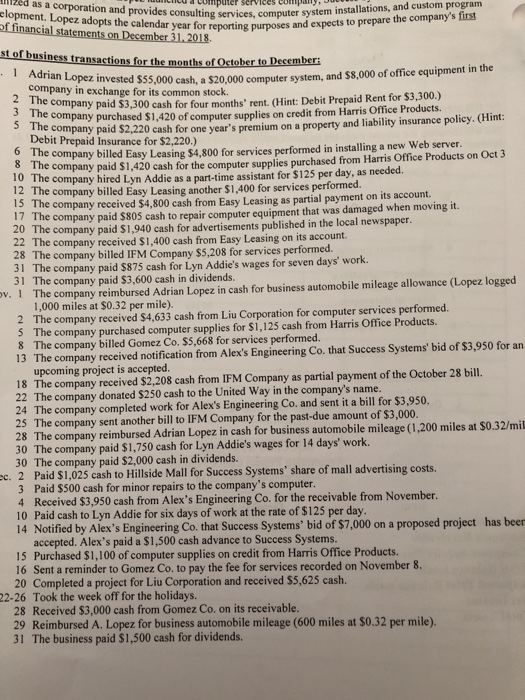

Question: Adrain consulting services, computer system installations, and custom program earfor reporting purposes and expects to prepare the company's first 2ed as a corporation and provides

consulting services, computer system installations, and custom program earfor reporting purposes and expects to prepare the company's first 2ed as a corporation and provides usiness transactions for the months of October to Decemberi Adrian Lopez in company in exchange for its common stock. The company paid $3,300 cash for four months' rent. (Hint: Debit Prepaid Rent 1 vested $55,000 cash, a $20,000 computer system, and $8,000 of office equipment in the 5 T mpany purchased $1,420 of computer supplies on credit from Harris Office Product pany paid 52,220 cash for one year's premium on a property and liability insurance policy. (Hint $2,220 cash for one year's premium on a property and liability insurance policy. (Hint Debit it Prepaid Insurance for $2 ,220.) company billed Easy Leasing $4,800 for services performed in installing a new Web server company paid $1,420 cash for the computer supplies purchased from Harris Office Products on Oct 3 The 10 Th 12 The company billed Easy Leasing another $1,400 for services 15 The company received $4,800 cash from Easy Leasing as partial payment on its account. e company hired Lyn Addie as a part-time assistant for $125 per day, as needed. 17 Th 20 The 22 The company received $1,400 cash from Easy Leasing on its account 28 The company billed IFM Company $5,208 for services performed. 31 The company paid $875 cash for Lyn Addie's wages e company paid $80S cash to repair computer equipment that was damaged when moving it company paid $1,940 cash for advertisements published in the local newspaper for seven days' work. paid $3,600 cash in dividends v. 1 The company reimbursed Adrian Lopez in cash for business automobile mileage allowance (Lopez logged 1,000 miles at $0.32 per mile). 2 The company received $4,633 cash from Liu Corporation for computer services performed 5 The company purchased computer supplies for $1,125 cash from Harris Office Products The company billed Gomez Co. $5,668 for services performed 13 The company received notification from Alex's Engineering Co. that Success Systems' bid of $3,950 for an upcoming project is accepted 18 The company received $2,208 cash from IFM Company as partial payment of the October 28 bill. 22 The company donated $250 cash to the United Way in the company's name 24 The company completed work for Alex's Engineering Co. and sent it a bill for $3,950 25 The company sent another bill to IFM Company for the past-due amount of $3,000 28 The company reimbursed Adrian Lopez in cash for business automobile mileage (1,200 miles at $0.32/mil 30 The company paid $1,750 cash for Lyn Addie's wages for 14 days' work. 30 The company paid $2,000 cash in dividends Paid S1,025 cash to Hillside Mall for Success Systems' share of mall advertising costs. 3 Paid $500 cash for minor repairs to the company's computer 4 Received $3,950 cash from Alex's Engineering Co. for the receivable from November 10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day 14 Notified by Alex's Engineering Co. that Success Systems' bid of $7,000 on a proposed project ec. 2 has beer accepted. Alex's paid a $1,500 cash advance to Success Systems 1,100 of computer supplies on credit from Harris Office Products. 16 Sent a reminder to Gomez Co.to pay the fee for services recorded on November 8 20 Completed a project for Liu Corporation and received $5,625 cash. 22-26 Took the week off for the holidays. 28 Received $3,000 cash from Gomez Co. on its receivable 29 Reimbursed A. Lopez for business automobile mileage (600 miles at $0.32 per mile). 31 The business paid $1,500 cash for dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts