Question: ADVANCED ACCT Jeter, Advanced Accounting, NEXT 4 BACK PRINTER VERSION STANDARD VIEW CALCULATOR MESSAGE MY INSTRUCTOR Dave, Brian, and Paul are partners in a retail

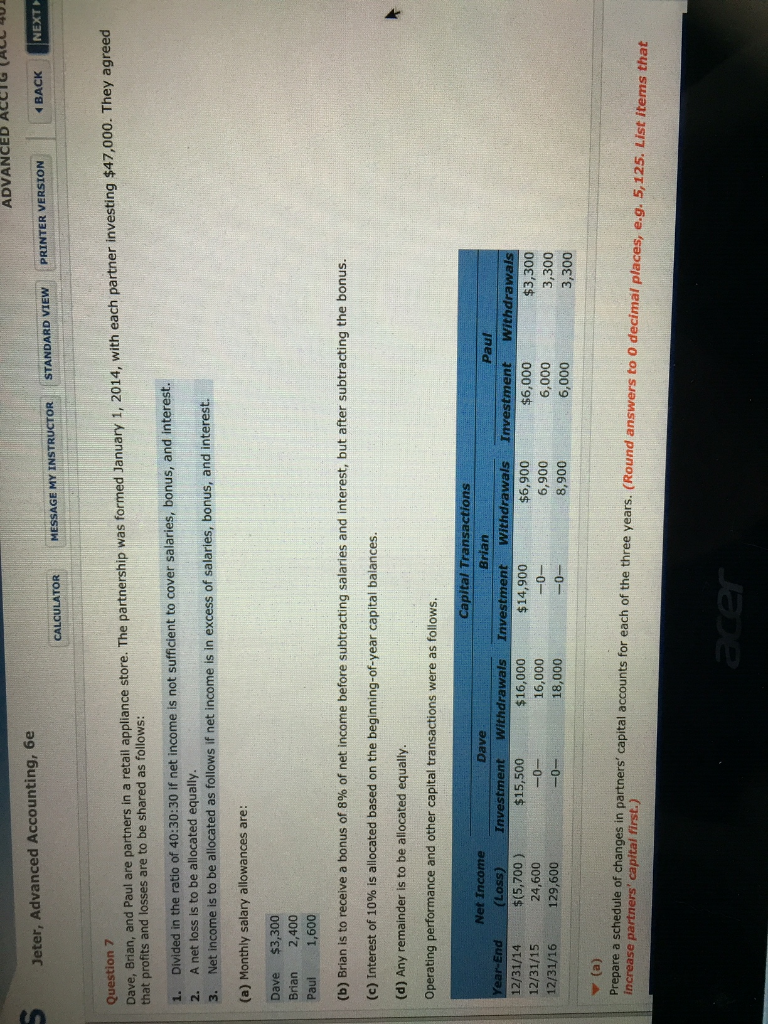

ADVANCED ACCT Jeter, Advanced Accounting, NEXT 4 BACK PRINTER VERSION STANDARD VIEW CALCULATOR MESSAGE MY INSTRUCTOR Dave, Brian, and Paul are partners in a retail appliance store. The partnership was formed January 1, 2014, with each partner investing $47,000. They agreed that profits and losses are to be shared as follows: Question 7 1. Divided in the ratio of 40:30:30 if net income is not sufficient to cover salaries, bonus, and interest. A net loss is to be allocated equally. Net income is to be allocated as follows if net income is in excess of salaries, bonus, and interest. (a) Monthly salary allowances are: Dave $3,300 Brian 2,400 Paul 009'T (b) Brian is to receive a bonus of 8% of net income before subtracting salaries and interest, but after subtracting the snuoq (c) Interest of 10% is allocated based on the beginning-of-year capital balances. (d) Any remainder is to be allocated equally. Operating performance and other capital transactions were as follows. Capital Transactions Net Income Dave Brian Ined Withdrawals Year-End Investment (ss) Withdrawals Investment Withdrawals Investment 12/31/14 $(5,700) $15,500 $16,000 16,000 $14,900 $6,900 000 9$ 000 9 12/31/15 24,600 $3,300 006 9 8,900 0- 3,300 12/31/16 -0- 129,600 -0- -0- 3,300 000'8 000'9 (e) A Prepare a schedule of changes in partners capital accounts for each of the three years. (Round answers toO decimal places, e.g. 5,125. List items that increase partners' capital first.) acer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts