Question: After becoming a ( n ) q , Author zed User on her parent's credit card, Clara was ablu to make purchases and build her

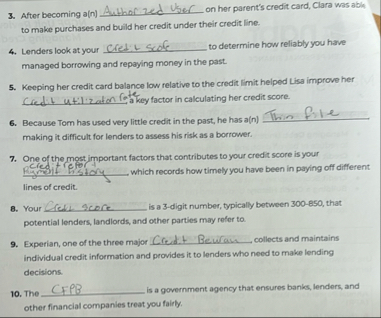

After becoming an Author zed User on her parent's credit card, Clara was ablu to make purchases and build her credit under their credit line.

Lenders look at your to determine how reliably you have managed borrowing and repaying money in the past.

Keeping her credit card balance low relative to the credit limit helped Lisa improve her Credit util:zaton fore a key factor in calculating her credit score.

Because Tom has used very little credit in the past, he has an making it difficult for lenders to assess his risk as a borrower.

One of the most important factors that contributes to your credit score is your

perfesitrorstory which records how timely you have been in paying off different lines of credit.

You is a digit number, typically between that potential lenders, landlords, and other parties may refer to

Experian, one of the three major collects and maintains individual credit information and provides it to lenders who need to make lending decisions.

The sa government agency that ensures banks, lenders, and other financial companies triat you fairly.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock