Question: Advanced Auditing - ACF3003 (5) SECTION A (COMPULSORY) Question 1 (25 marks) You are the audit manager of the Visible Associates, an accounting and auditing

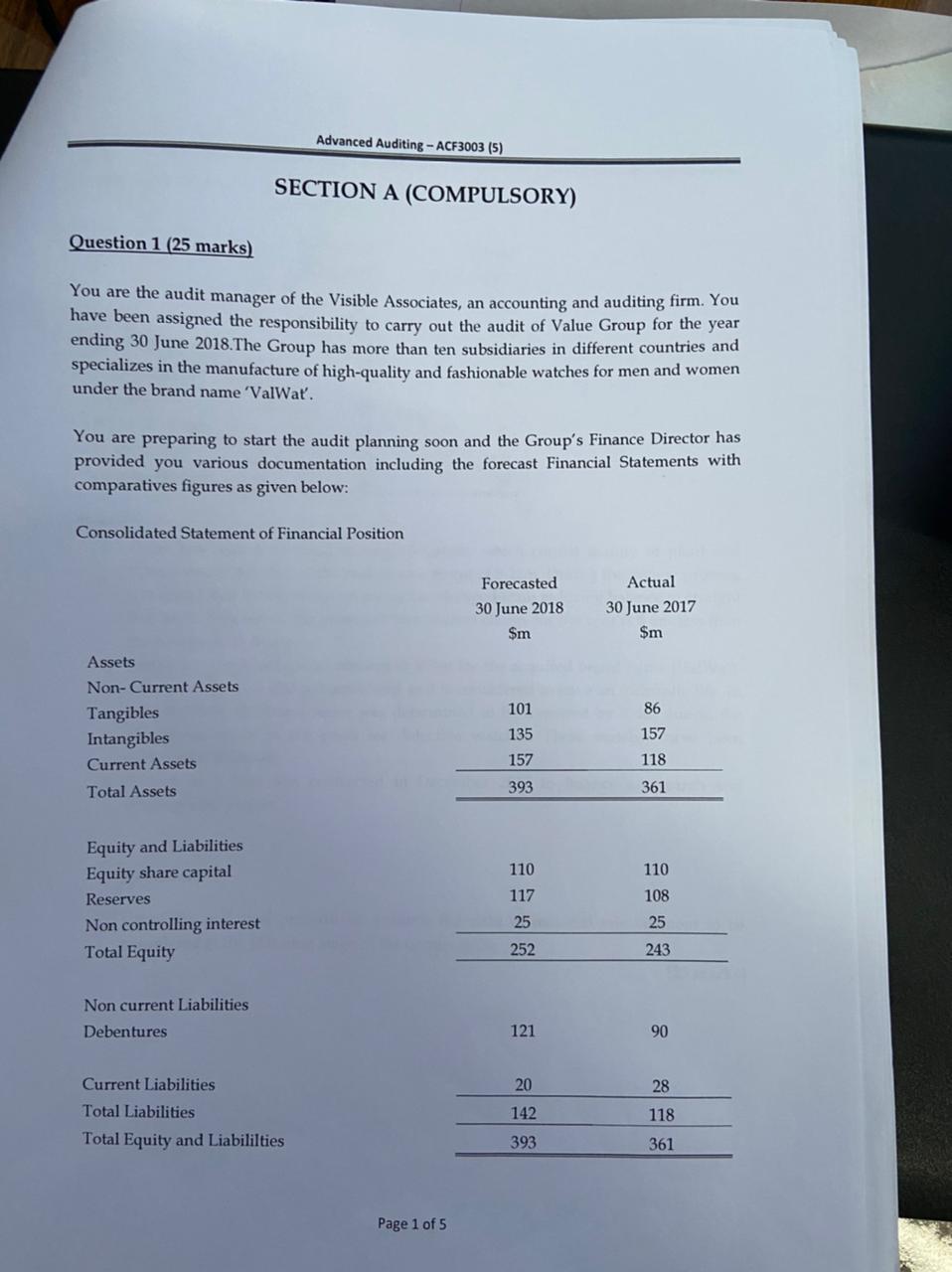

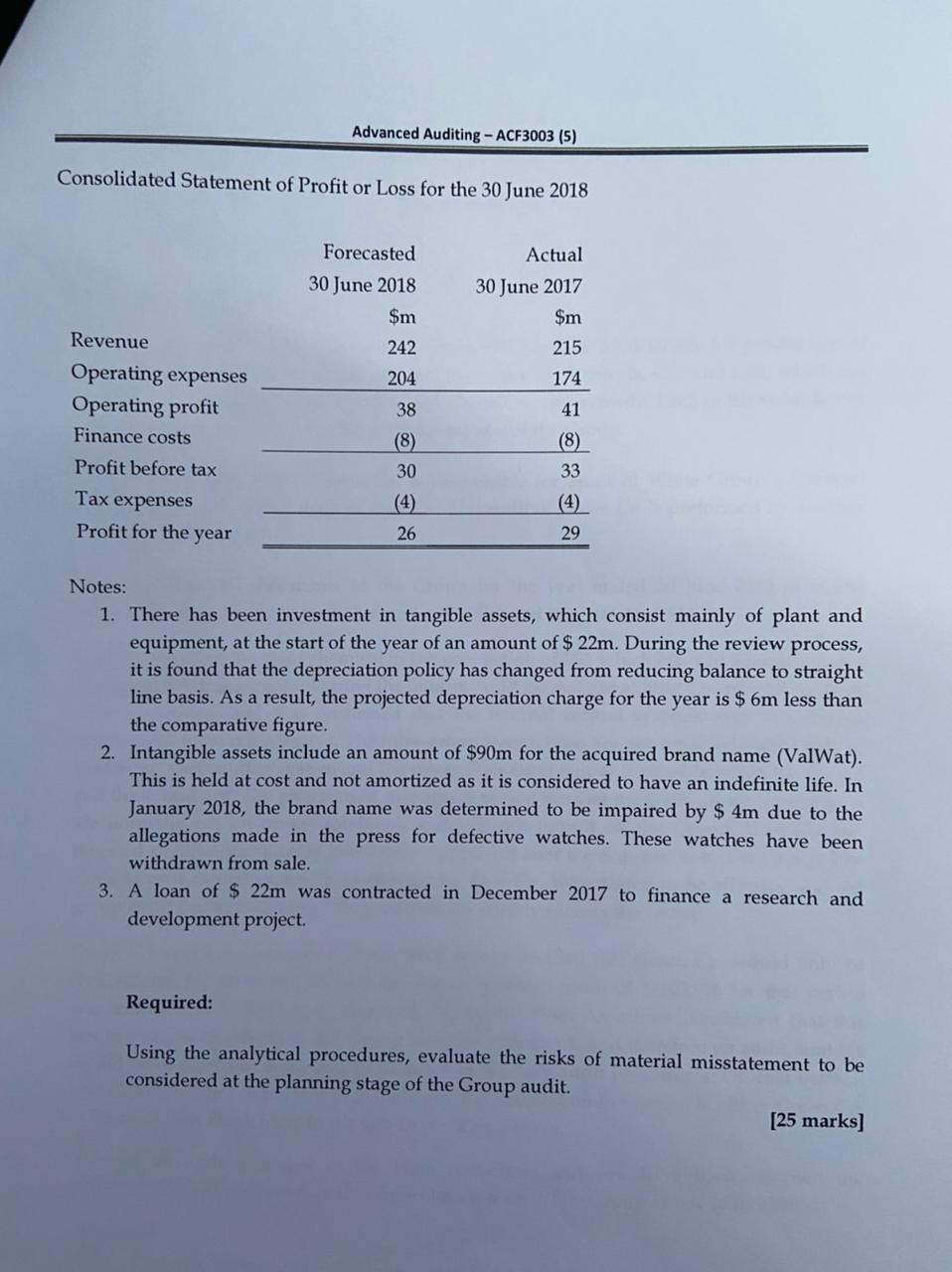

Advanced Auditing - ACF3003 (5) SECTION A (COMPULSORY) Question 1 (25 marks) You are the audit manager of the Visible Associates, an accounting and auditing firm. You have been assigned the responsibility to carry out the audit of Value Group for the year ending 30 June 2018.The Group has more than ten subsidiaries in different countries and specializes in the manufacture of high-quality and fashionable watches for men and women under the brand name 'ValWa. You are preparing to start the audit planning soon and the Group's Finance Director has provided you various documentation including the forecast Financial Statements with comparatives figures as given below: Consolidated Statement of Financial Position Forecasted 30 June 2018 $m Actual 30 June 2017 $m 101 86 Assets Non-Current Assets Tangibles Intangibles Current Assets Total Assets 157 135 157 118 393 361 110 Equity and Liabilities Equity share capital Reserves Non controlling interest Total Equity 117 108 25 25 252 243 Non current Liabilities Debentures 121 90 20 28 Current Liabilities Total Liabilities Total Equity and Liabililties 142 118 393 361 Page 1 of 5 Advanced Auditing - ACF3003 (5) Consolidated Statement of Profit or Loss for the 30 June 2018 Forecasted 30 June 2018 $m Actual 30 June 2017 $m Revenue 242 215 204 174 38 41 Operating expenses Operating profit Finance costs Profit before tax Tax expenses Profit for the year (8) 33 30 26 29 Notes: 1. There has been investment in tangible assets, which consist mainly of plant and equipment, at the start of the year of an amount of $ 22m. During the review process, it is found that the depreciation policy has changed from reducing balance to straight line basis. As a result, the projected depreciation charge for the year is $ 6m less than the comparative figure. 2. Intangible assets include an amount of $90m for the acquired brand name (ValWat). This is held at cost and not amortized as it is considered to have an indefinite life. In January 2018, the brand name was determined to be impaired by $ 4m due to the allegations made in the press for defective watches. These watches have been withdrawn from sale. 3. A loan of $ 22m was contracted in December 2017 to finance a research and development project. Required: Using the analytical procedures, evaluate the risks of material misstatement to be considered at the planning stage of the Group audit. [25 marks) Advanced Auditing - ACF3003 (5) SECTION A (COMPULSORY) Question 1 (25 marks) You are the audit manager of the Visible Associates, an accounting and auditing firm. You have been assigned the responsibility to carry out the audit of Value Group for the year ending 30 June 2018.The Group has more than ten subsidiaries in different countries and specializes in the manufacture of high-quality and fashionable watches for men and women under the brand name 'ValWa. You are preparing to start the audit planning soon and the Group's Finance Director has provided you various documentation including the forecast Financial Statements with comparatives figures as given below: Consolidated Statement of Financial Position Forecasted 30 June 2018 $m Actual 30 June 2017 $m 101 86 Assets Non-Current Assets Tangibles Intangibles Current Assets Total Assets 157 135 157 118 393 361 110 Equity and Liabilities Equity share capital Reserves Non controlling interest Total Equity 117 108 25 25 252 243 Non current Liabilities Debentures 121 90 20 28 Current Liabilities Total Liabilities Total Equity and Liabililties 142 118 393 361 Page 1 of 5 Advanced Auditing - ACF3003 (5) Consolidated Statement of Profit or Loss for the 30 June 2018 Forecasted 30 June 2018 $m Actual 30 June 2017 $m Revenue 242 215 204 174 38 41 Operating expenses Operating profit Finance costs Profit before tax Tax expenses Profit for the year (8) 33 30 26 29 Notes: 1. There has been investment in tangible assets, which consist mainly of plant and equipment, at the start of the year of an amount of $ 22m. During the review process, it is found that the depreciation policy has changed from reducing balance to straight line basis. As a result, the projected depreciation charge for the year is $ 6m less than the comparative figure. 2. Intangible assets include an amount of $90m for the acquired brand name (ValWat). This is held at cost and not amortized as it is considered to have an indefinite life. In January 2018, the brand name was determined to be impaired by $ 4m due to the allegations made in the press for defective watches. These watches have been withdrawn from sale. 3. A loan of $ 22m was contracted in December 2017 to finance a research and development project. Required: Using the analytical procedures, evaluate the risks of material misstatement to be considered at the planning stage of the Group audit. [25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts