Question: Advanced 3-1 (similar to) Question Help Future value of a portfolio. Rachel and Richard want to know when their current portfolio will be sufficient for

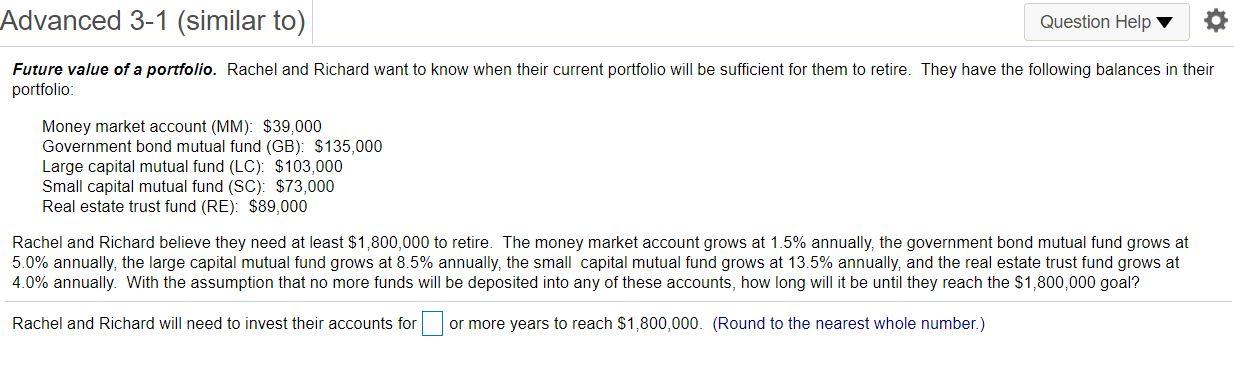

Advanced 3-1 (similar to) Question Help Future value of a portfolio. Rachel and Richard want to know when their current portfolio will be sufficient for them to retire. They have the following balances in their portfolio Money market account (MM): $39,000 Government bond mutual fund (GB): $135,000 Large capital mutual fund (LC): $103,000 Small capital mutual fund (SC): $73,000 Real estate trust fund (RE): $89,000 Rachel and Richard believe they need at least $1,800,000 to retire. The money market account grows at 1.5% annually, the government bond mutual fund grows at 5.0% annually, the large capital mutual fund grows at 8.5% annually, the small capital mutual fund grows at 13.5% annually, and the real estate trust fund grows at 4.0% annually. With the assumption that no more funds will be deposited into any of these accounts, how long will it be until they reach the $1,800,000 goal? Rachel and Richard will need to invest their accounts for or more years to reach $1,800,000. (Round to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts