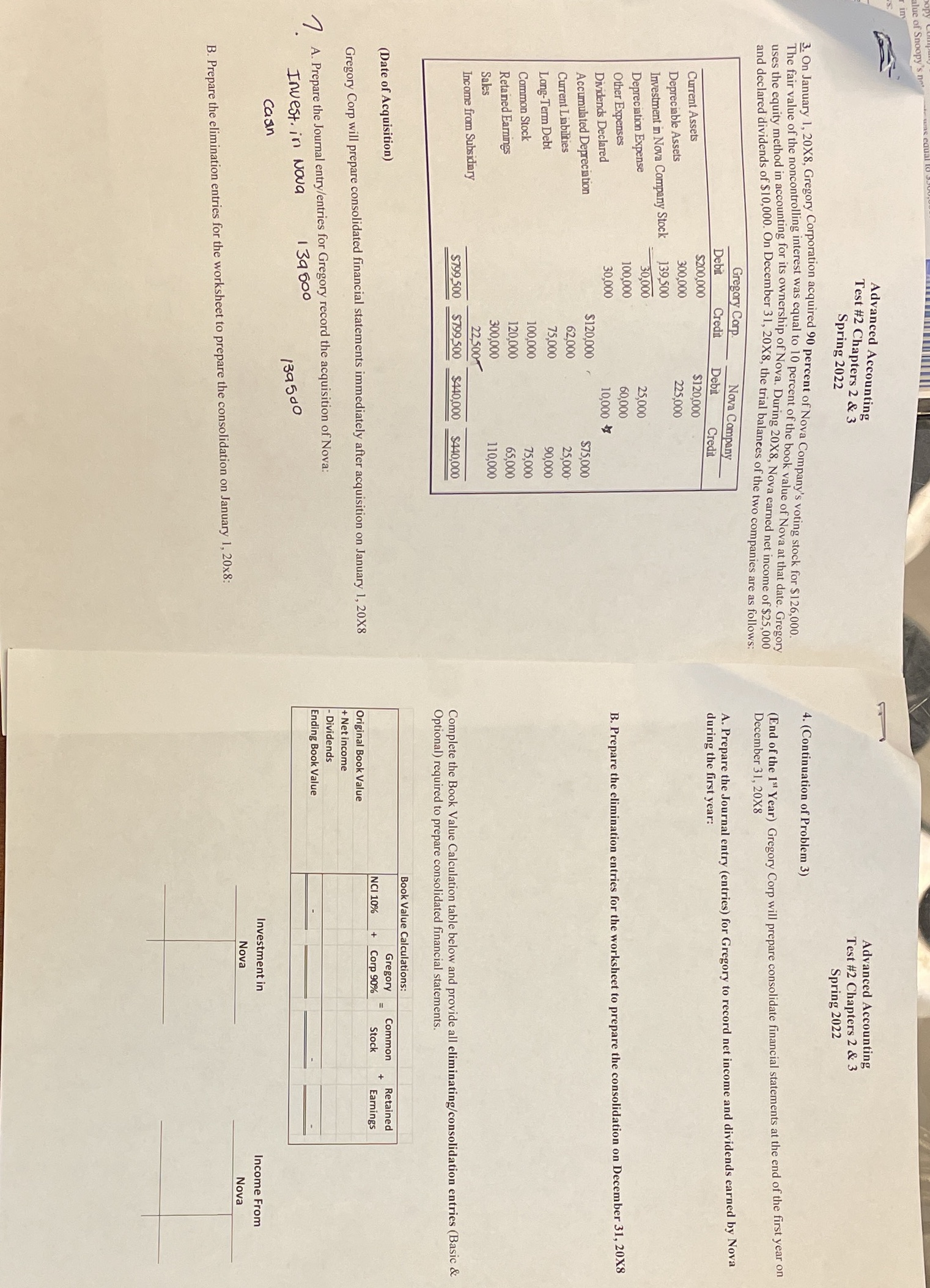

Question: Advanced Accounting Test #2 Chapters 2 & 3 Advanced Accounting Spring 2022 Test #2 Chapters 2 & 3 Spring 2022 3. On January 1, 20X8,

Advanced Accounting Test #2 Chapters 2 & 3 Advanced Accounting Spring 2022 Test #2 Chapters 2 & 3 Spring 2022 3. On January 1, 20X8, Gregory Corporation acquired 90 percent of Nova Company's voting stock for $126,000. 4. ( Continuation of Problem 3) The fair value of the noncontrolling interest was equal to 10 percent of the book value of Nova at that date. Gregory uses the equity method in accounting for its ownership of Nova. During 20X8, Nova earned net income of $25,000 and declared dividends of $10,000. On December 31, 20X8, the trial balances of the two companies are as follows: (End of the 151 Year) Gregory Corp will prepare consolidate financial statements at the end of the first year on December 31, 20X8 Gregory Corp. Nova Company Debit Credit Debit A. Prepare the Journal entry (entries) for Gregory to record net income and dividends earned by Nova Credit during the first year: Current Assets $200,000 $120,000 Depreciable Assets 300.000 225,000 Investment in Nova Company Stock 139,500 Depreciation Expense 30.000 25,000 Other Expenses 100,000 60,000 Dividends Declared 30,000 10,000 B. Prepare the elimination entries for the worksheet to prepare the consolidation on December 31, 20X8 Accumulated Depreciation $120.000 $75,000 Current Liabilities 62,000 25,000 Long-Term Debt 75,000 90,000 Common Stock 100.000 75,000 Retained Earnings 120,000 65,000 Sales 300,000 110,000 Income from Subsidiary 22 5007 $799 500 $799 500 $440.000 $440.000 Complete the Book Value Calculation table below and provide all eliminating/consolidation entries (Basic & Optional) required to prepare consolidated financial statements. Book Value Calculations: (Date of Acquisition) Gregory Common Retained NCI 10% Corp 90% Stock Earnings Gregory Corp will prepare consolidated financial statements immediately after acquisition on January 1, 20X8 Original Book Value + Net income A. Prepare the Journal entry/entries for Gregory record the acquisition of Nova: - Dividends 139 600 Ending Book Value Invest. in Nova 139 500 Caan Investment in Income From Nova Nova B. Prepare the elimination entries for the worksheet to prepare the consolidation on January 1, 20x8