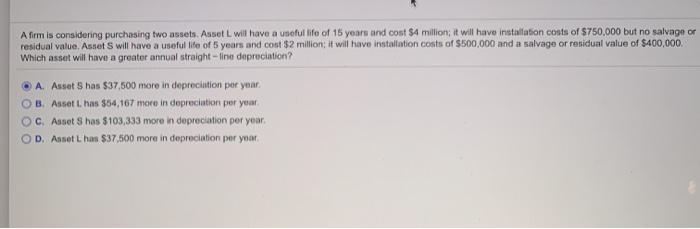

Question: Afirm is considering purchasing two assets. Asset will have a neful life of 15 years and cost $4 million; it will have installation costs of

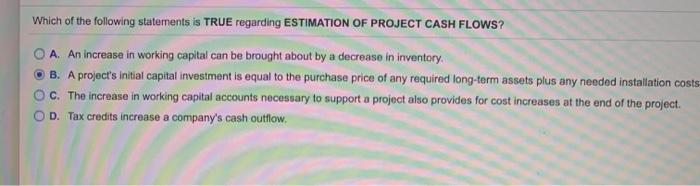

Afirm is considering purchasing two assets. Asset will have a neful life of 15 years and cost $4 million; it will have installation costs of S750,000 but no salvagn or residual value, Assets will have a useful life of 5 years and cost $2 million; it will have installation costs of $500,000 and a salvage or residual value of $400,000 Which asset will have a greater annual straight-line depreciation? A. Assets has $37,600 more in depreciation per year. OB. Assett. has $54,167 more in depreciation per year c. Assets has $103,333 more in depreciation per year, D. Anse Lhas $37,600 more in depreciation per your Which of the following statements is TRUE regarding ESTIMATION OF PROJECT CASH FLOWS? A. An increase in working capital can be brought about by a decrease in inventory B. A project's initial capital investment is equal to the purchase price of any required long-term assets plus any needed installation costs C. The increase in working capital accounts necessary to support a project also provides for cost increases at the end of the project D. Tax credits increase a company's cash outflow. OOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts