Question: Advise on the following situation using the applicable tax codes below (Use only the tax codes that apply). IRC Section 167 IRC Section 168d Regulation

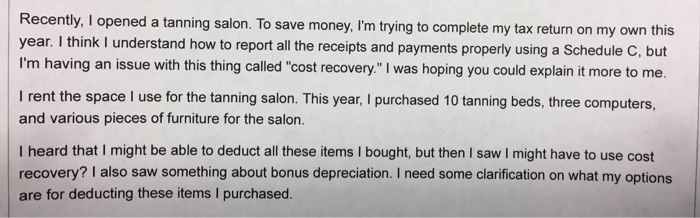

Recently, I opened a tanning salon. To save money, I'm trying to complete my tax return on my own this year. I think I understand how to report all the receipts and payments properly using a Schedule C, but I'm having an issue with this thing called "cost recovery." I was hoping you could explain it more to me. I rent the space I use for the tanning salon. This year, I purchased 10 tanning beds, three computers, and various pieces of furniture for the salon. I heard that I might be able to deduct all these items I bought, but then I saw I might have to use cost recovery? I also saw something about bonus depreciation. I need some clarification on what my options are for deducting these items I purchased. Recently, I opened a tanning salon. To save money, I'm trying to complete my tax return on my own this year. I think I understand how to report all the receipts and payments properly using a Schedule C, but I'm having an issue with this thing called "cost recovery." I was hoping you could explain it more to me. I rent the space I use for the tanning salon. This year, I purchased 10 tanning beds, three computers, and various pieces of furniture for the salon. I heard that I might be able to deduct all these items I bought, but then I saw I might have to use cost recovery? I also saw something about bonus depreciation. I need some clarification on what my options are for deducting these items I purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts