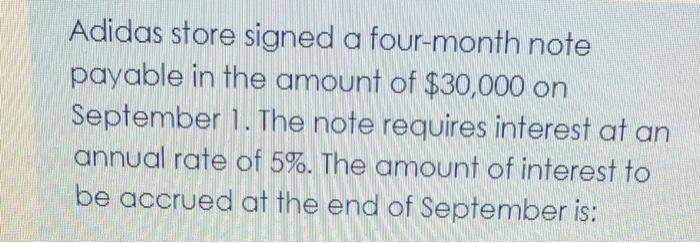

Question: Adidas store signed a four-month note payable in the amount of $30,000 on September 1. The note requires interest at an annual rate of 5%.

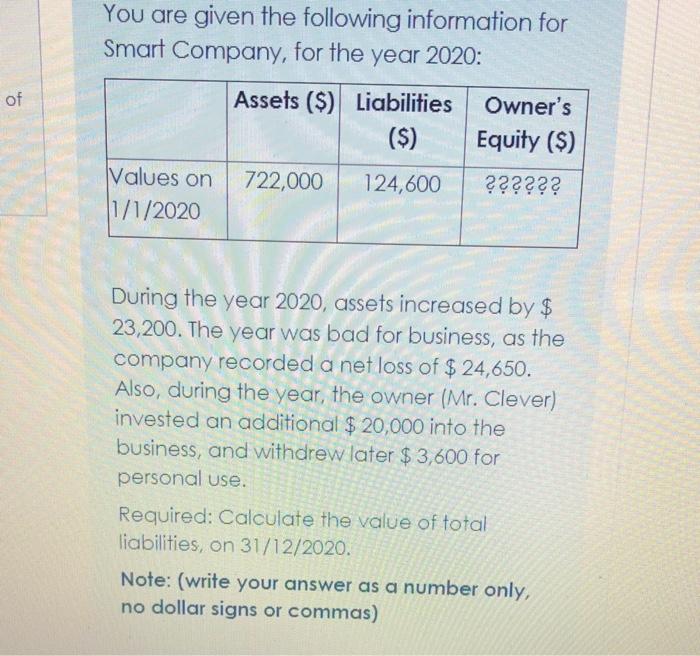

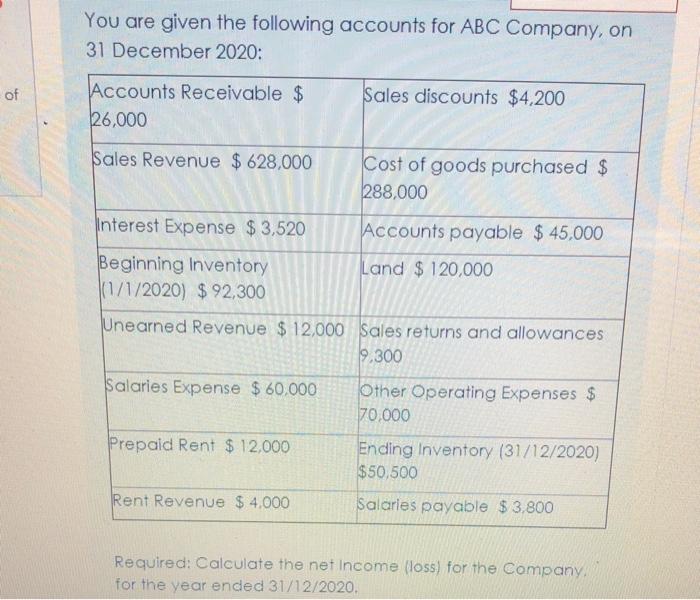

Adidas store signed a four-month note payable in the amount of $30,000 on September 1. The note requires interest at an annual rate of 5%. The amount of interest to be accrued at the end of September is: You are given the following information for Smart Company, for the year 2020: of Owner's Assets ($) Liabilities ($) Equity ($) 722,000 Values on 1/1/2020 124,600 ?????? During the year 2020, assets increased by $ 23,200. The year was bad for business, as the company recorded a net loss of $ 24,650. Also, during the year, the owner (Mr. Clever) invested an additional $ 20,000 into the business, and withdrew later $3,600 for personal use. Required: Calculate the value of total liabilities, on 31/12/2020. Note: (write your answer as a number only, no dollar signs or commas) You are given the following accounts for ABC Company, on 31 December 2020: of Accounts Receivable $ 26,000 Sales discounts $4,200 Sales Revenue $ 628,000 Cost of goods purchased $ 288,000 Interest Expense $ 3,520 Accounts payable $ 45,000 Beginning Inventory Land $ 120,000 (1/1/2020) $ 92,300 Unearned Revenue $ 12,000 Sales returns and allowances 9.300 Salaries Expense $ 60,000 Other Operating Expenses $ 70.000 Prepaid Rent $ 12,000 Ending Inventory (31/12/2020) $50,500 Rent Revenue $ 4.000 Salaries payable $ 3.800 Required: Calculate the net Income (loss) for the Company for the year ended 31/12/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts