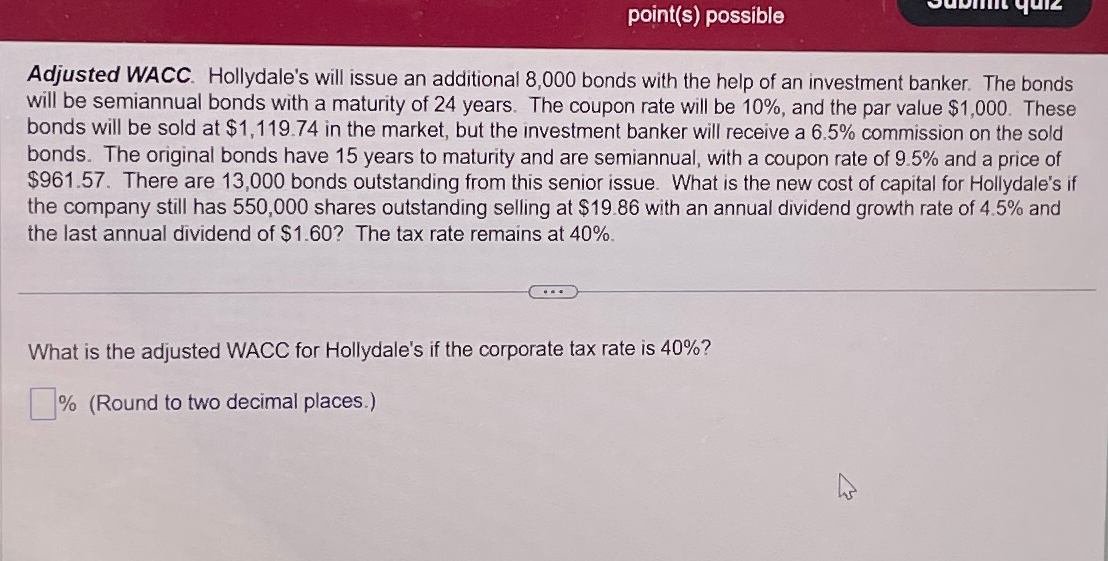

Question: Adjusted WACC. Hollydale's will issue an additional 8 , 0 0 0 bonds with the help of an investment banker. The bonds will be semiannual

Adjusted WACC. Hollydale's will issue an additional bonds with the help of an investment banker. The bonds will be semiannual bonds with a maturity of years. The coupon rate will be and the par value $ These bonds will be sold at $ in the market, but the investment banker will receive a commission on the sold bonds. The original bonds have years to maturity and are semiannual, with a coupon rate of and a price of $ There are bonds outstanding from this senior issue. What is the new cost of capital for Hollydale's if the company still has shares outstanding selling at $ with an annual dividend growth rate of and the last annual dividend of $ The tax rate remains at

What is the adjusted WACC for Hollydale's if the corporate tax rate is

Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock