Question: Advanced Scenario 6: Jennifer Morrison Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer

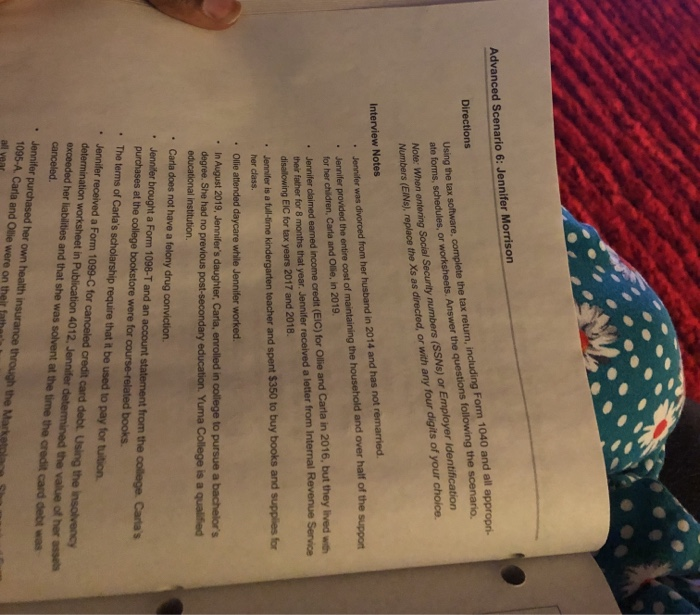

Advanced Scenario 6: Jennifer Morrison Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSNS) or Employer Identification Numbers (EINS), replace the Xs as directed, or with any four digits of your choice Directions Jennifer was divorced from her husband in 2014 and has not remarried Jennifer provided the entire cost of maintaining the household and over half of the support for her children, Carla and Olie, in 2019. Jennifer claimed earned income credit (EIC) for Ollie and Carla in 2016, but they lived with their father for 8 months that year. Jennifer received a letter from Internal Revenue Service disallowing EIC for tax years 2017 and 2018. Interview Notes Jennifer is a full-time kindergarten teacher and spent $350 to buy books and supplies for her class. Ollie attended daycare while Jennifer worked. In August 2019, Jennifer's daughter, Carla, enrolled in college to pursue a bachelor's degree. She had no previous post-secondary education. Yuma College is a qualified educational institution. Carla does not have a felony drug conviction Jennifer brought a Form 1098-T and an account statement from the college. Carla's purchases at the college bookstore were for course-related books. The terms of Carla's scholarship require that it be used to pay for tuition Jennifer received a Form 1099-C for canceled credit card debt. Using the insolvency determination worksheet in Publication 4012, Jennifer determined the value of her assels exceeded her liabilities and that she was solvent at the time the credit card debt was canceled. Jennifer purchased her own health insurance through the Mart 1095-A. Carla and Olie were on their all Advanced Scenario 6: Jennifer Morrison Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSNS) or Employer Identification Numbers (EINS), replace the Xs as directed, or with any four digits of your choice Directions Jennifer was divorced from her husband in 2014 and has not remarried Jennifer provided the entire cost of maintaining the household and over half of the support for her children, Carla and Olie, in 2019. Jennifer claimed earned income credit (EIC) for Ollie and Carla in 2016, but they lived with their father for 8 months that year. Jennifer received a letter from Internal Revenue Service disallowing EIC for tax years 2017 and 2018. Interview Notes Jennifer is a full-time kindergarten teacher and spent $350 to buy books and supplies for her class. Ollie attended daycare while Jennifer worked. In August 2019, Jennifer's daughter, Carla, enrolled in college to pursue a bachelor's degree. She had no previous post-secondary education. Yuma College is a qualified educational institution. Carla does not have a felony drug conviction Jennifer brought a Form 1098-T and an account statement from the college. Carla's purchases at the college bookstore were for course-related books. The terms of Carla's scholarship require that it be used to pay for tuition Jennifer received a Form 1099-C for canceled credit card debt. Using the insolvency determination worksheet in Publication 4012, Jennifer determined the value of her assels exceeded her liabilities and that she was solvent at the time the credit card debt was canceled. Jennifer purchased her own health insurance through the Mart 1095-A. Carla and Olie were on their all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts