Question: Adjusting Entries: If you could do 1,3, & 4 Thatd be great The following additional information is provided at July 31, 2018 1) Prepaid insurance

Adjusting Entries:

If you could do 1,3, & 4 Thatd be great

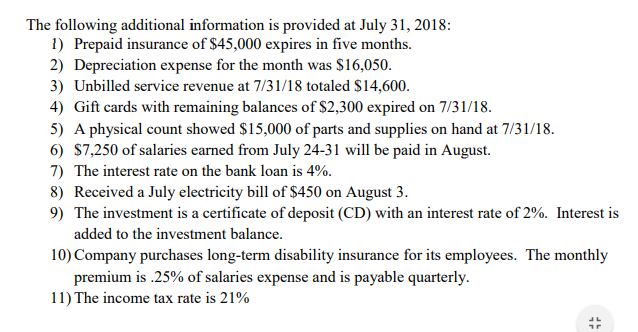

The following additional information is provided at July 31, 2018 1) Prepaid insurance of $45,000 expires in five months. 2) Depreciation expense for the month was $16,050 3) Unbilled service revenue at 7/31/18 totaled $14,600 4) Gift cards with remaining balances of $2,300 expired on 7/31/18 5) A physical count showed $15,000 of parts and supplies on hand at 7/31/18 6) $7,250 of salaries earned from July 24-31 will be paid in August. 7) The interest rate on the bank loan is 4% 8) Received a July electricity bill of $450 on August 3 9) The investment is a certificate of deposit (CD) with an interest rate of 2%. Interest is added to the investment balance 10) Company purchases long-term disability insurance for its employees. The monthly premium is .25% of salaries expense and is payable quarterly 11) The income tax rate is 21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts