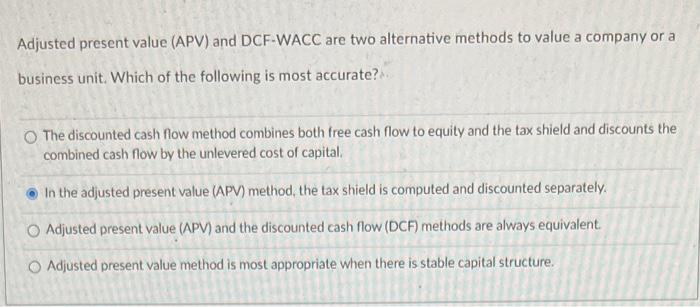

Question: Adjusted present value (APV) and DCF-WACC are two alternative methods to value a company or a business unit. Which of the following is most accurate?

Adjusted present value (APV) and DCF-WACC are two alternative methods to value a company or a business unit. Which of the following is most accurate? The discounted cash flow method combines both free cash flow to equity and the tax shield and discounts the combined cash flow by the unlevered cost of capital, In the adjusted present value (APV) method, the tax shield is computed and discounted separately. Adjusted present value (APV) and the discounted cash flow (DCF) methods are always equivalent. Adjusted present value method is most appropriate when there is stable capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts