Question: On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January

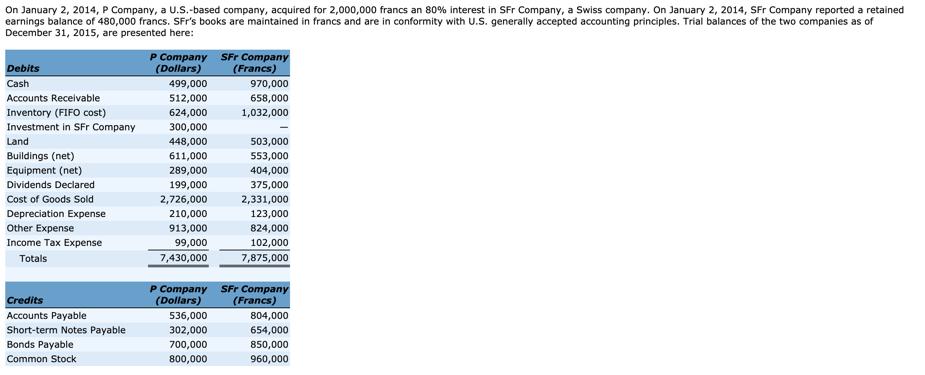

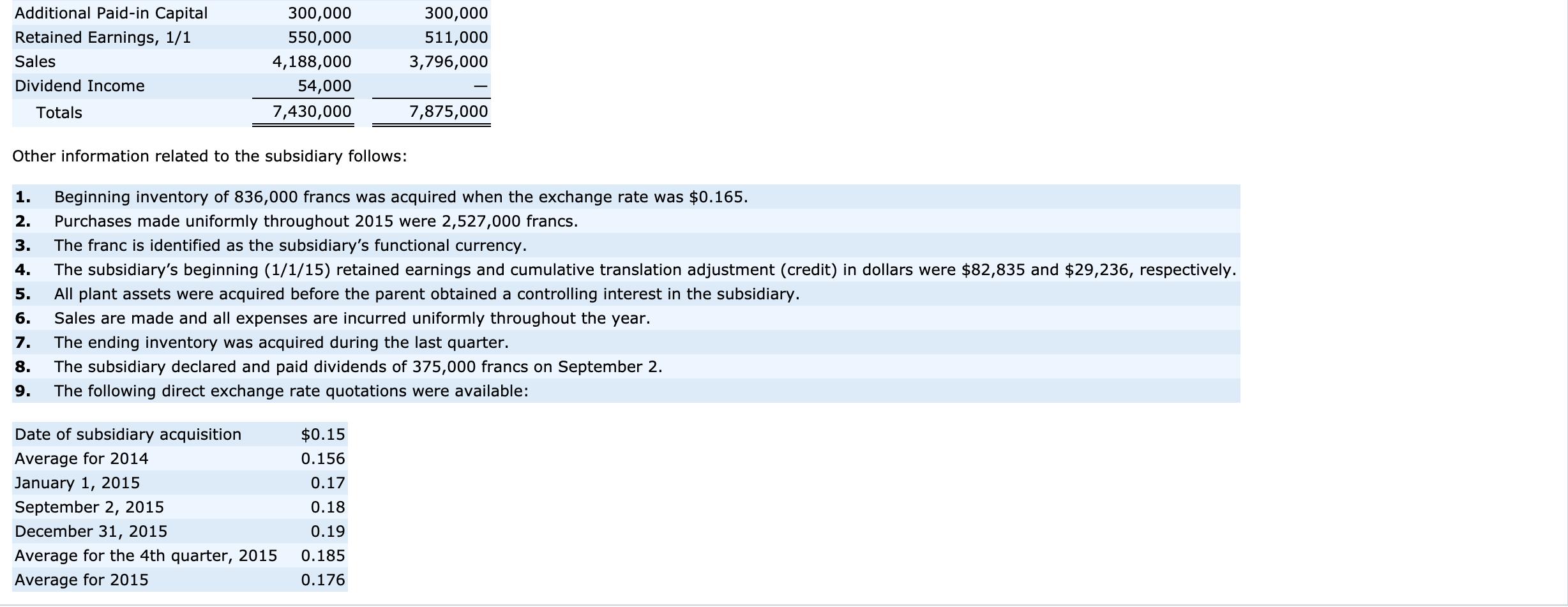

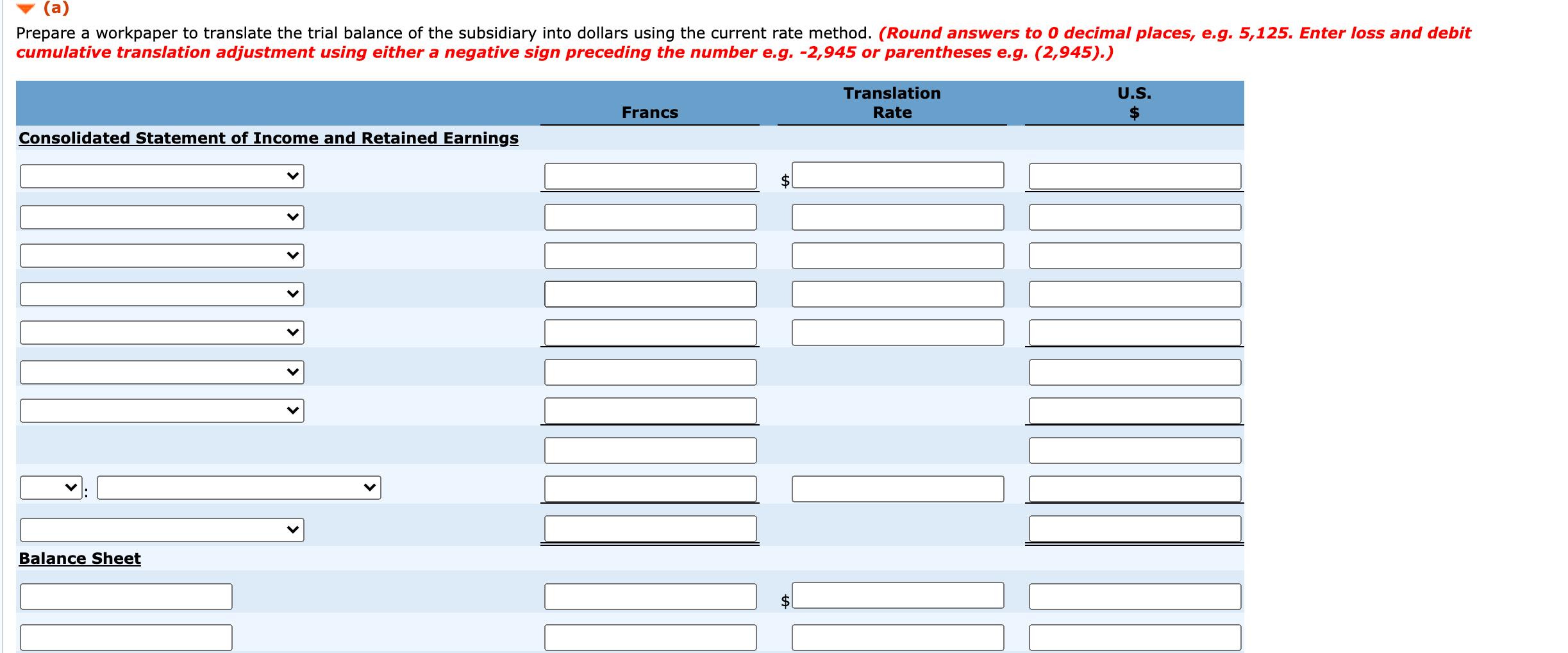

On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2014, SFr Company reported a retained earnings balance of 480,000 francs. SFr s books are maintained in francs and are in conformity with U.S. generally accepted accounting principles. Trial balances of the two companies as of December 31, 2015, are presented here: Debits Cash Accounts Receivable Inventory (FIFO cost) Investment in SFr Company Land Buildings (net) Equipment (net) Dividends Declared Cost of Goods Sold Depreciation Expense Other Expense Income Tax Expense Totals Credits Accounts Payable Short-term Notes Payable Bonds Payable Common Stock P Company SFr Company (Dollars) (Francs) 499,000 512,000 624,000 300,000 448,000 611,000 289,000 199,000 2,726,000 210,000 913,000 99,000 7,430,000 970,000 658,000 1,032,000 536,000 302,000 700,000 800,000 503,000 553,000 404,000 375,000 2,331,000 123,000 824,000 102,000 7,875,000 P Company SFr Company (Dollars) (Francs) 804,000 654,000 850,000 960,000 Additional Paid-in Capital Retained Earnings, 1/1 Sales Dividend Income Totals 300,000 550,000 4,188,000 54,000 7,430,000 Date of subsidiary acquisition Average for 2014 January 1, 2015 Other information related to the subsidiary follows: 1. Beginning inventory of 836,000 francs was acquired when the exchange rate was $0.165. 2. Purchases made uniformly throughout 2015 were 2,527,000 francs. 3. The franc is identified as the subsidiary s functional currency. 4. The subsidiary s beginning (1/1/15) retained earnings and cumulative translation adjustment (credit) in dollars were $82,835 and $29,236, respectively. All plant assets were quired before the parent obtained a controlling interest in the subsidiary. 5. 6. Sales are made and all expenses are incurred uniformly throughout the year. 7. The ending inventory was acquired during the last quarter. 8. The subsidiary declared and paid dividends of 375,000 francs on September 2. The following direct exchange rate quotations were available: 9. September 2, 2015 December 31, 2015 Average for the 4th quarter, 2015 Average for 2015 300,000 511,000 3,796,000 $0.15 0.156 0.17 0.18 0.19 0.185 0.176 7,875,000 (a) Prepare a workpaper to translate the trial balance of the subsidiary into dollars using the current rate method. (Round answers to 0 decimal places, e.g. 5,125. Enter loss and debit cumulative translation adjustment using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Consolidated Statement of Income and Retained Earnings Balance Sheet Francs Translation Rate X U.S.

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

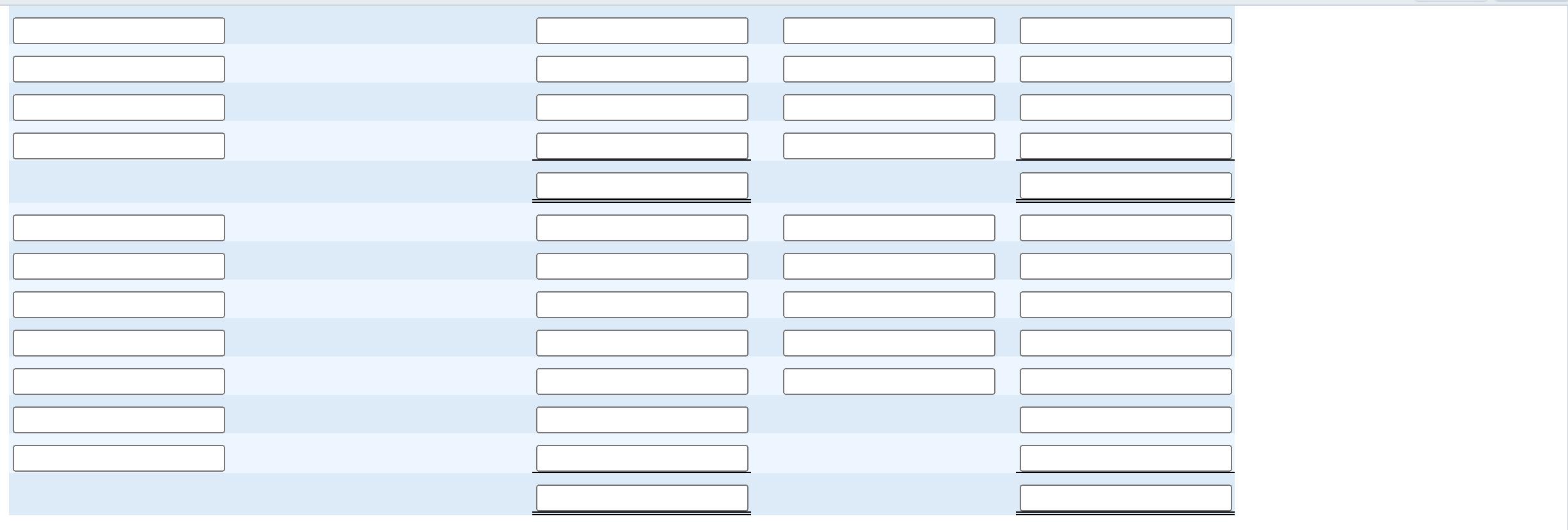

Part A Translation Balance Sheet Francs Rate US Cash 962500 019 182875 Accounts Receivable 660000 01... View full answer

Get step-by-step solutions from verified subject matter experts