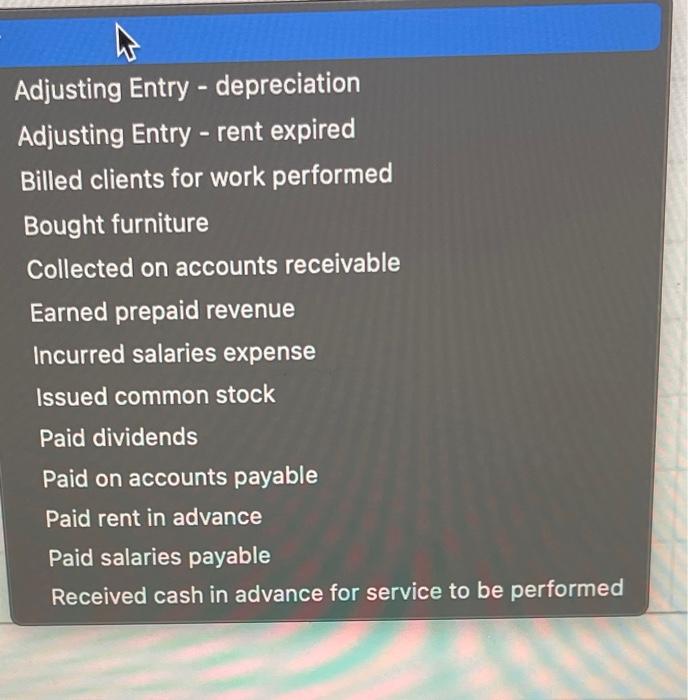

Question: Adjusting Entry - depreciation Adjusting Entry - rent expired Billed clients for work performed Bought furniture Collected on accounts receivable Earned prepaid revenue Incurred

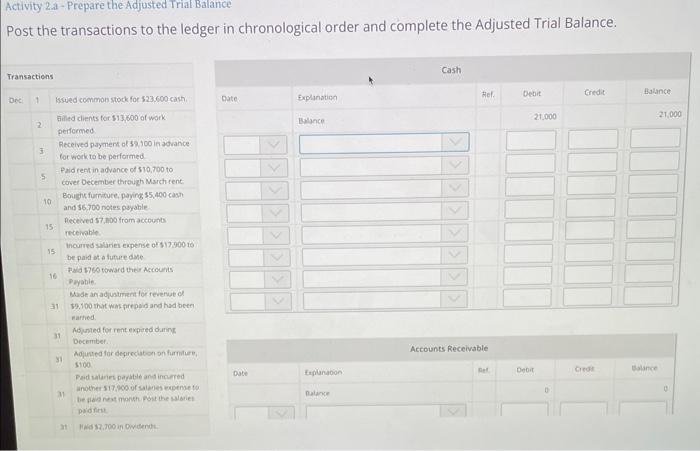

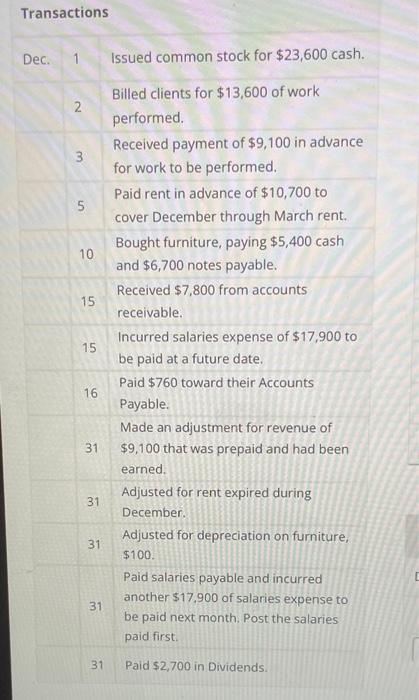

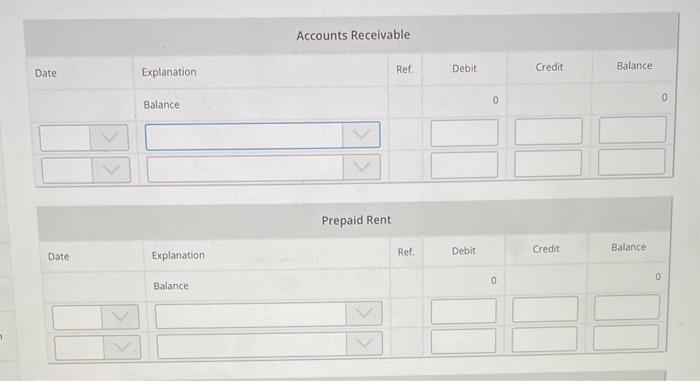

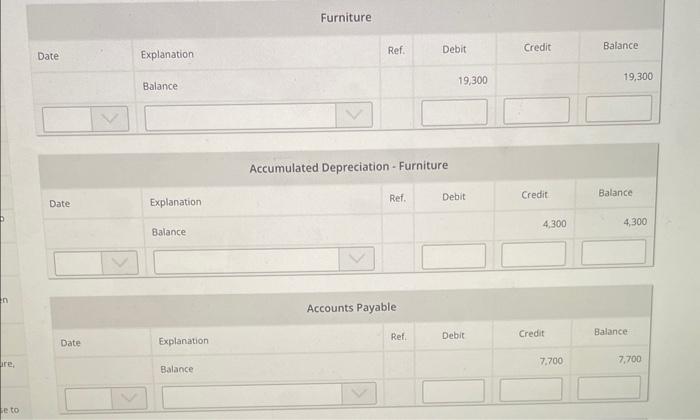

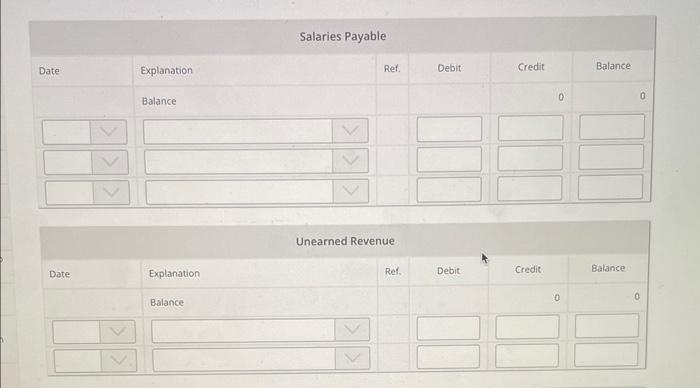

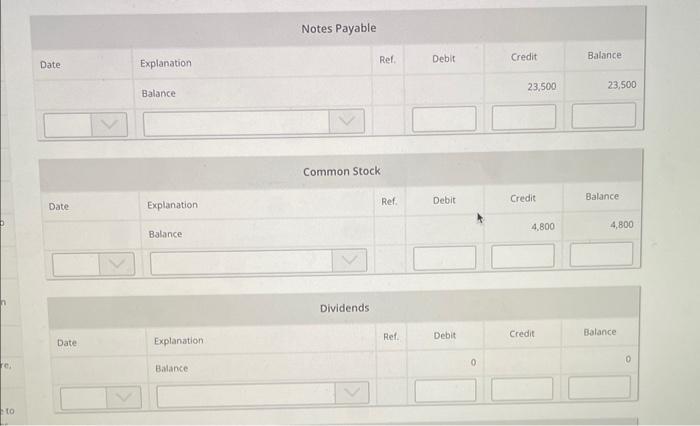

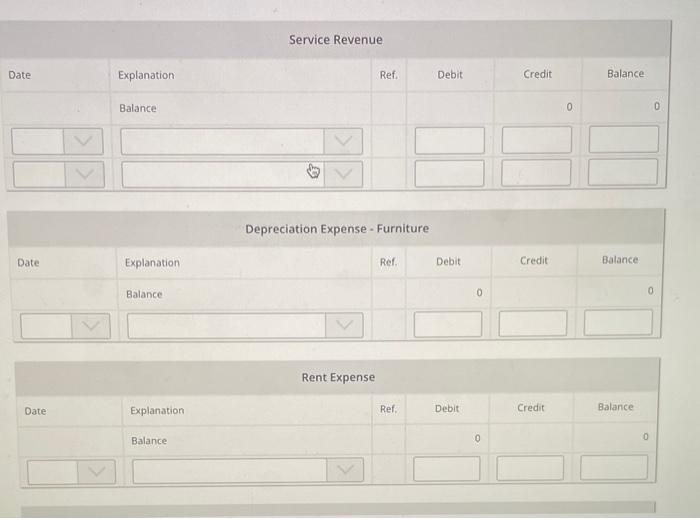

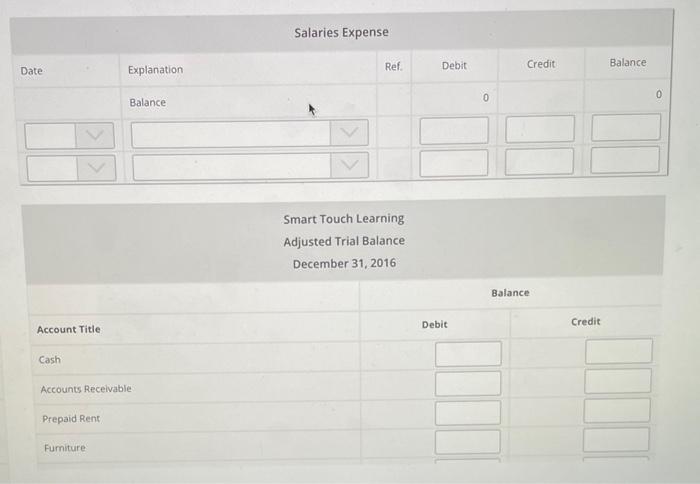

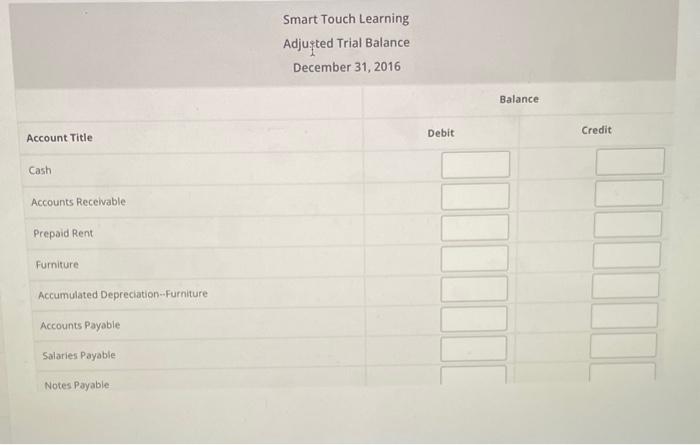

Adjusting Entry - depreciation Adjusting Entry - rent expired Billed clients for work performed Bought furniture Collected on accounts receivable Earned prepaid revenue Incurred salaries expense Issued common stock Paid dividends Paid on accounts payable Paid rent in advance Paid salaries payable Received cash in advance for service to be performed Activity 2.a-Prepare the Adjusted Trial Balance Post the transactions to the ledger in chronological order and complete the Adjusted Trial Balance. Transactions Dec 1 2 3 5 10 15 Issued common stock for $23,600 cash Billed clients for $13,600 of work performed. Received payment of $9,100 in advance for work to be performed Paid rent in advance of $10,700 to cover December through March rent Bought furniture, paying $5,400 cash and $6,700 notes payable Received $7,800 from accounts receivable. incurred salaries expense of $17.900 to be paid at a future date Paid $750 toward their Accounts 15 16 31 31 31 31 Payable. Made an adjustment for revenue of $9,100 that was prepaid and had been warned. Adjusted for rent expired during December. Adjusted for depreciation on furniture, $100 Pad salanes payable and incurred another $17,900 of salanes expense to be paid next month Post the salaries paid first 31 Faid $2.700 in Dividends Date Date Explanation Balance Explanation Balance Cash Ref. Accounts Receivable Ref Debit 21,000 Debit Credit Credit Balance 21,000 Balance Transactions Dec. 1 2 5 10 15 15 16 31 31 31 31 31 Issued common stock for $23,600 cash. Billed clients for $13,600 of work performed. Received payment of $9,100 in advance for work to be performed. Paid rent in advance of $10,700 to cover December through March rent. Bought furniture, paying $5,400 cash and $6,700 notes payable. Received $7,800 from accounts receivable. Incurred salaries expense of $17,900 to be paid at a future date. Paid $760 toward their Accounts Payable. Made an adjustment for revenue of $9,100 that was prepaid and had been earned. Adjusted for rent expired during December. Adjusted for depreciation on furniture, $100. Paid salaries payable and incurred another $17,900 of salaries expense to be paid next month. Post the salaries paid first. Paid $2,700 in Dividends. Date Date Explanation Balance Explanation Balance Accounts Receivable Prepaid Rent Ref. Ref. Debit Debit 0 0 Credit Credit Balance Balance 0 0 en ire, se to Date Date Date Explanation Balance Explanation Balance Explanation Balance Furniture. Ref. Accumulated Depreciation - Furniture Ref. Accounts Payable Debit Ref. 19,300 Debit Debit Credit Credit 4,300 Credit 7,700 Balance 19,300 Balance 4,300 Balance 7,700 Date Date Explanation Balance Explanation Balance Salaries Payable Ref. Unearned Revenue Ref. Debit Debit Credit Credit 0 0 Balance: Balance 0 re to Date Date Date Explanation Balance Explanation. Balance Explanation. Balance. Notes Payable Ref. Common Stock Dividends. Ref. Ref. Debit Debit Debit 0 Credit 23,500 Credit 4,800 Credit Balance 23,500 Balance 4,800 Balance 0 Date Date Date Explanation Balance Explanation Balance Explanation Balance Service Revenue Ref. Depreciation Expense - Furniture Rent Expense Ref. Ref. Debit Debit Debit 0 0 Credit Credit Credit 0 Balance. Balance: Balance 0 0 Date: Account Title Cash Prepaid Rent Explanation Accounts Receivable Furniture Balance Salaries Expense Ref. Smart Touch Learning Adjusted Trial Balance December 31, 2016 Debit Debit 0 Credit Balance Credit Balance 0 Account Title Cash Accounts Receivable. Prepaid Rent, Furniture. Accumulated Depreciation--Furniture Accounts Payable Salaries Payable Notes Payable Smart Touch Learning Adjusted Trial Balance December 31, 2016 Debit Balance Credit

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts