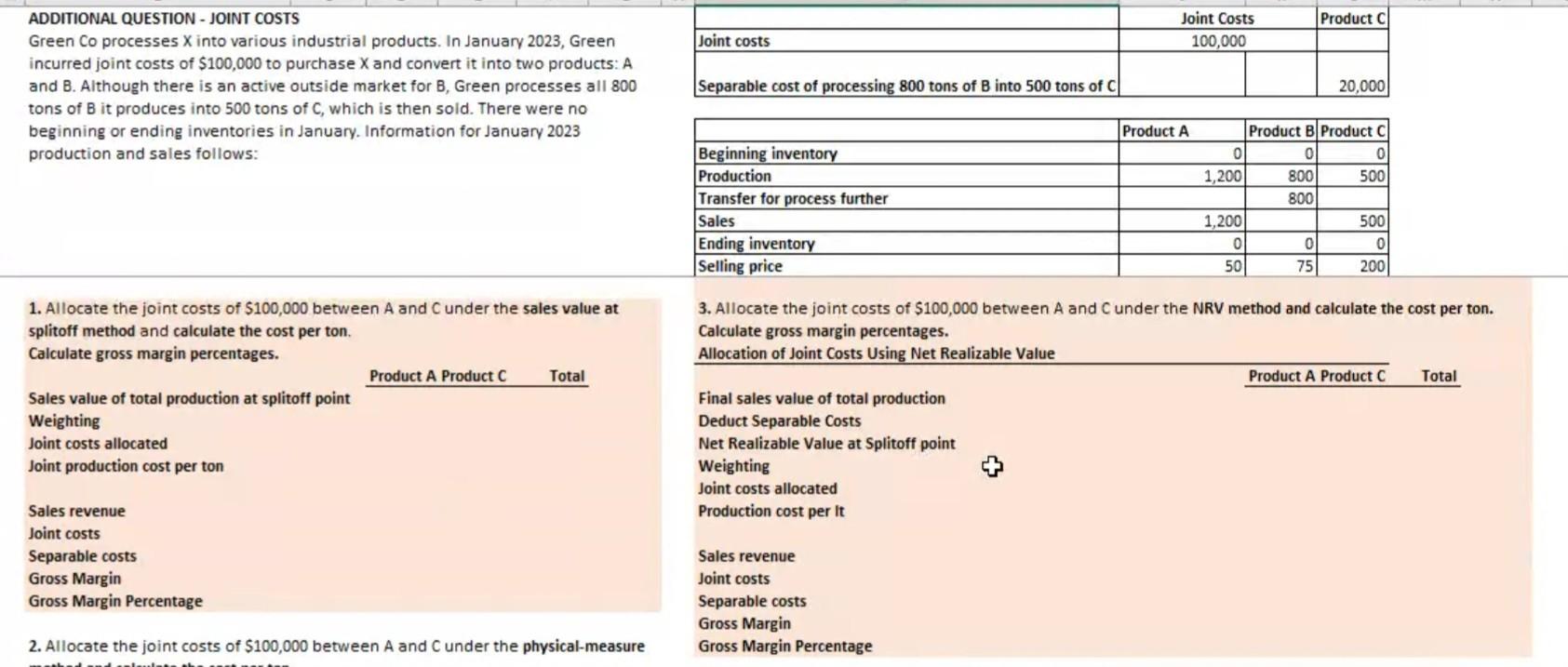

Question: ADDITIONAL QUESTION - JOINT COSTS Green Co processes X into various industrial products. In January 2023 , Green incurred joint costs of $100,000 to purchase

ADDITIONAL QUESTION - JOINT COSTS Green Co processes X into various industrial products. In January 2023 , Green incurred joint costs of $100,000 to purchase X and convert it into two products: A and B. Although there is an active outside market for B, Green processes all 800 tons of B it produces into 500 tons of C, which is then sold. There were no beginning or ending inventories in January. Information for January 2023 production and sales follows: 1. Allocate the joint costs of $100,000 between A and C under the sales value at splitoff method and calculate the cost per ton. Calculate gross margin percentages. 3. Allocate the joint costs of $100,000 between A and C under the NRV method and calculate the cost per ton. Calculate gross margin percentages. Allocation of Joint Costs Using Net Realizable Value 2. Allocate the joint costs of $100,000 between A and C under the physical-measure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts