Question: AEEC/BFIN 311 Derivative Markets Assignment 7. Option Hedging Spring 2022 4. A soybean producer recently planted their crop and is concerned about a potential decline

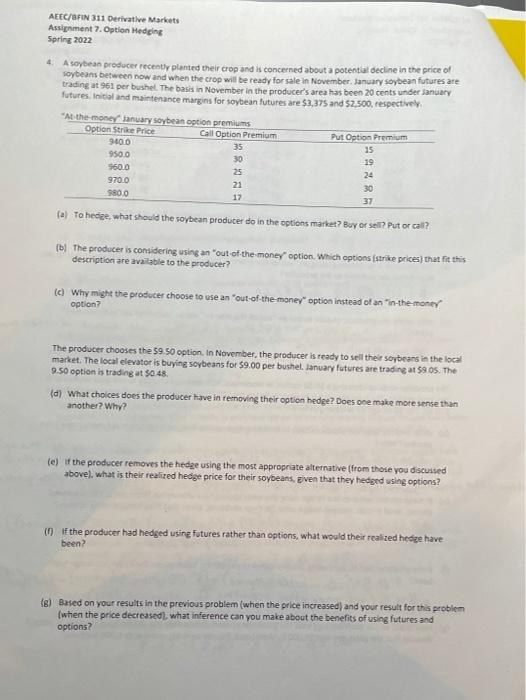

AEEC/BFIN 311 Derivative Markets Assignment 7. Option Hedging Spring 2022 4. A soybean producer recently planted their crop and is concerned about a potential decline in the price of soybeans between now and when the crop will be ready for sale in November. January soybean futures are trading at 961 per bushel. The basis in November in the producer's area has been 20 cents under January futures. Initial and maintenance margins for soybean futures are $3,375 and $2,500, respectively. "At the money January soybean option premiums Option Strike Price Call Option Premium Put Option Premium 940.0 35 15 950.0 30 19 960.0 25 24 970.0 21 30 980.0 17 37 (a) To hedge, what should the soybean producer do in the options market? Buy or sell? Put or call? (b) The producer is considering using an "out of the money option. Which options (strike prices) that fit this description are available to the producer? (c) Why might the producer choose to use an "out-of-the-money" option instead of an "in the money option? The producer chooses the 59.50 option. In November, the producer is ready to sell their soybeans in the local market. The local elevator is buying soybeans for $9.00 per bushel. January futures are trading at $9.05. The 9.50 option is trading at $0.48. (d) What choices does the producer have in removing their option hedge? Does one make more sense than another? Why? (e) if the producer removes the hedge using the most appropriate alternative (from those you discussed above), what is their realized hedge price for their soybeans, given that they hedged using options? (f) If the producer had hedged using futures rather than options, what would their realized hedge have been? (g) Based on your results in the previous problem (when the price increased) and your result for this problem (when the price decreased), what inference can you make about the benefits of using futures and options? AEEC/BFIN 311 Derivative Markets Assignment 7. Option Hedging Spring 2022 4. A soybean producer recently planted their crop and is concerned about a potential decline in the price of soybeans between now and when the crop will be ready for sale in November. January soybean futures are trading at 961 per bushel. The basis in November in the producer's area has been 20 cents under January futures. Initial and maintenance margins for soybean futures are $3,375 and $2,500, respectively. "At the money January soybean option premiums Option Strike Price Call Option Premium Put Option Premium 940.0 35 15 950.0 30 19 960.0 25 24 970.0 21 30 980.0 17 37 (a) To hedge, what should the soybean producer do in the options market? Buy or sell? Put or call? (b) The producer is considering using an "out of the money option. Which options (strike prices) that fit this description are available to the producer? (c) Why might the producer choose to use an "out-of-the-money" option instead of an "in the money option? The producer chooses the 59.50 option. In November, the producer is ready to sell their soybeans in the local market. The local elevator is buying soybeans for $9.00 per bushel. January futures are trading at $9.05. The 9.50 option is trading at $0.48. (d) What choices does the producer have in removing their option hedge? Does one make more sense than another? Why? (e) if the producer removes the hedge using the most appropriate alternative (from those you discussed above), what is their realized hedge price for their soybeans, given that they hedged using options? (f) If the producer had hedged using futures rather than options, what would their realized hedge have been? (g) Based on your results in the previous problem (when the price increased) and your result for this problem (when the price decreased), what inference can you make about the benefits of using futures and options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts