Question: Adriana Corporation manufactures football equipment. In planning for next year, the managers want to understand the relation between activity and overhead costs. Discussions with the

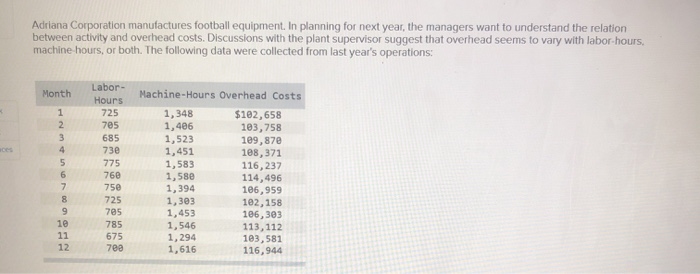

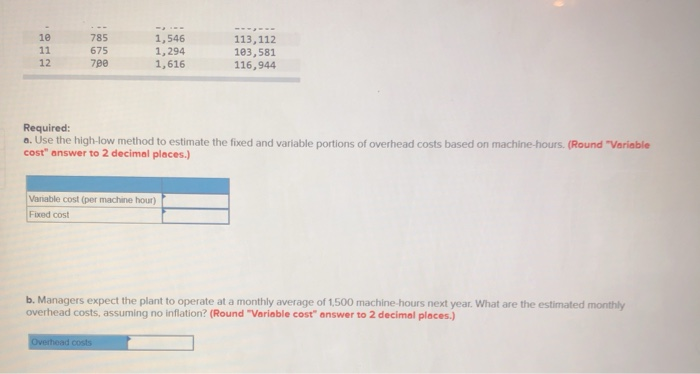

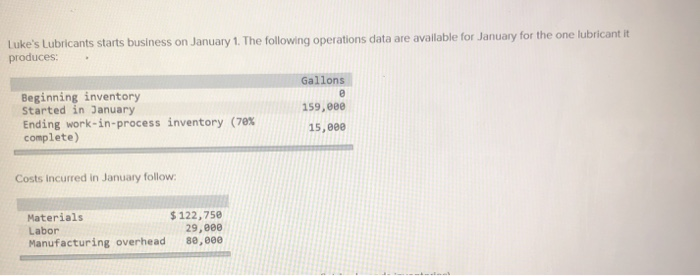

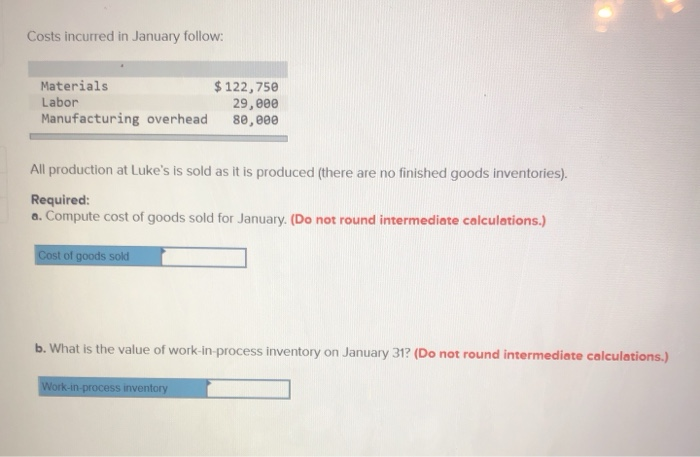

Adriana Corporation manufactures football equipment. In planning for next year, the managers want to understand the relation between activity and overhead costs. Discussions with the plant supervisor suggest that overhead seems to vary with labor-hours, machine hours, or both. The following data were collected from last year's operations: Month 1 2 3 4 5 6 7 8 9 10 11 12 Labor- Hours 725 705 685 73e 775 760 750 725 705 785 675 700 Machine - Hours Overhead Costs 1,348 $102,658 1,406 103,758 1,523 109,870 1,451 108, 371 1,583 116,237 1,58 114,496 1,394 106,959 1,303 102,158 1,453 106,303 1,546 113,112 1,294 103,581 1,616 116,944 le 11 12 785 675 720 1,546 1,294 1,616 113,112 183,581 116,944 Required: o. Use the high-low method to estimate the fixed and variable portions of overhead costs based on machine-hours. (Round "Variable cost" answer to 2 decimal places.) Variable cost (per machine hour) Fixed cost b. Managers expect the plant to operate at a monthly average of 1,500 machine-hours next year. What are the estimated monthly overhead costs, assuming no inflation? (Round "Variable cost" answer to 2 decimal places.) Overhead costs Luke's Lubricants starts business on January 1. The following operations data are available for January for the one lubricant it produces: Gallons Beginning inventory Started in January Ending work-in-process inventory (78% complete) 159, eee 15,000 Costs incurred in January follow: Materials $ 122,750 Labor 29,000 Manufacturing overhead 80,000 Costs incurred in January follow: Materials Labor Manufacturing overhead $ 122,750 29,000 80,000 All production at Luke's is sold as it is produced (there are no finished goods inventories). Required: a. Compute cost of goods sold for January. (Do not round intermediate calculations.) Cost of goods sold b. What is the value of work-in-process inventory on January 31? (Do not round intermediate calculations.) Work-in-process inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts