Question: AEE211 1. ABCD Normal A B C DdEx AaBb CeDe Aal Question ContSub Questio. Sub Main Question Ferrous Supplies, Inc., a manufacturer of finished steel

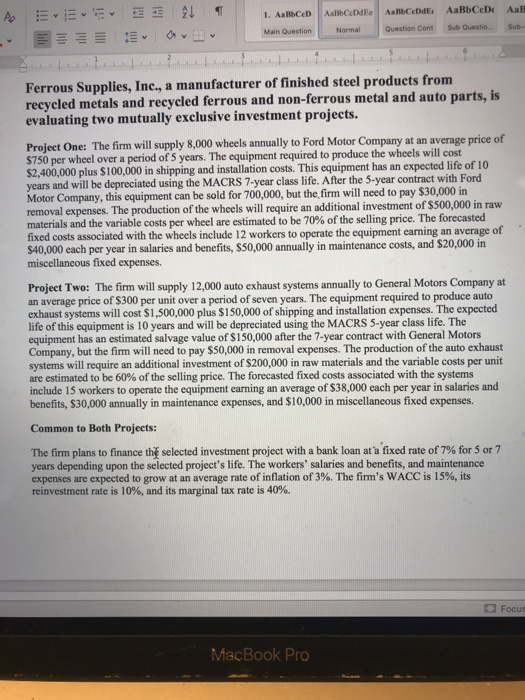

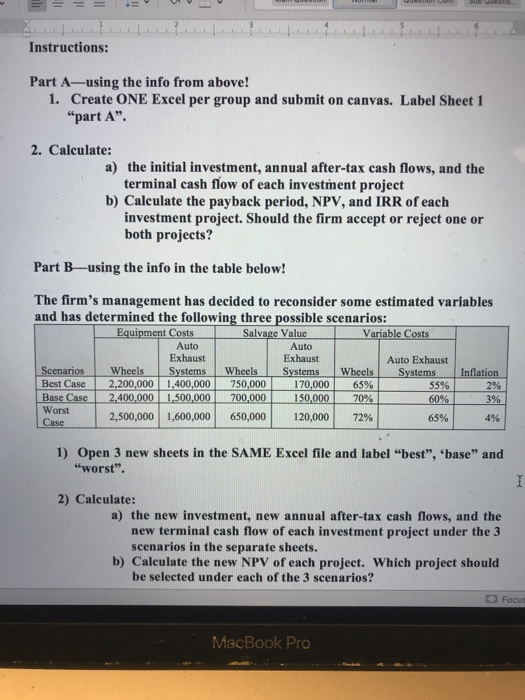

AEE211 1. ABCD Normal A B C DdEx AaBb CeDe Aal Question ContSub Questio. Sub Main Question Ferrous Supplies, Inc., a manufacturer of finished steel products from recycled metals and recycled ferrous and non-ferrous metal and auto parts, is evaluating two mutually exclusive investment projects. Project One: The firm will supply 8,000 wheels annually to Ford Motor Company at an average price of $750 per wheel over a period of 5 years. The equipment required to produce the wheels will cost $2,400,000 plus $100,000 in shipping and installation costs. This equipment has an expected life of 10 years and will be depreciated using the MACRS 7-year class life. After the 5-year contract with Ford Motor Company, this equipment can be sold for 700.000, but the firm will need to pay $30,000 in removal expenses. The production of the wheels will require an additional investment of $500,000 in raw materials and the variable costs per wheel are estimated to be 70% of the selling price. The forecasted fixed costs associated with the wheels include 12 workers to operate the equipment earning an average of $40,000 each per year in salaries and benefits, S50,000 annually in maintenance costs, and 20,000 in miscellaneous fixed expenses. Project Two: The firm will supply 12,000 auto exhaust systems annually to General Motors Company at an average price of $300 per unit over a period of seven years. The equipment required to produce auto exhaust systems will cost $1,500,000 plus S150,000 of shipping and installation expenses. The expected life of this equipment is 10 years and will be depreciated using the MACRS 5-year class life. The equipment has an estimated salvage value of $150,000 after the 7-year contract with General Motors Company, but the firm will need to pay $50,000 in removal expenses. The production of the auto exhaust systems will require an additional investment of $200,000 in raw materials and the variable costs per unit are estimated to be 60% of the selling price. The forecasted fixed costs associated with the systems include 15 workers to operate the equipment caring an average of $38,000 each per year in salaries and benefits, $30,000 annually in maintenance expenses, and $10,000 in miscellaneous fixed expenses. Common to Both Projects: The firm plans to finance the selected investment project with a bank loan at a fixed rate of 7% for 5 or 7 years depending upon the selected project's life. The workers' salaries and benefits, and maintenance expenses are expected to grow at an average rate of inflation of 3%. The firm's WACC is 15%, its reinvestment rate is 10%, and its marginal tax rate is 40%. Focu MacBook Pro Instructions: Part A using the info from above! 1. Create ONE Excel per group and submit on canvas. Label Sheet 1 "part A". 2. Calculate: a) the initial investment, annual after-tax cash flows, and the terminal cash flow of each investment project b) Calculate the payback period, NPV, and IRR of each investment project. Should the firm accept or reject one or both projects? Part B using the info in the table below! The firm's management has decided to reconsider some estimated variables and has determined the following three possible scenarios: Equipment Costs Salvage Value Variable Costs Auto Auto Exhaust Exhaust Auto Exhaust Scenarios Wheels Systems Wheels Systems Wheels Systems Inflation Best Case 2,200,000 1,400,000 750.000 170,000 65% 55% Base Case 2.400,000 1,500,000 700,000 150,000 70% 60% | Worst 2,500,000 1,600,000 650,000 120,000 72% 65% 4% Case 1) Open 3 new sheets in the SAME Excel file and label "best", "base" and "worst". 2) Calculate: a) the new investment, new annual after-tax cash flows, and the new terminal cash flow of each investment project under the 3 scenarios in the separate sheets. b) Calculate the new NPV of each project. Which project should be selected under each of the 3 scenarios? Focus MacBook Pro AEE211 1. ABCD Normal A B C DdEx AaBb CeDe Aal Question ContSub Questio. Sub Main Question Ferrous Supplies, Inc., a manufacturer of finished steel products from recycled metals and recycled ferrous and non-ferrous metal and auto parts, is evaluating two mutually exclusive investment projects. Project One: The firm will supply 8,000 wheels annually to Ford Motor Company at an average price of $750 per wheel over a period of 5 years. The equipment required to produce the wheels will cost $2,400,000 plus $100,000 in shipping and installation costs. This equipment has an expected life of 10 years and will be depreciated using the MACRS 7-year class life. After the 5-year contract with Ford Motor Company, this equipment can be sold for 700.000, but the firm will need to pay $30,000 in removal expenses. The production of the wheels will require an additional investment of $500,000 in raw materials and the variable costs per wheel are estimated to be 70% of the selling price. The forecasted fixed costs associated with the wheels include 12 workers to operate the equipment earning an average of $40,000 each per year in salaries and benefits, S50,000 annually in maintenance costs, and 20,000 in miscellaneous fixed expenses. Project Two: The firm will supply 12,000 auto exhaust systems annually to General Motors Company at an average price of $300 per unit over a period of seven years. The equipment required to produce auto exhaust systems will cost $1,500,000 plus S150,000 of shipping and installation expenses. The expected life of this equipment is 10 years and will be depreciated using the MACRS 5-year class life. The equipment has an estimated salvage value of $150,000 after the 7-year contract with General Motors Company, but the firm will need to pay $50,000 in removal expenses. The production of the auto exhaust systems will require an additional investment of $200,000 in raw materials and the variable costs per unit are estimated to be 60% of the selling price. The forecasted fixed costs associated with the systems include 15 workers to operate the equipment caring an average of $38,000 each per year in salaries and benefits, $30,000 annually in maintenance expenses, and $10,000 in miscellaneous fixed expenses. Common to Both Projects: The firm plans to finance the selected investment project with a bank loan at a fixed rate of 7% for 5 or 7 years depending upon the selected project's life. The workers' salaries and benefits, and maintenance expenses are expected to grow at an average rate of inflation of 3%. The firm's WACC is 15%, its reinvestment rate is 10%, and its marginal tax rate is 40%. Focu MacBook Pro Instructions: Part A using the info from above! 1. Create ONE Excel per group and submit on canvas. Label Sheet 1 "part A". 2. Calculate: a) the initial investment, annual after-tax cash flows, and the terminal cash flow of each investment project b) Calculate the payback period, NPV, and IRR of each investment project. Should the firm accept or reject one or both projects? Part B using the info in the table below! The firm's management has decided to reconsider some estimated variables and has determined the following three possible scenarios: Equipment Costs Salvage Value Variable Costs Auto Auto Exhaust Exhaust Auto Exhaust Scenarios Wheels Systems Wheels Systems Wheels Systems Inflation Best Case 2,200,000 1,400,000 750.000 170,000 65% 55% Base Case 2.400,000 1,500,000 700,000 150,000 70% 60% | Worst 2,500,000 1,600,000 650,000 120,000 72% 65% 4% Case 1) Open 3 new sheets in the SAME Excel file and label "best", "base" and "worst". 2) Calculate: a) the new investment, new annual after-tax cash flows, and the new terminal cash flow of each investment project under the 3 scenarios in the separate sheets. b) Calculate the new NPV of each project. Which project should be selected under each of the 3 scenarios? Focus MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts