Question: adjusting data not listed Required: 1. Using the above information, prepare adjusting journal entries. 2. Prepare a multiple-step income statement that includes separate categories for

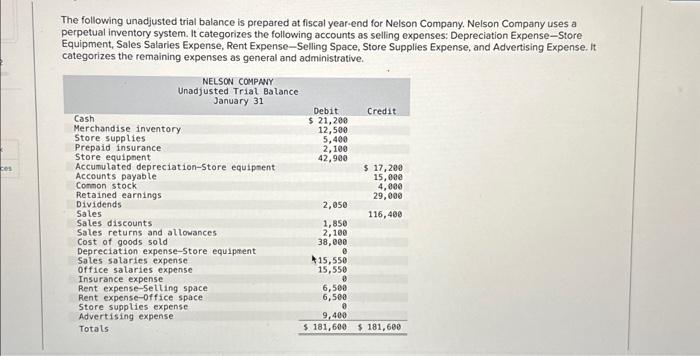

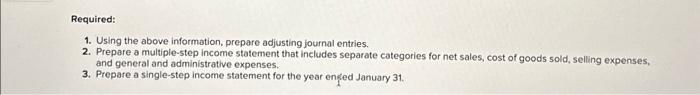

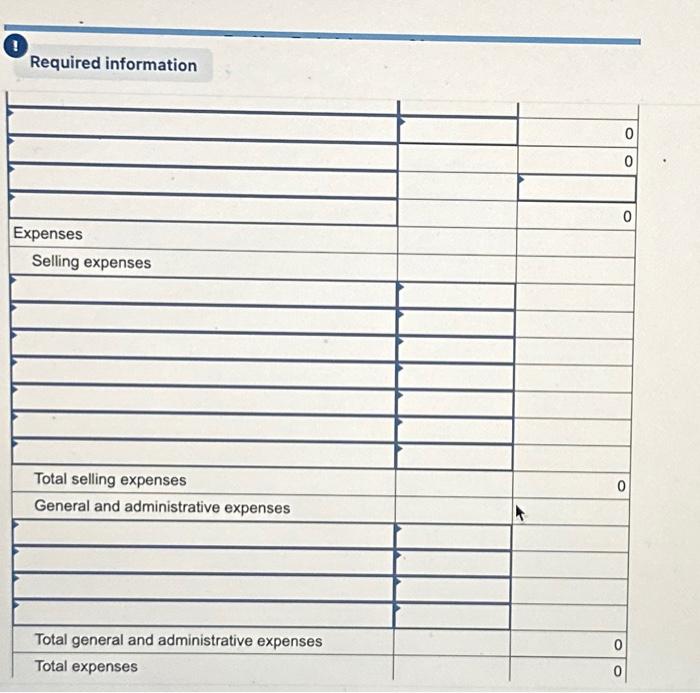

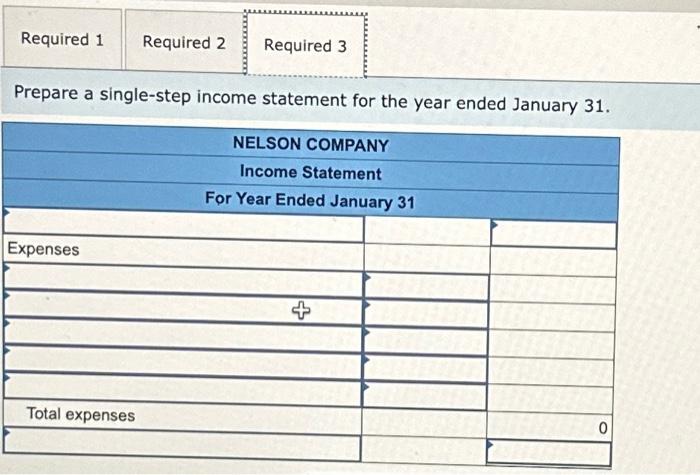

Required: 1. Using the above information, prepare adjusting journal entries. 2. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 3. Prepare a single-step income statement for the year enfed January 31. Required information The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. Prepare a single-step income statement for the year ended January 31 Required: 1. Using the above information, prepare adjusting journal entries. 2. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 3. Prepare a single-step income statement for the year enfed January 31. Required information The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. Prepare a single-step income statement for the year ended January 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts