Question: Adjusted WACC . Clark Explorers Inc., an engineering firm, has the following capital structure: Equity Preferred Stock Debt Market Price $49.41 $79.61 $970.65 Outstanding units

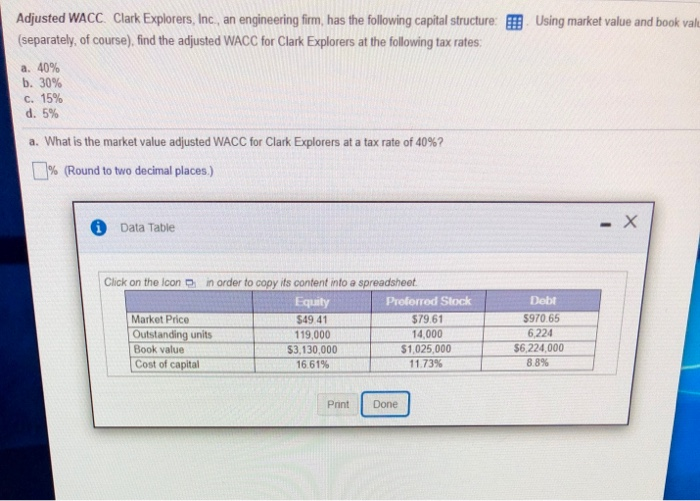

Adjusted WACC. Clark Explorers Inc., an engineering firm, has the following capital structure:

| Equity | Preferred Stock | Debt | |

| Market Price | $49.41 | $79.61 | $970.65 |

| Outstanding units | 119,000 | 14,000 | 6,224 |

| Book Value | $3,130,000 | $1,025,000 | $6,224,000 |

| Cost of Capital | 16.61% | 11.73% | 8.8% |

Using market value and book value (separately, of course), find the adjusted WACC for clark explorers at the following tax rates:

What is the market value adjusted WACC for Clark explorers at a tax rate of 40%

What is the market value adjusted WACC for Clark explorers at a tax rate of 30%

What is the market value adjusted WACC for Clark explorers at a tax rate of 15%

What is the market value adjusted WACC for Clark explorers at a tax rate of 5%

Adjusted WACC. Clark Explorers, Inc., an engineering firm, has the following capital structure: Using market value and book val (separately, of course), find the adjusted WACC for Clark Explorers at the following tax rates: a. 40% b. 30% C. 15% d. 5% a. What is the market value adjusted WACC for Clark Explorers at a tax rate of 40%? % (Round to two decimal places.) - X Data Table in arder to copy its content into a spreadsheet Click on the Icon Debt Equity Preferred Stock $79.61 $970 65 Market Price $49 41 Outstanding units 14,000 $1,025,000 6224 119,000 $6,224,000 88 % $3,130,000 Book value Cost of capital 11.73% 16.61% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts