Question: a)Evaluate the five alternative production projects using traditional discounted cash flow analysis: What is the appropriate cost of capital for this case? Support your reasoning.

a)Evaluate the five alternative production projects using traditional discounted cash flow analysis:

What is the appropriate cost of capital for this case? Support your reasoning.

Note that the marginal cost of capital is the appropriate input for capital budgeting decisions. This rate should best estimate of the current cost of raising additional debt of similar risk.

| Year | Natural Gas Plant Cash Flows (In Millions $) | Nuclear Plant Cash Flows (In Millions $) | Wind Plant Cash Flows (In Millions $) | Solar Plant Cash Flows (In Millions $) | Coal Plant Cash Flows (In Millions $) |

|---|---|---|---|---|---|

| 0 | (650) | ||||

| 1 | 0 | ||||

| 2 | 0 | ||||

| 3 | 42.5 | ||||

| 4 | 85 | ||||

| 5 | 85 | ||||

| 6 | 85 | ||||

| 7 | 85 | ||||

| 8 | 85 | ||||

| 9 | 85 | ||||

| 10 | 85 | ||||

| 11 | 85 | ||||

| 12 | 85 | ||||

| 13 | 85 | ||||

| 14 | 85 | ||||

| 15 | 85 | ||||

| 16 | 85 | ||||

| 17 | 85 | ||||

| 18 | 85 | ||||

| 19 | 85 | ||||

| 20 | 85 | ||||

| 21 | 0 | ||||

| 22 | 0 | ||||

| 23 | 0 | ||||

| 24 | 0 | ||||

| 25 | 0 | ||||

| 26 | 0 | ||||

| 27 | 0 | ||||

| 28 | 0 | ||||

| 29 | 0 | ||||

| 30 | 0 |

WACC = ? MUST ENTER Cost of Capital for NPV computations in spreadsheet below to calculate. I have provided Natural gas below, fill out the remaining.

| NPV | $837.50 | ||||

| IRR | 7.99% |

d)

You will need to reference the case study which can be found in the URL below: View the case study which you will use to answer the questions. The natural gas below, the numbers for that are found in the article and that's how you will also find the answer to the others.

URL: https://www.imanet.org/-/media/a099d3d3475b4f7d939bc32c1a67d1a5.ashx

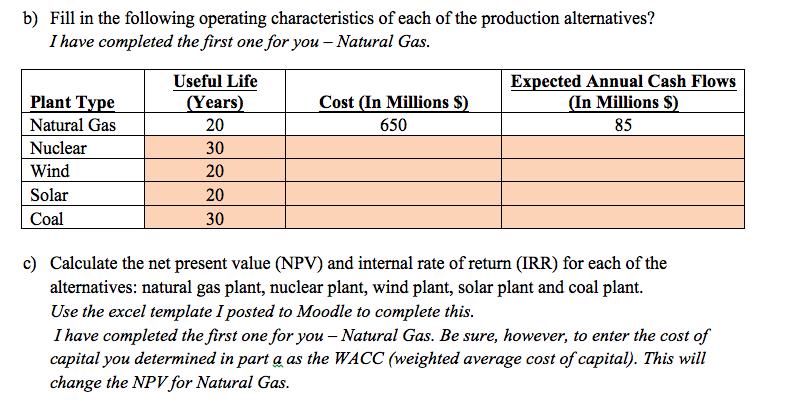

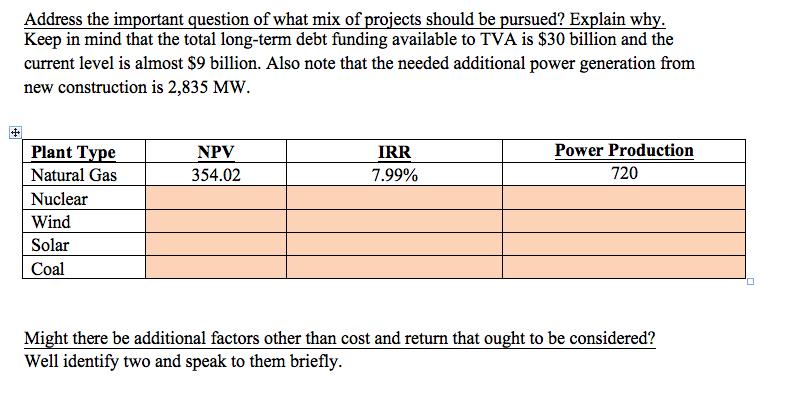

b) Fill in the following operating characteristics of each of the production alternatives? I have completed the first one for you - Natural Gas. Plant Type Natural Gas Nuclear Wind Solar Coal Useful Life (Years) 20 30 20 20 30 Cost (In Millions $) 650 Expected Annual Cash Flows (In Millions $) 85 c) Calculate the net present value (NPV) and internal rate of return (IRR) for each of the alternatives: natural gas plant, nuclear plant, wind plant, solar plant and coal plant. Use the excel template I posted to Moodle to complete this. I have completed the first one for you - Natural Gas. Be sure, however, to enter the cost of capital you determined in part a as the WACC (weighted average cost of capital). This will change the NPV for Natural Gas.

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Evaluate the five alternative Product Projet ... View full answer

Get step-by-step solutions from verified subject matter experts