Question: ADVANCEDACCOUNTING UNIT 2 POST PROBLEM 1 MERGER On June 30, 200X Carl Corporation purchased Lin Company by issuing 50,000 shares of stock. Stock has a

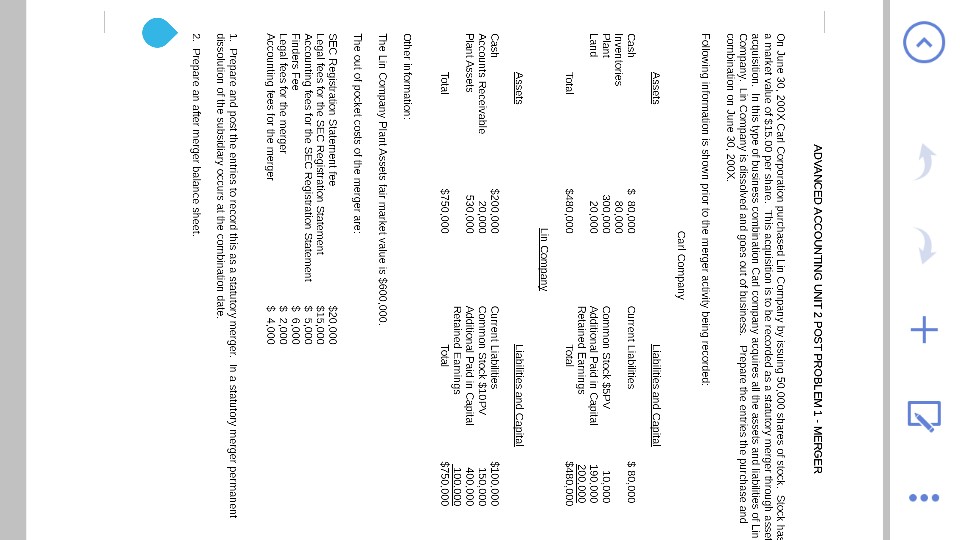

ADVANCEDACCOUNTING UNIT 2 POST PROBLEM 1 MERGER On June 30, 200X Carl Corporation purchased Lin Company by issuing 50,000 shares of stock. Stock has a market value of $15.00 per share. This acquisition is to he recorded as a statutory merger through asset acquisition. In this type of business combination Carl company acquires all the assets and liabilities of Lin Company. Lin Company is dissolved and goes out of husiness. Prepare the entries the purchase and combination on June 30, 200X Following information is shown prior to the merger activity being recorded: Carl Company $ 80,000 Curent Liabilities 80.000 Cash Inventories Plant Land 10.000 190.000 200,000 480.000 Additional Paid in Capital Retained Eamings 20,000 Total $480,000 an Cash Accounts Receivable Plant Assets $200,000 20,000 530,000 Current Liabilities Common Stock $10PV Additional Paid in Capital Retained Eamings $100,000 150.000 400.000 100,000 $750,000 Total $750,000 Total Other information: The Lin Company Plant Assets fair market value is $600,000 The out of pocket costs of the merger are SEC Registration Statement fee Legal fees for the SEC Registration Statement Accounting fees for the SEC Registration Finders Fee Legal fees for the mercer Accouning fees for the merger $20,000 $15,000 $5,000 6,000 $2,000 4,000 1. Prepare and post the entries to record this as a statutory merger. In a statutory merger permanent dissolution of the subsidiary occurs at the combination date 2. Prepare an after merger balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts