Question: John Corporation exchanges 200,000 shares of newly issued $10 par value common stock with a fair market value of $40 per share for all

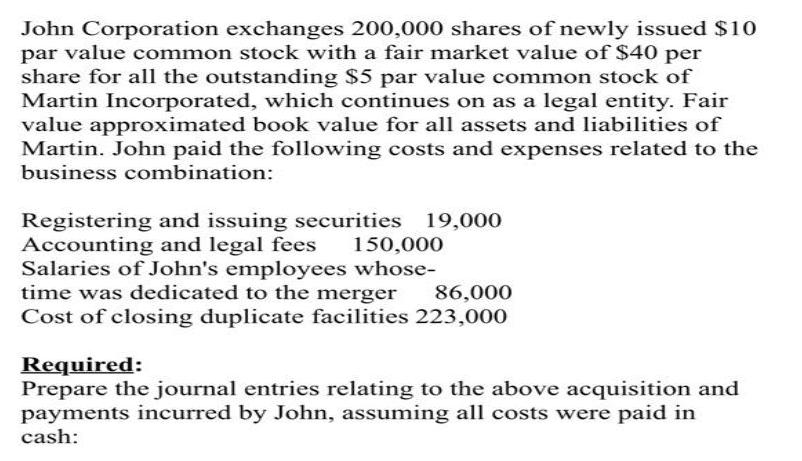

John Corporation exchanges 200,000 shares of newly issued $10 par value common stock with a fair market value of $40 per share for all the outstanding $5 par value common stock of Martin Incorporated, which continues on as a legal entity. Fair value approximated book value for all assets and liabilities of Martin. John paid the following costs and expenses related to the business combination: Registering and issuing securities 19,000 Accounting and legal fees Salaries of John's employees whose- time was dedicated to the merger Cost of closing duplicate facilities 223,000 150,000 86,000 Required: Prepare the journal entries relating to the above acquisition and payments incurred by John, assuming all costs were paid in cash:

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Answer Given below Answee giuen below Table showing Jouena... View full answer

Get step-by-step solutions from verified subject matter experts