Question: Advanced Ratio Analysis Task 1. Having the following financial statement at your disposal please calculate and interpret the following ratios: a) profitability ratios: ROA (return

Advanced Ratio Analysis

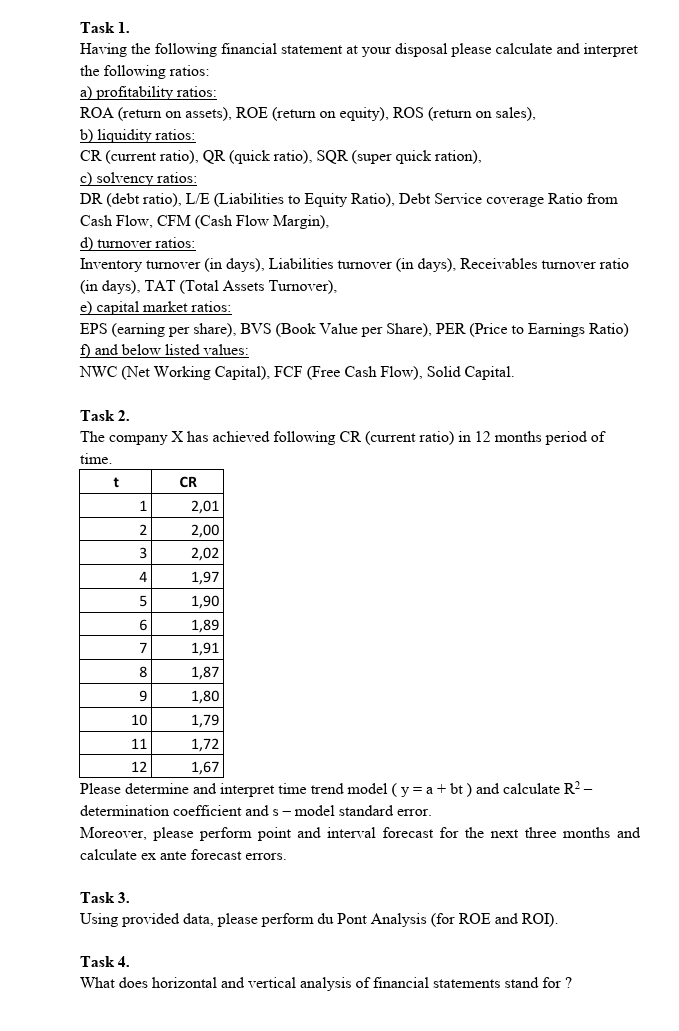

Task 1. Having the following financial statement at your disposal please calculate and interpret the following ratios: a) profitability ratios: ROA (return on assets), ROE (return on equity), ROS (return on sales), b) liquidity ratios: CR (current ratio), QR (quick ratio), SQR (super quick ration), c) solvency ratios: DR (debt ratio), L/E (Liabilities to Equity Ratio), Debt Service coverage Ratio from Cash Flow, CFM (Cash Flow Margin), d) turnover ratios: Inventory turnover (in days), Liabilities turnover (in days), Receivables turnover ratio (in days), TAT (Total Assets Turnover), e) capital market ratios: EPS (earning per share), BVS (Book Value per Share), PER (Price to Earnings Ratio) f) and below listed values: NWC (Net Working Capital), FCF (Free Cash Flow), Solid Capital. Task 2. The company X has achieved following CR (current ratio) in 12 months period of time t CR 1 2,01 2 2,00 2,02 3 4 1,97 5 1,90 6 1,89 7 1,91 1,87 8 9 1,80 10 1,79 11 1,72 12 1,67 Please determine and interpret time trend model (y= a + bt) and calculate R2- determination coefficient and s-model standard error. Moreover, please perform point and interval forecast for the next three months and calculate ex ante forecast errors. Task 3. Using provided data, please perform du Pont Analysis (for ROE and ROI). Task 4. What does horizontal and vertical analysis of financial statements stand for? Task 1. Having the following financial statement at your disposal please calculate and interpret the following ratios: a) profitability ratios: ROA (return on assets), ROE (return on equity), ROS (return on sales), b) liquidity ratios: CR (current ratio), QR (quick ratio), SQR (super quick ration), c) solvency ratios: DR (debt ratio), L/E (Liabilities to Equity Ratio), Debt Service coverage Ratio from Cash Flow, CFM (Cash Flow Margin), d) turnover ratios: Inventory turnover (in days), Liabilities turnover (in days), Receivables turnover ratio (in days), TAT (Total Assets Turnover), e) capital market ratios: EPS (earning per share), BVS (Book Value per Share), PER (Price to Earnings Ratio) f) and below listed values: NWC (Net Working Capital), FCF (Free Cash Flow), Solid Capital. Task 2. The company X has achieved following CR (current ratio) in 12 months period of time t CR 1 2,01 2 2,00 2,02 3 4 1,97 5 1,90 6 1,89 7 1,91 1,87 8 9 1,80 10 1,79 11 1,72 12 1,67 Please determine and interpret time trend model (y= a + bt) and calculate R2- determination coefficient and s-model standard error. Moreover, please perform point and interval forecast for the next three months and calculate ex ante forecast errors. Task 3. Using provided data, please perform du Pont Analysis (for ROE and ROI). Task 4. What does horizontal and vertical analysis of financial statements stand for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts