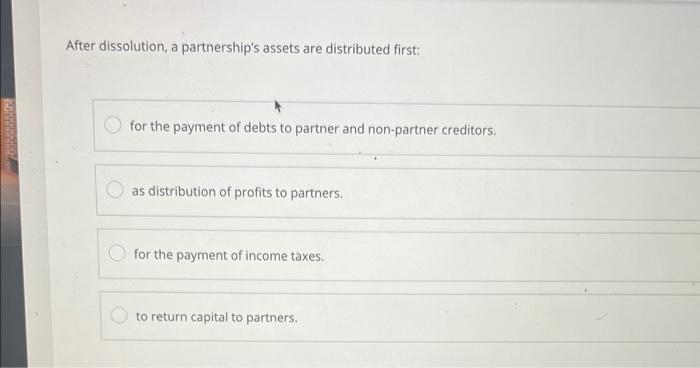

Question: After dissolution, a partnership's assets are distributed first: for the payment of debts to partner and non-partner creditors. as distribution of profits to partners. for

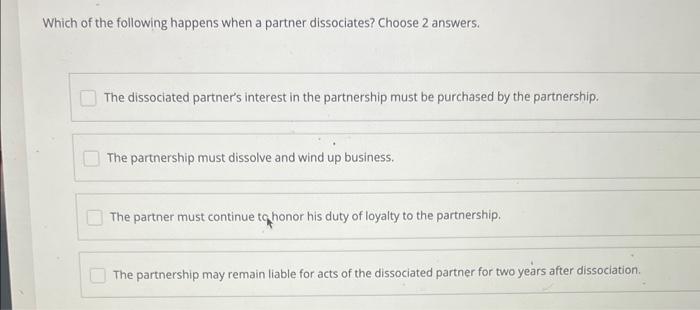

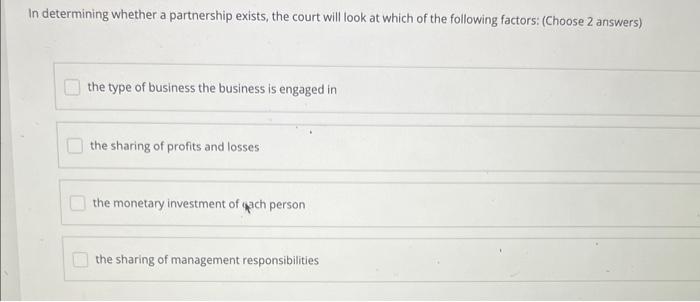

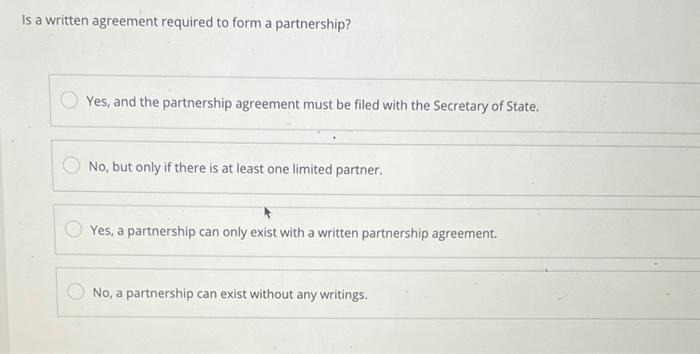

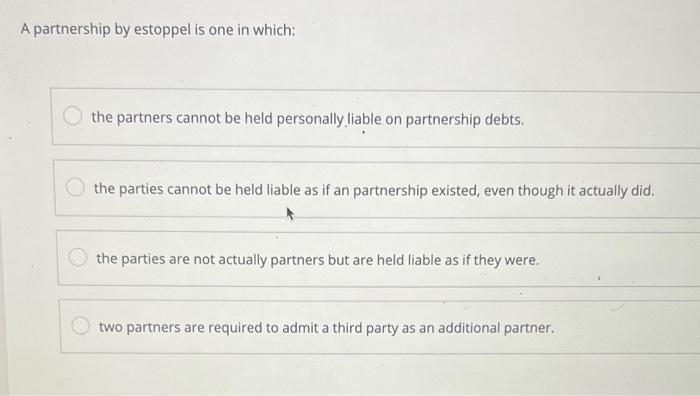

After dissolution, a partnership's assets are distributed first: for the payment of debts to partner and non-partner creditors. as distribution of profits to partners. for the payment of income taxes. to return capital to partners. Which of the following happens when a partner dissociates? Choose 2 answers. The dissociated partner's interest in the partnership must be purchased by the partnership. The partnership must dissolve and wind up business. The partner must continue to honor his duty of loyalty to the partnership. The partnership may remain liable for acts of the dissociated partner for two years after dissociation. In determining whether a partnership exists, the court will look at which of the following factors: (Choose 2 answers) the type of business the business is engaged in the sharing of profits and losses the monetary investment of chach person the sharing of management responsibilities Is a written agreement required to form a partnership? Yes, and the partnership agreement must be filed with the Secretary of State. No, but only if there is at least one limited partner. Yes, a partnership can only exist with a written partnership agreement. No, a partnership can exist without any writings. A partnership by estoppel is one in which: the partners cannot be held personally liable on partnership debts. the parties cannot be held liable as if an partnership existed, even though it actually did. the parties are not actually partners but are held liable as if they were. two partners are required to admit a third party as an additional partner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts