Question: Advanced accounting: Assignment 2 Question 1: Fill in the spaces: No.% of ownership Influence control Accounting method 1 Less than 20% presumes significant influence Consolidated

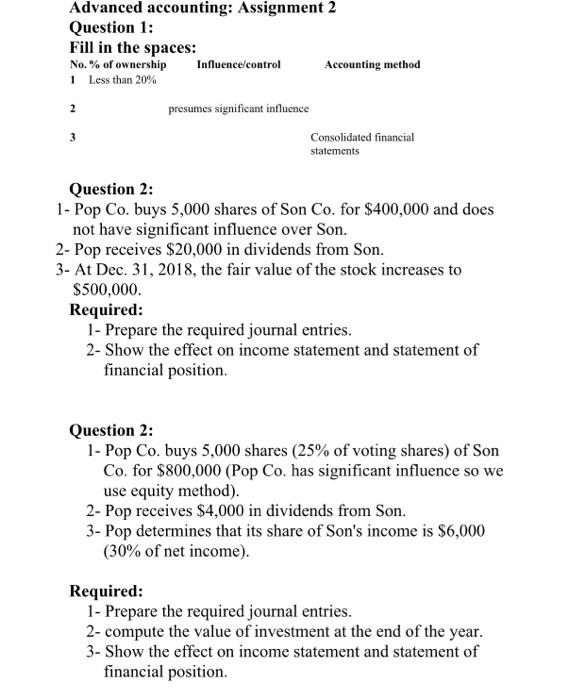

Advanced accounting: Assignment 2 Question 1: Fill in the spaces: No.% of ownership Influence control Accounting method 1 Less than 20% presumes significant influence Consolidated financial statements 2 3 Question 2: 1- Pop Co. buys 5,000 shares of Son Co. for $400,000 and does not have significant influence over Son. 2- Pop receives $20,000 in dividends from Son. 3- At Dec. 31, 2018, the fair value of the stock increases to $500,000. Required: 1- Prepare the required journal entries. 2- Show the effect on income statement and statement of financial position. Question 2: 1- Pop Co. buys 5,000 shares (25% of voting shares) of Son Co. for $800,000 (Pop Co, has significant influence so we use equity method). 2- Pop receives $4,000 in dividends from Son. 3- Pop determines that its share of Son's income is $6,000 (30% of net income). Required: 1- Prepare the required journal entries. 2- compute the value of investment at the end of the year. 3- Show the effect on income statement and statement of financial position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts