Question: adjusting entry information information for AJE 2 and 13 2. 3. 4. Adjusting Entry Information Note: All adjusting entries are dated December 31, 20X5. To

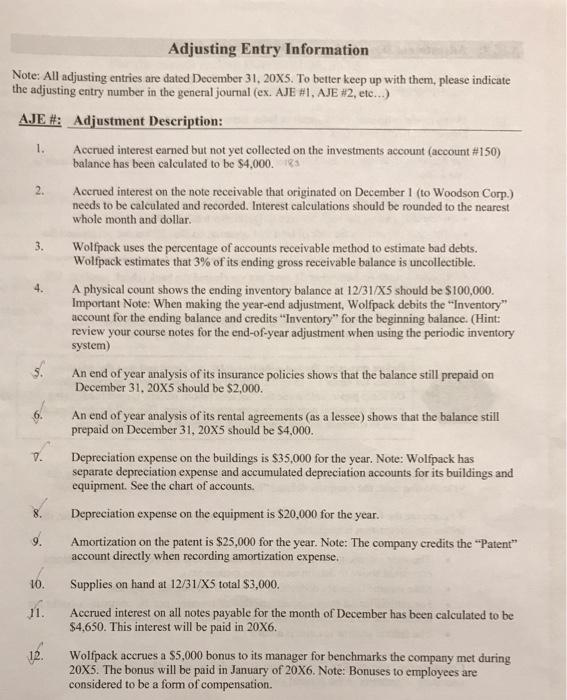

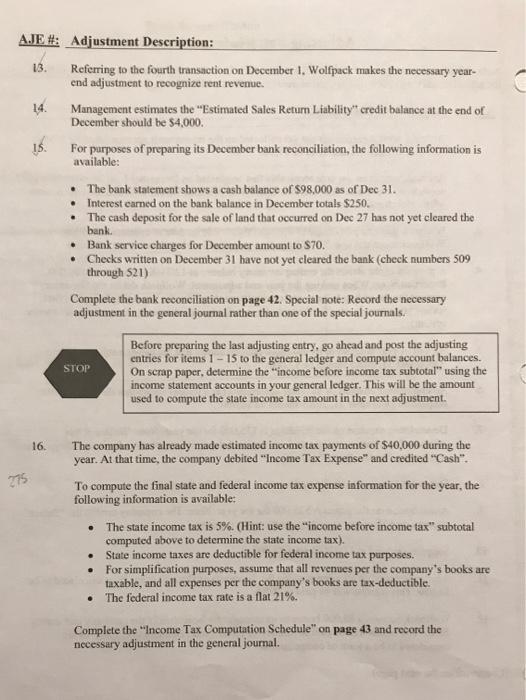

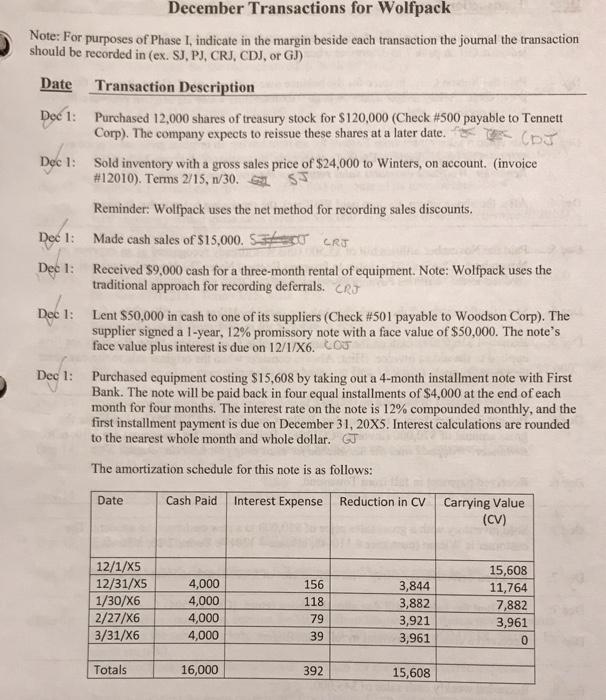

2. 3. 4. Adjusting Entry Information Note: All adjusting entries are dated December 31, 20X5. To better keep up with them, please indicate the adjusting entry number in the general journal (ex. AJE #1, AJE #2, etc...) AJE #: Adjustment Description: 1. Accrued interest earned but not yet collected on the investments account (account #150) balance has been calculated to be $4,000. 188 Accrued interest on the note receivable that originated on December 1 (to Woodson Corp.) needs to be calculated and recorded. Interest calculations should be rounded to the nearest whole month and dollar Wolfpack uses the percentage of accounts receivable method to estimate bad debts. Wolfpack estimates that 3% of its ending gross receivable balance is uncollectible. A physical count shows the ending inventory balance at 12/31/X5 should be $100,000 Important Note: When making the year-end adjustment, Wolfpack debits the "Inventory account for the ending balance and credits "Inventory" for the beginning balance. (Hint: review your course notes for the end-of-year adjustment when using the periodic inventory system) An end of year analysis of its insurance policies shows that the balance still prepaid on December 31, 20X5 should be $2,000. An end of year analysis of its rental agreements (as a lessee) shows that the balance still prepaid on December 31, 20Xs should be $4.000. Depreciation expense on the buildings is $35,000 for the year. Note: Wolfpack has separate depreciation expense and accumulated depreciation accounts for its buildings and equipment. See the chart of accounts. Depreciation expense on the equipment is $20,000 for the year. Amortization on the patent is $25,000 for the year. Note: The company credits the "Patent" account directly when recording amortization expense. Supplies on hand at 12/31/X5 total $3,000, 11. Accrued interest on all notes payable for the month of December has been calculated to be $4,650. This interest will be paid in 20X6. Wolfpack accrues a $5,000 bonus to its manager for benchmarks the company met during 20X5. The bonus will be paid in January of 20X6. Note: Bonuses to employees are considered to be a form of compensation. V. 8. 9. 10. 12. 15. AJE #: Adjustment Description: 13. Referring to the fourth transaction on December 1. Wolfpack makes the necessary year- end adjustment to recognize rent revenue. Management estimates the "Estimated Sales Return Liability credit balance at the end of December should be $4.000. For purposes of preparing its December bank reconciliation, the following information is available: The bank statement shows a cash balance of 898,000 as of Dec 31. . Interest earned on the bank balance in December totals $250. The cash deposit for the sale of land that occurred on Dec 27 has not yet cleared the bank Bank service charges for December amount to S70. Checks written on December 31 have not yet cleared the bank (check numbers 509 through 521) Complete the bank reconciliation on page 42. Special note: Record the necessary adjustment in the general journal rather than one of the special journals. Before preparing the last adjusting entry, go ahead and post the adjusting entries for items 1 - 15 to the general ledger and compute account balances. STOP On scrap paper, determine the "income before income tax subtotal" using the income statement accounts in your gencral ledger. This will be the amount used to compute the state income tax amount in the next adjustment 16. 275 The company has already made estimated income tax payments of $40,000 during the year. At that time, the company debited "Income Tax Expense" and credited "Cash". To compute the final state and federal income tax expense information for the year, the following information is available: The state income tax is 5%. (Hint: use the income before income tax" subtotal computed above to determine the state income tax). State income taxes are deductible for federal income tax purposes. For simplification purposes, assume that all revenues per the company's books are taxable, and all expenses per the company's books are tax-deductible The federal income tax rate is a flat 21%. Complete the "Income Tax Computation Schedule" on page 43 and record the necessary adjustment in the general journal. . The Coo December Transactions for Wolfpack Note: For purposes of Phase I, indicate in the margin beside each transaction the journal the transaction should be recorded in (ex. SJ, PJ, CRJ, CDJ, or GJ) Date Transaction Description Dec 1: Purchased 12,000 shares of treasury stock for $120,000 (Check #500 payable to Tennett Corp). The company expects to reissue these shares at a later date. Dec 1: Sold inventory with a gross sales price of $24,000 to Winters, on account. (invoice #12010). Terms 2/15, n/30. SI 55 Reminder: Wolfpack uses the net method for recording sales discounts, Dec 1: Made cash sales of $15,000. 53 CRU Received $9,000 cash for a three-month rental of equipment. Note: Wolfpack uses the traditional approach for recording deferrals. CRJ Dec 1: Lent $50,000 in cash to one of its suppliers (Check #501 payable to Woodson Corp). The supplier signed a 1-year, 12% promissory note with a face value of $50,000. The note's face value plus interest is due on 12/1/X6. COJ Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank. The note will be paid back in four equal installments of $4,000 at the end of each month for four months. The interest rate on the note is 12% compounded monthly, and the first installment payment is due on December 31, 20X5. Interest calculations are rounded to the nearest whole month and whole dollar. GJ The amortization schedule for this note is as follows: Dec 1: Dec 1: Date Cash Paid Interest Expense Reduction in CV Carrying Value (CV) 12/1/15 12/31/35 1/30/X6 2/27/X6 3/31/X6 4,000 4,000 4,000 4,000 156 118 79 39 3,844 3,882 3,921 3,961 15,608 11,764 7,882 3,961 0 Totals 16,000 392 15,608 2. 3. 4. Adjusting Entry Information Note: All adjusting entries are dated December 31, 20X5. To better keep up with them, please indicate the adjusting entry number in the general journal (ex. AJE #1, AJE #2, etc...) AJE #: Adjustment Description: 1. Accrued interest earned but not yet collected on the investments account (account #150) balance has been calculated to be $4,000. 188 Accrued interest on the note receivable that originated on December 1 (to Woodson Corp.) needs to be calculated and recorded. Interest calculations should be rounded to the nearest whole month and dollar Wolfpack uses the percentage of accounts receivable method to estimate bad debts. Wolfpack estimates that 3% of its ending gross receivable balance is uncollectible. A physical count shows the ending inventory balance at 12/31/X5 should be $100,000 Important Note: When making the year-end adjustment, Wolfpack debits the "Inventory account for the ending balance and credits "Inventory" for the beginning balance. (Hint: review your course notes for the end-of-year adjustment when using the periodic inventory system) An end of year analysis of its insurance policies shows that the balance still prepaid on December 31, 20X5 should be $2,000. An end of year analysis of its rental agreements (as a lessee) shows that the balance still prepaid on December 31, 20Xs should be $4.000. Depreciation expense on the buildings is $35,000 for the year. Note: Wolfpack has separate depreciation expense and accumulated depreciation accounts for its buildings and equipment. See the chart of accounts. Depreciation expense on the equipment is $20,000 for the year. Amortization on the patent is $25,000 for the year. Note: The company credits the "Patent" account directly when recording amortization expense. Supplies on hand at 12/31/X5 total $3,000, 11. Accrued interest on all notes payable for the month of December has been calculated to be $4,650. This interest will be paid in 20X6. Wolfpack accrues a $5,000 bonus to its manager for benchmarks the company met during 20X5. The bonus will be paid in January of 20X6. Note: Bonuses to employees are considered to be a form of compensation. V. 8. 9. 10. 12. 15. AJE #: Adjustment Description: 13. Referring to the fourth transaction on December 1. Wolfpack makes the necessary year- end adjustment to recognize rent revenue. Management estimates the "Estimated Sales Return Liability credit balance at the end of December should be $4.000. For purposes of preparing its December bank reconciliation, the following information is available: The bank statement shows a cash balance of 898,000 as of Dec 31. . Interest earned on the bank balance in December totals $250. The cash deposit for the sale of land that occurred on Dec 27 has not yet cleared the bank Bank service charges for December amount to S70. Checks written on December 31 have not yet cleared the bank (check numbers 509 through 521) Complete the bank reconciliation on page 42. Special note: Record the necessary adjustment in the general journal rather than one of the special journals. Before preparing the last adjusting entry, go ahead and post the adjusting entries for items 1 - 15 to the general ledger and compute account balances. STOP On scrap paper, determine the "income before income tax subtotal" using the income statement accounts in your gencral ledger. This will be the amount used to compute the state income tax amount in the next adjustment 16. 275 The company has already made estimated income tax payments of $40,000 during the year. At that time, the company debited "Income Tax Expense" and credited "Cash". To compute the final state and federal income tax expense information for the year, the following information is available: The state income tax is 5%. (Hint: use the income before income tax" subtotal computed above to determine the state income tax). State income taxes are deductible for federal income tax purposes. For simplification purposes, assume that all revenues per the company's books are taxable, and all expenses per the company's books are tax-deductible The federal income tax rate is a flat 21%. Complete the "Income Tax Computation Schedule" on page 43 and record the necessary adjustment in the general journal. . The Coo December Transactions for Wolfpack Note: For purposes of Phase I, indicate in the margin beside each transaction the journal the transaction should be recorded in (ex. SJ, PJ, CRJ, CDJ, or GJ) Date Transaction Description Dec 1: Purchased 12,000 shares of treasury stock for $120,000 (Check #500 payable to Tennett Corp). The company expects to reissue these shares at a later date. Dec 1: Sold inventory with a gross sales price of $24,000 to Winters, on account. (invoice #12010). Terms 2/15, n/30. SI 55 Reminder: Wolfpack uses the net method for recording sales discounts, Dec 1: Made cash sales of $15,000. 53 CRU Received $9,000 cash for a three-month rental of equipment. Note: Wolfpack uses the traditional approach for recording deferrals. CRJ Dec 1: Lent $50,000 in cash to one of its suppliers (Check #501 payable to Woodson Corp). The supplier signed a 1-year, 12% promissory note with a face value of $50,000. The note's face value plus interest is due on 12/1/X6. COJ Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank. The note will be paid back in four equal installments of $4,000 at the end of each month for four months. The interest rate on the note is 12% compounded monthly, and the first installment payment is due on December 31, 20X5. Interest calculations are rounded to the nearest whole month and whole dollar. GJ The amortization schedule for this note is as follows: Dec 1: Dec 1: Date Cash Paid Interest Expense Reduction in CV Carrying Value (CV) 12/1/15 12/31/35 1/30/X6 2/27/X6 3/31/X6 4,000 4,000 4,000 4,000 156 118 79 39 3,844 3,882 3,921 3,961 15,608 11,764 7,882 3,961 0 Totals 16,000 392 15,608

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts