Question: a)Find the expected values and standard deviations of the returns. Find the coefficient of correlation between r1 and r2 b)Suppose that the risk-free return is

a)Find the expected values and standard deviations of the returns. Find the coefficient of correlation between r1 and r2 b)Suppose that the risk-free return is r = 3%. Find the weights in market portfolio construct from the three assets in Exercise 3.5. Compute the expected return and standard deviation of the return of the market portfolio.

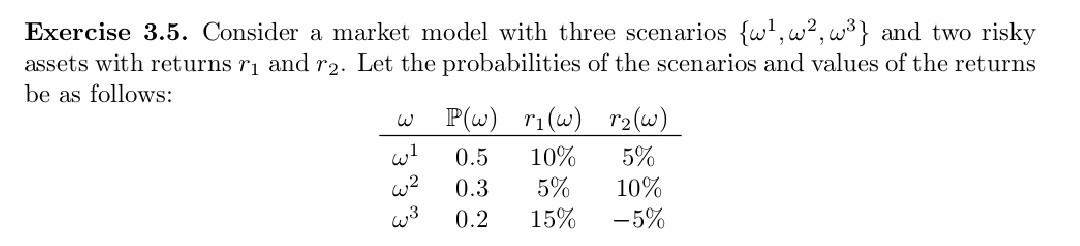

Exercise 3.5. Consider a market model with three scenarios {w7,wa,w2} and two risky assets with returns r and r2. Let the probabilities of the scenarios and values of the returns be as follows: P(w) ri(w) r2(w) w1 0.5 10% 5% 0.3 5% 10% 0.2 15% -5% w w2 w3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts