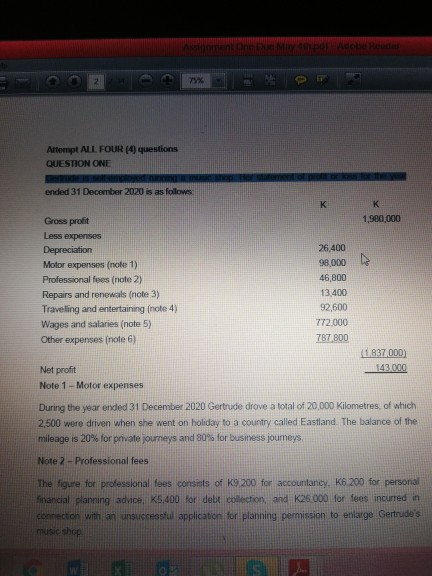

Question: Adobe Red 73% Attempt ALL FOUR (4) questions QUESTION ONE vod ended 31 December 2020 is as follows K K 1,980,000 26.400 98,000 Gross profit

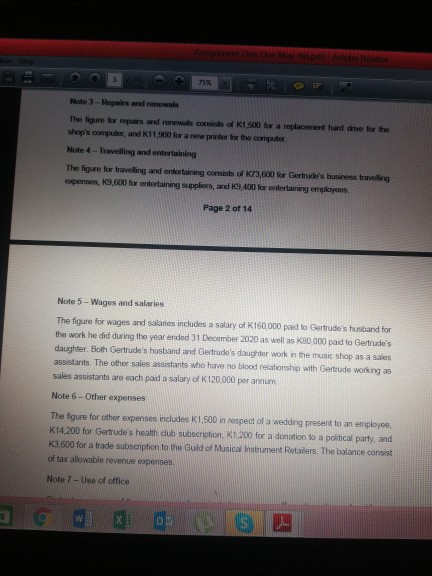

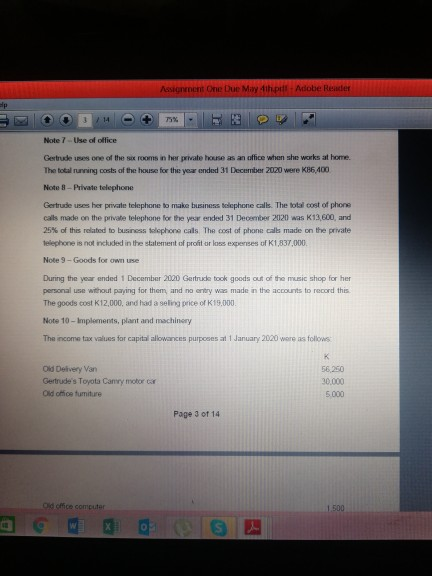

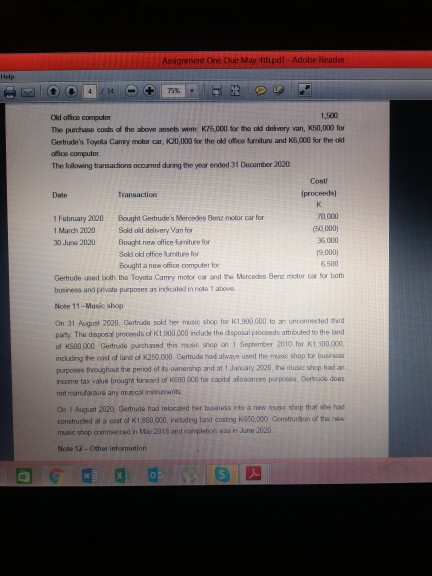

Adobe Red 73% Attempt ALL FOUR (4) questions QUESTION ONE vod ended 31 December 2020 is as follows K K 1,980,000 26.400 98,000 Gross profit Less expenses Depreciation Motor expenses (note 1) Professional fees (note 2) Repairs and renewals (note 3) Traveling and entertaining (note 4) Wages and salaries (note 5) Other expenses (note 6) 46,800 13.400 92,600 772.000 787 800 (1 83700D 143.000 Net profit Note 1 - Motor expenses During the year ended 31 December 2020 Gertrude drave a total of 20,000 kilometres, of which 2,500 were driven when she went on holiday to a country called Eastland. The balance of the mileage is 20% for private journeys and 80% for business journeys Note 2 - Professional fees The figure for professional foes consists of K9 200 for accountancy, K6 200 for personal financial planning advice, K5,400 for debt collection and 26.000 for fees incurred in connection with an unsuccessful applicator for planning permission to enlarge Gertrude's music shop 3 75% Note 3 - Repairs and was The figure for repairs and renewal consists of K1 500 for a replacement hadde for the shop's computer, and 11,900 for a new primer for the computer Note 4 - Travelling and entertaining The figure for traveling and entertaining consists of K73,600 for Gertrude's business traveling expenses, k9,600 for entertaining suppliers, and 9,400 for entertaining employees Page 2 of 14 Note 5 - Wages and salaries The figure for wages and salaries includes a salary of K160.000 paid to Gertrude's husband for the work he did during the year ended 31 December 2020 as well as 80000 paid to Gertrude's daughter. Both Gertrude's husband and Gertrude's daughter work in the music shop as a sales assistants. The other sales assistants who have no blood relationship with Gertrude working as sales assistants are each pad a salary of K120.000 per annum Note 6 - Other expenses The figure for other expenses includes 1,500 in respect of a wedding present to an employee K14,200 for Gertrude's health dub subscripton, K1200 for a donation to a political party, and K3,600 for a trade subscription to the Guld of Musical Instrument Retailers. The balance consist of tax allowable revenue expenses Note 7 - Use of office Assignment One Due May the Adobe Reader lp Note 7 - Use of office Gertrudeuses one of the sex rooms in her private house an office when she works at home The total running costs of the house for the year ended 31 December 2020 were K86,400 Note 8 - Private telephone Gertrudeuses her private telephone to make business telephone calls. The total cost of phone calls made on the private telephone for the year ended 31 December 2020 was K13.600and 25% of this related to business Solephone calls. The cost of phone calls made on the private telephone is not included in the statement of profit or less expenses of K1,837,000 Note 3 - Goods for own use During the year anded 1 December 2000 Gertrude took goods out of the music shop for her personal use without paying for them, and no entry was made in the accounts to record this The goods cost R12,000, and had a selling price of K15,000 Note 10 - Implements, plant and machinery The income tax values for capital allowances purposes at 1 January 2020 were as follows: Old Delivery Van Gertrude's Toyota Camry motorc Oldotice furniture K 56 250 30.000 5.000 Page 3 of 14 Odome comcutar 1.500 Assignment One Due May 4th pdf - Adobe Reader Help 4 14 75%. Old at the computer The purchase costs of the above assets were: K75.000 for the old delivery van, K50,000 for Gertrude's Toyota Camry motorcar, K20,000 for the old office furniture and K6,000 for the old oce computer The following transactions occurred during the year ended 31 December 2020 Cost Date Transaction (proceeds K 1 February 2020 Bought Gertrude Mercedes Benz motor car for 70 000 1 March 2020 Sold old delivery Van for (50,000) 30 June 2020 Bought new office furniture for 36.000 Sold old office furniture for 19,000 Bought a new office computer for 6,500 Gertrude used both the Toyota Camry motorcar and the Mercedes Bere motor car for both business and private purposes as indicated in note 1 above Note 11 - Music Shop On 31 August 2020, Bertrude sold her music shop for K1 900,000 to an unconnected third party. The disposal proceeds of K1 900.000 include the disposal proceeds attributed to the land of KSOO,000. Gertrude purchased this music shop on 1 September 2010 for K1.100.000 including the cost of land of K250.000 Gertrude had always used the shop for business purposes toughout the period of ownership and at Jawaty 2020, the music shop had an ncome tax value brought forward of 50000 for capital alowances purpos Gertrud does not manufacture any musical instruments On 1 August 2020. Gertrude had relocated here to a new music shop that she had constructed at a cost of K1 860,000, including and costing K650,000 Construction of the now music shop commenced in May 2015 and completion in June 2020 No 12 - Other information Assignment One Du May 4th Adobe Reader 5 14 75% music shop commenced in May 2018 and completion was in June 2020 Note 12 - Other Information For the tax year 2020, Gertrude pard provisional income tax that was calculated on an amount of provisional income of K600,000. The whole of this amount of provisional income was made up of provisional business profit from the music shop. Gertrude paid the provisional income tax Page 4 of 14 on the appropriate due dates and she had also submitted the retum of provisional income on the due date In February 2020, Gertrude got employer as a part time lecturer in music at a local private colege. She was paid at a gross rate of K320 per session and she had a total of 120 sessions in the period from February 2020 to 31 December 2020. The college deducted income tax of K14.400 from Gertude's salary under the pay as you earn system. The college paid the income tax to the Zambia Revenue Authority on the appropriate due dates Gertrude received Royalties of 34,000 in the tax year 2020. This is the actual amount that Gertrude received Withhoking Tax had been deducted at source Required la Calculate the amount of provisional income tax paid by Gertrude for the tax year 2020. and prepare a schedule showing the due dates and amous pard on each due date 15 Marks by Calculate the captalowances for the lax your 2020 on $ KO on the appropriate due dates and she had to submitted the return of provisional income on the due date In February 2020. Gertrude got employment as a part time lecturer in music at a local private college. She was paid at a gross rate of K320 per session and she had a total of 120 sessions in the period from February 2020 to 31 December 2020. The college deduced income tax of K14,400 from Gertude's salary under the pay as you ear system. The college paid the income tax to the Zambia Revenue Authority on the appropriate due dates. Gertrude received Royalties of K34,000 in the tax year 2020. This is the actual amount that Gertrude received. Withholding Tax had been deducted at source. Required: (a) Calculate the amount of provisional income tax paid by Gertrude for the tax year 2020, and prepare a schedule showing the due dates and amounts paid on each due date [5 Marks) (b) Calculate the capital allowances for the tax year 2020 on: 0 Implements, plant and machinery and [12 Marks! () Buildings [4 Marks (c) Calculate Gertrude's taxable business profit figure after capital allowances for the tax year 2020 [12 Marks (d) Calculate the balance of income tax payable by Gertrude for the tax year 2020 17 Marks] [TOTAL: 40 MARKS QUESTION TWO IS Adobe Red 73% Attempt ALL FOUR (4) questions QUESTION ONE vod ended 31 December 2020 is as follows K K 1,980,000 26.400 98,000 Gross profit Less expenses Depreciation Motor expenses (note 1) Professional fees (note 2) Repairs and renewals (note 3) Traveling and entertaining (note 4) Wages and salaries (note 5) Other expenses (note 6) 46,800 13.400 92,600 772.000 787 800 (1 83700D 143.000 Net profit Note 1 - Motor expenses During the year ended 31 December 2020 Gertrude drave a total of 20,000 kilometres, of which 2,500 were driven when she went on holiday to a country called Eastland. The balance of the mileage is 20% for private journeys and 80% for business journeys Note 2 - Professional fees The figure for professional foes consists of K9 200 for accountancy, K6 200 for personal financial planning advice, K5,400 for debt collection and 26.000 for fees incurred in connection with an unsuccessful applicator for planning permission to enlarge Gertrude's music shop 3 75% Note 3 - Repairs and was The figure for repairs and renewal consists of K1 500 for a replacement hadde for the shop's computer, and 11,900 for a new primer for the computer Note 4 - Travelling and entertaining The figure for traveling and entertaining consists of K73,600 for Gertrude's business traveling expenses, k9,600 for entertaining suppliers, and 9,400 for entertaining employees Page 2 of 14 Note 5 - Wages and salaries The figure for wages and salaries includes a salary of K160.000 paid to Gertrude's husband for the work he did during the year ended 31 December 2020 as well as 80000 paid to Gertrude's daughter. Both Gertrude's husband and Gertrude's daughter work in the music shop as a sales assistants. The other sales assistants who have no blood relationship with Gertrude working as sales assistants are each pad a salary of K120.000 per annum Note 6 - Other expenses The figure for other expenses includes 1,500 in respect of a wedding present to an employee K14,200 for Gertrude's health dub subscripton, K1200 for a donation to a political party, and K3,600 for a trade subscription to the Guld of Musical Instrument Retailers. The balance consist of tax allowable revenue expenses Note 7 - Use of office Assignment One Due May the Adobe Reader lp Note 7 - Use of office Gertrudeuses one of the sex rooms in her private house an office when she works at home The total running costs of the house for the year ended 31 December 2020 were K86,400 Note 8 - Private telephone Gertrudeuses her private telephone to make business telephone calls. The total cost of phone calls made on the private telephone for the year ended 31 December 2020 was K13.600and 25% of this related to business Solephone calls. The cost of phone calls made on the private telephone is not included in the statement of profit or less expenses of K1,837,000 Note 3 - Goods for own use During the year anded 1 December 2000 Gertrude took goods out of the music shop for her personal use without paying for them, and no entry was made in the accounts to record this The goods cost R12,000, and had a selling price of K15,000 Note 10 - Implements, plant and machinery The income tax values for capital allowances purposes at 1 January 2020 were as follows: Old Delivery Van Gertrude's Toyota Camry motorc Oldotice furniture K 56 250 30.000 5.000 Page 3 of 14 Odome comcutar 1.500 Assignment One Due May 4th pdf - Adobe Reader Help 4 14 75%. Old at the computer The purchase costs of the above assets were: K75.000 for the old delivery van, K50,000 for Gertrude's Toyota Camry motorcar, K20,000 for the old office furniture and K6,000 for the old oce computer The following transactions occurred during the year ended 31 December 2020 Cost Date Transaction (proceeds K 1 February 2020 Bought Gertrude Mercedes Benz motor car for 70 000 1 March 2020 Sold old delivery Van for (50,000) 30 June 2020 Bought new office furniture for 36.000 Sold old office furniture for 19,000 Bought a new office computer for 6,500 Gertrude used both the Toyota Camry motorcar and the Mercedes Bere motor car for both business and private purposes as indicated in note 1 above Note 11 - Music Shop On 31 August 2020, Bertrude sold her music shop for K1 900,000 to an unconnected third party. The disposal proceeds of K1 900.000 include the disposal proceeds attributed to the land of KSOO,000. Gertrude purchased this music shop on 1 September 2010 for K1.100.000 including the cost of land of K250.000 Gertrude had always used the shop for business purposes toughout the period of ownership and at Jawaty 2020, the music shop had an ncome tax value brought forward of 50000 for capital alowances purpos Gertrud does not manufacture any musical instruments On 1 August 2020. Gertrude had relocated here to a new music shop that she had constructed at a cost of K1 860,000, including and costing K650,000 Construction of the now music shop commenced in May 2015 and completion in June 2020 No 12 - Other information Assignment One Du May 4th Adobe Reader 5 14 75% music shop commenced in May 2018 and completion was in June 2020 Note 12 - Other Information For the tax year 2020, Gertrude pard provisional income tax that was calculated on an amount of provisional income of K600,000. The whole of this amount of provisional income was made up of provisional business profit from the music shop. Gertrude paid the provisional income tax Page 4 of 14 on the appropriate due dates and she had also submitted the retum of provisional income on the due date In February 2020, Gertrude got employer as a part time lecturer in music at a local private colege. She was paid at a gross rate of K320 per session and she had a total of 120 sessions in the period from February 2020 to 31 December 2020. The college deducted income tax of K14.400 from Gertude's salary under the pay as you earn system. The college paid the income tax to the Zambia Revenue Authority on the appropriate due dates Gertrude received Royalties of 34,000 in the tax year 2020. This is the actual amount that Gertrude received Withhoking Tax had been deducted at source Required la Calculate the amount of provisional income tax paid by Gertrude for the tax year 2020. and prepare a schedule showing the due dates and amous pard on each due date 15 Marks by Calculate the captalowances for the lax your 2020 on $ KO on the appropriate due dates and she had to submitted the return of provisional income on the due date In February 2020. Gertrude got employment as a part time lecturer in music at a local private college. She was paid at a gross rate of K320 per session and she had a total of 120 sessions in the period from February 2020 to 31 December 2020. The college deduced income tax of K14,400 from Gertude's salary under the pay as you ear system. The college paid the income tax to the Zambia Revenue Authority on the appropriate due dates. Gertrude received Royalties of K34,000 in the tax year 2020. This is the actual amount that Gertrude received. Withholding Tax had been deducted at source. Required: (a) Calculate the amount of provisional income tax paid by Gertrude for the tax year 2020, and prepare a schedule showing the due dates and amounts paid on each due date [5 Marks) (b) Calculate the capital allowances for the tax year 2020 on: 0 Implements, plant and machinery and [12 Marks! () Buildings [4 Marks (c) Calculate Gertrude's taxable business profit figure after capital allowances for the tax year 2020 [12 Marks (d) Calculate the balance of income tax payable by Gertrude for the tax year 2020 17 Marks] [TOTAL: 40 MARKS QUESTION TWO IS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts