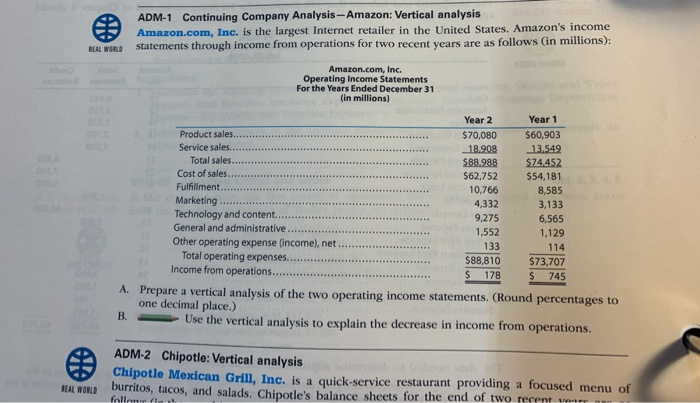

Question: ADM-1 Continuing Company Analysis Amazon: Vertical analysis Amazon.com, Inc. is the largest Internet retailer in the United States. Amazon's income statements through income from operations

ADM-1 Continuing Company Analysis Amazon: Vertical analysis Amazon.com, Inc. is the largest Internet retailer in the United States. Amazon's income statements through income from operations for two recent years are as follows (in millions): REAL WORLD Amazon.com, Inc. Operating Income Statements For the Years Ended December 31 in millions) Year 2 Year 1 60,903 -18.908-13.549 $88,988 $74.45 $62,752 $54,181 8,585 $70,080 Total sales Cost of sales. Fulfillment... Marketing Technology and content.. General and administrative 10,766 4,332 6,565 1,129 92753,133 1,552 133 114 Total operating expenses.. Income from operation... $88,810 $73,707 $ 178 745 Prepare a vertical analysis of the two operating income statements. (Roundp one decimal place.) A. Use the vertical analysis to explain the decrease in income from operations. ADM-2 Chipotle: Vertical analysis Chipotle Mexican Grill, Inc. is a quick-service restaurant providing a focused menu burritos, tacos, and salads. Chipotle's balance sheets for the end of two recent REAL WORLD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts