Question: Adjusting entry for customer refunds, allowances, and returns Scott Company had sales of $12,950,000 and related cost of goods sold of $7,500,000 for the year

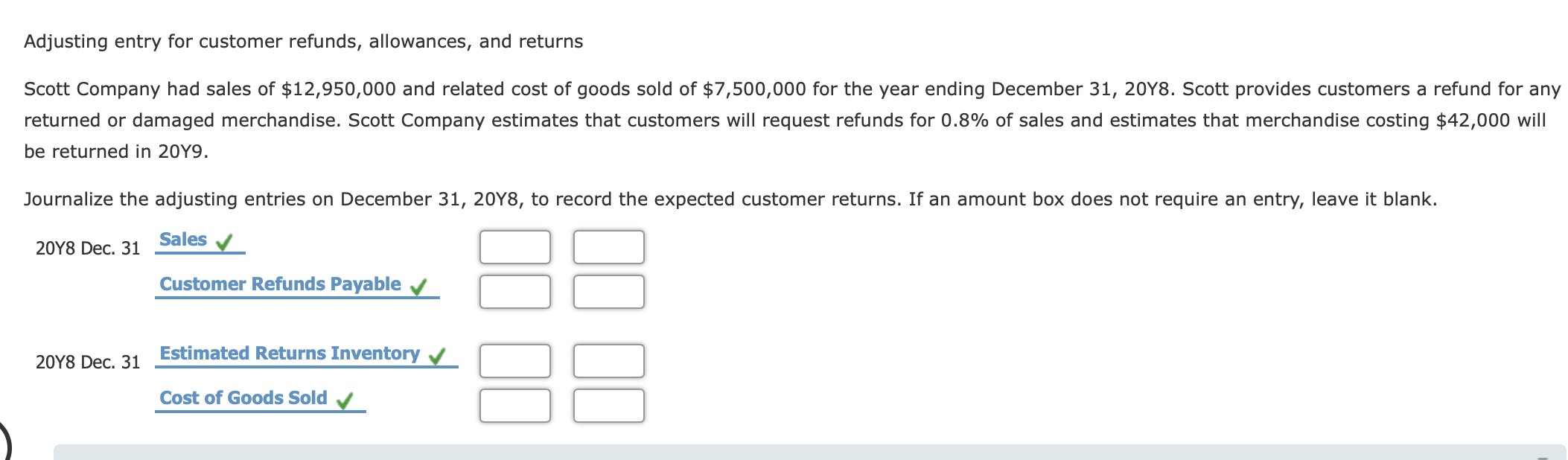

Adjusting entry for customer refunds, allowances, and returns Scott Company had sales of $12,950,000 and related cost of goods sold of $7,500,000 for the year ending December 31, 2018. Scott provides customers a refund for any returned or damaged merchandise. Scott Company estimates that customers will request refunds for 0.8% of sales and estimates that merchandise costing $42,000 will be returned in 2049. Journalize the adjusting entries on December 31, 2048, to record the expected customer returns. If an amount box does not require an entry, leave it blank. Sales 20Y8 Dec. 31 Customer Refunds Payable Estimated Returns Inventory 20Y8 Dec. 31 Cost of Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts