Question: After completing the FSIs two profitability analysis projects, Chen now moves on value FSI using the following valuation models: Dividend Discount Model (DDM) - 10

After completing the FSIs two profitability analysis projects, Chen now moves on value FSI using the following valuation models: Dividend Discount Model (DDM) - 10 Points Free Cash Flow to Equity (FCFE) -15 Points Free Cash Flow to the Firm (FCFF) -10 Points Residual Income (RI) -10 Points

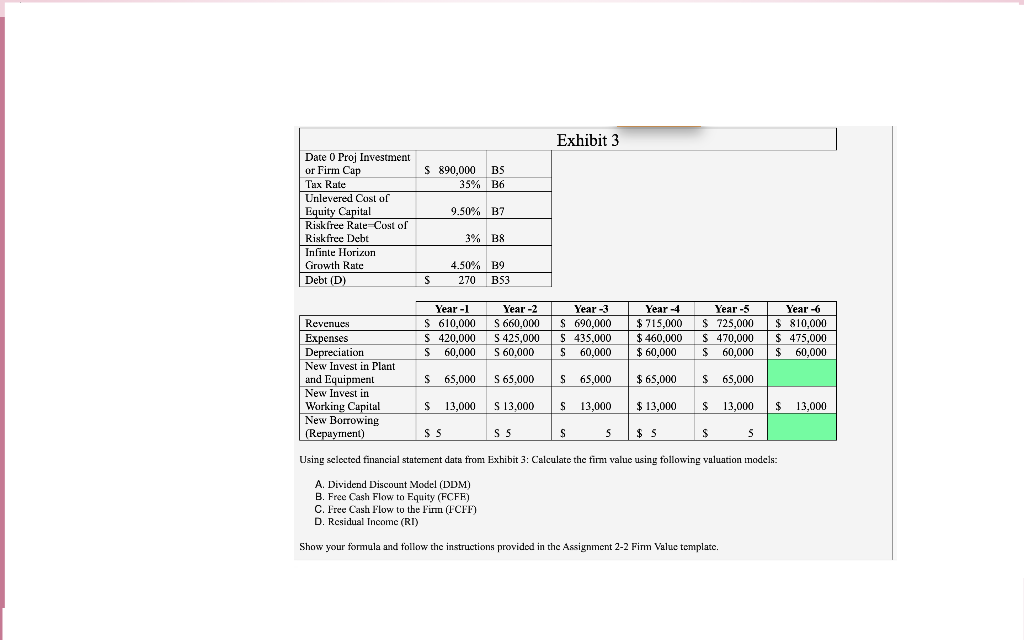

Using selected financial statement data from Exhibit 3: Calculate the firm value using following valuation models: Dividend Discount Model (DDM) Free Cash Flow to Equity (FCFE) Free Cash Flow to the Firm (FCFF) Residual Income (RI)

Using selected financial statement data from Exhibit 3: Calculate the firm value using following valuation models: Dividend Discount Model (DDM) Free Cash Flow to Equity (FCFE) Free Cash Flow to the Firm (FCFF) Residual Income (RI)

Using selected financial statement data from Exhibit 3: Calculate the firm value using following valuation models: A. Dividend Discount Model (DDM) B. Free Cash Flow to Fquity (FCFE) C. Free Cash Flow to the Finn (FCFI) D. Residual Ineome (RI) Show your formula and follow the instructions provided in the Assignment 2-2 Firm Value template. Using selected financial statement data from Exhibit 3: Calculate the firm value using following valuation models: A. Dividend Discount Model (DDM) B. Free Cash Flow to Fquity (FCFE) C. Free Cash Flow to the Finn (FCFI) D. Residual Ineome (RI) Show your formula and follow the instructions provided in the Assignment 2-2 Firm Value template

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts