Question: afe Question 3 (1 point) Claude was a sales manager for a large electronics manufacturer. He purchased a $250.000 universal life policy in 2000 with

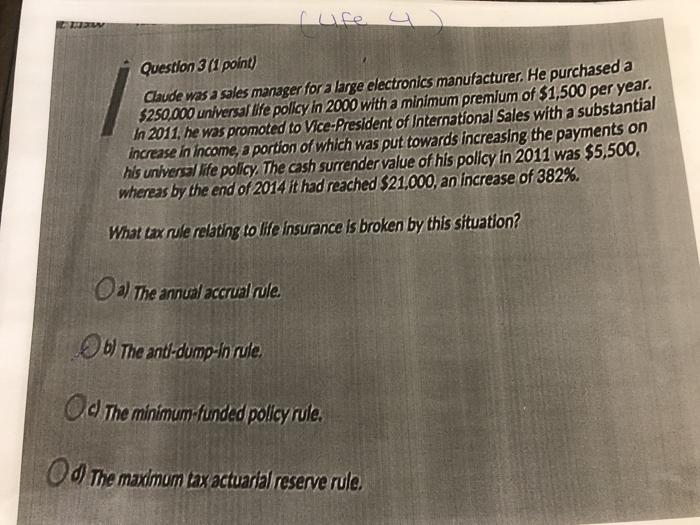

afe Question 3 (1 point) Claude was a sales manager for a large electronics manufacturer. He purchased a $250.000 universal life policy in 2000 with a minimum premium of $1,500 per year. In 2011, he was promoted to Vice-President of International Sales with a substantial increase in income, a portion of which was put towards increasing the payments on his universal life policy. The cash surrender value of his policy in 2011 was $5,500, whereas by the end of 2014 It had reached $21,000, an increase of 382%. What tax rule relating to life insurance is broken by this situation? a) The annual accrual rule b) The anti-dump-in rule Od The minimum-funded policy rule. Od The maximum tax actuarial reserve rule. afe Question 3 (1 point) Claude was a sales manager for a large electronics manufacturer. He purchased a $250.000 universal life policy in 2000 with a minimum premium of $1,500 per year. In 2011, he was promoted to Vice-President of International Sales with a substantial increase in income, a portion of which was put towards increasing the payments on his universal life policy. The cash surrender value of his policy in 2011 was $5,500, whereas by the end of 2014 It had reached $21,000, an increase of 382%. What tax rule relating to life insurance is broken by this situation? a) The annual accrual rule b) The anti-dump-in rule Od The minimum-funded policy rule. Od The maximum tax actuarial reserve rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts