Question: ADJUSTING ENTRY PRACTICE CLASSWORK For each separate case below, follow the 3-step process for adjusting the accrued revenue acc Step 1: Determine what the current

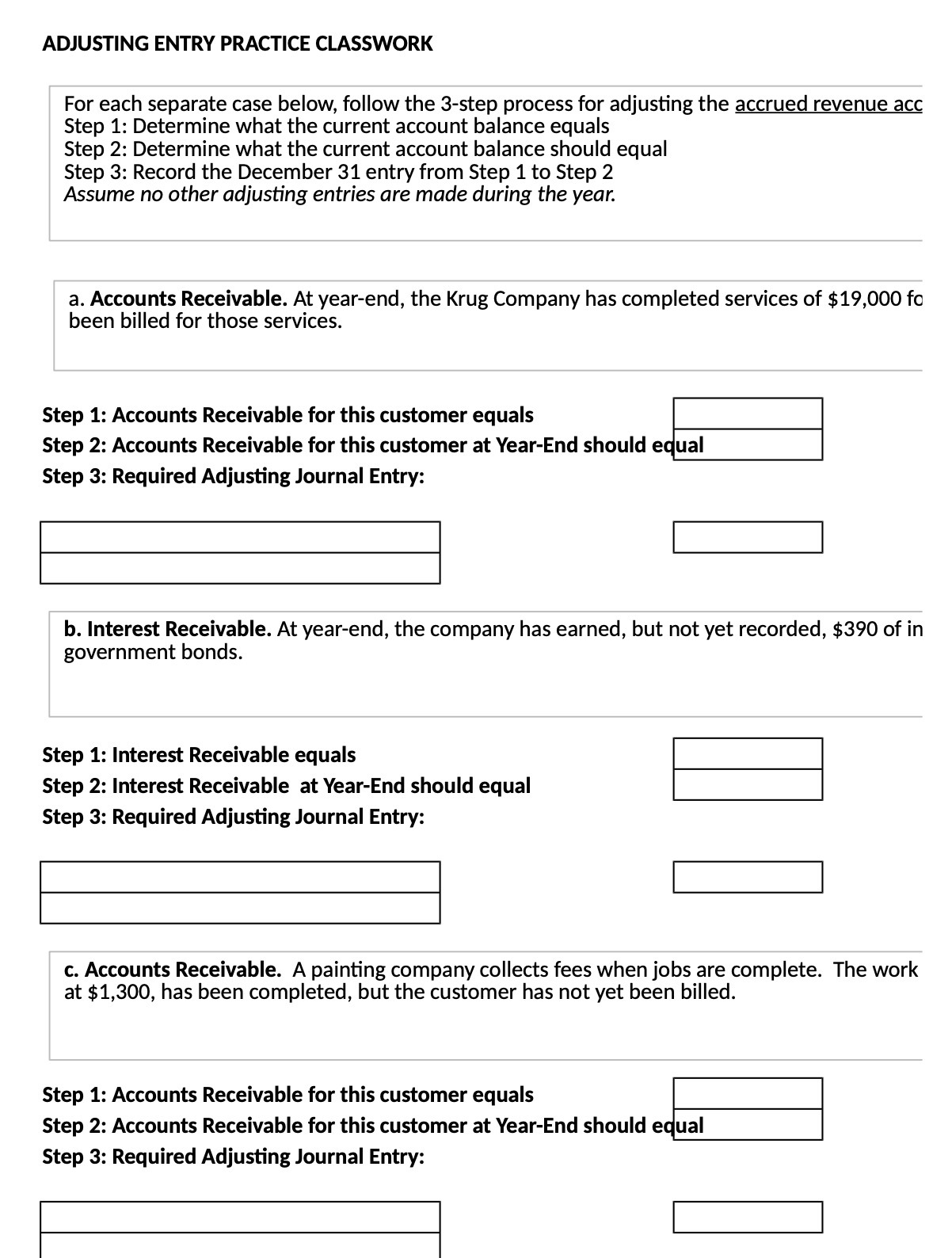

ADJUSTING ENTRY PRACTICE CLASSWORK For each separate case below, follow the 3-step process for adjusting the accrued revenue acc Step 1: Determine what the current account balance equals Step 2: Determine what the current account balance should equal Step 3: Record the December 31 entry from Step 1 to Step 2 Assume no other adjusting entries are made during the year. a. Accounts Receivable. At year-end, the Krug Company has completed services of $19,000 to been billed for those services. Step 1: Accounts Receivable for this customer equals Step 2: Accounts Receivable for this customer at Year-End should e - _ Step 3: Required Adjusting Journal Entry: b. Interest Receivable. At year-end, the company has earned, but not yet recorded, $390 of in government bonds. Step 1: Interest Receivable equals Step 2: Interest Receivable at Year-End should equal Step 3: Required Adjusting Journal Entry: E E c. Accounts Receivable. A painting company collects fees when jobs are complete. The work at $1,300, has been completed, but the customer has not yet been billed. Step 1: Accounts Receivable for this customer equals Step 2: Accounts Receivable for this customer at Year-End should e . _ Step 3: Required Adjusting Journal Entry: :l |:|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts